In the previous post I highlighted how even in the worst economic environment, well established and safe large cap stocks tend to perform well. It is in fact true that if one were to blindly buy any 5 out of the top ten stocks (by market capitalization) and hold on to them for a few years, he will not only beat the market, but also the performance of most mutual funds. There is ample evidence to certify this. Read the previous post – here

In this post, I will talk about the stock selection criteria to shortlist from amongst the list of safe large cap stocks.

Stock Selection Criteria

For blue chip investing, follow the 6 step stock selection criteria presented below:

[I] Price / Earnings Ratio – A good starting point will be to look for companies which are available at 10% discount to their industry PE ratios. Keep in mind that companies in some sectors will enjoy a high PE ratio in comparison to companies in other sectors. A more detailed discussion on this can be found here – Price Earnings Ratio.

[II] Average 10 years Return on Equity (“ROE”) in excess of 18% – ROE indicates the amount of profit which the company generates on the capital invested by the equity shareholders (i.e. shareholder return). A company must at the least generate a double digit ROE. Established blue chip stocks in India typically generate average ROE in excess of 15%. Keep in mind that certain companies with low equity base may report extremely high ROE’s and one must look for the reasons for a high (or low) ROE.

What is most important is to look at the trend in ROE (i.e. is it rising or falling and whether the company will be able to sustain a rising ROE going forward).

To explain this point with an extreme example, look at Colgate Palmolive, it has been reporting an ROE in excess of 100% for the last few years. ROE in such a case may not present a complete picture.

Behind Colgate’s high ROE (this section updated on 10th March 2015)

Colgate has only 13.6 Cr shares outstanding. Let’s say an investor was to buy 1% of it = 13,60,000 shares. The Investor will pay Rs. 286.1 Cr to get 1% equity (assuming the current share price of Colgate = Rs. 2104).

For Rs. 286.1 Cr, the investor becomes entitled to 1% of annual profit = 5.4 Cr (for FY 2014, PAT was Rs. 539 Cr). Effectively this means that if this company (Colgate) continues to generate a return at similar rate, it will take a little over 53 years for the investor to earn back his Rs. 286 Cr. (the math = 1% of total profit in his share = 5.4 crore * X = 286 Cr.)

This is just what the PE Ratio also indicates (i.e. Colgate’s current PE Ratio = 54.16)

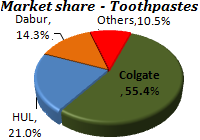

[III] Competitive advantages – Focus on companies that enjoy competitive advantages which in turn will help them in protecting their market share in the long term. A number of such competitive advantages (i.e. economic moats) help these well established companies in sustaining their dominant market position. For example, in case of Colgate, the company’s large market share, gives it a huge pricing advantage (i.e. it could temporarily lower the prices of its products to thwart any new entrant in the market). Having strong economic moats is one of the most important stock selection criteria for any serious investor.

[IV] Future Prospects – This is an area of research, where there is no substitute for hard work. These days, Google can help you a great deal in finding all the relevant information about the company. However, keep in mind that Google cannot separate sponsored content from the genuine and you must be careful with your research. That said, it is not difficult to do a SWOT analysis of a company and list down your findings.

Those who follow my writings will know how much emphasis I give to the quality of management and on the role of corporate governance in investing. In case of Blue Chip investing however, you could focus more on market developments than on who runs the company. Unlike, small and mid cap companies, blue chips have withstood the test of time and their managers are being tracked by a large number of analysts. With that kind of scrutiny, this is one area where you could cut your work short. On the contrary, your focus should be on finding such strong businesses that managers should have little to do in running them successfully.To go back to my example of Colgate, I am in no doubt that the share price will be affected more by the impact of Procter and Gamble’s entry in the Indian toothpaste market and less by who succeeds the current CEO of Colgate.“Buy into a business that’s doing so well, an idiot could run it, because sooner or later, one will”. – Warren Buffet.

[V] Dividend Record – Large, well established companies typically have a huge pile of accumulated reserves. While it is important to have healthy reserves for future expansion and contingencies, dividend payments indicate the profitable nature of the company and a positive management outlook.

Once the business of a company matures, and in the absence of any realistic expansion plans for future, the management of a well established company returns a large portion of the profit it generates to the shareholders as dividends. Uninterrupted and growing dividend payments are a hallmark of blue chip investing. A dividend yield upwards of 2.5%, coupled with rising profitability is a strong indication that the company will raise the dividends going forward.

[VI] High (institutional) Investor base – A large investor base and particularly institutional holding not only assures liquidity in the stock, but is also a seal of approval from experienced investors on the quality and strength of the stock.

That’s a very educating research but I am sure that you do more with stock selection than this.

Of course Chris, but a stock selection criteria based on these parameters should surely help you shortlist some high quality blue chips. Hope it helps. Best – Rajat

Very well. But How Can an average investor do all This. you should tell us which Stocks Have you Shortlisted Based on this Criteria. Thank You Sir .

You can sure do all this Anil, check your emails. You will find some helpful material.

Interesting research.well written.

Wish your team a very happy new year..

Thank you Akhil.

Interesting article, thanks. Can we apply this to Midcaps as well? Would you please share some list of stock which passed your above mentioned test. Thx

When I made my first little investment in stock market 2 years back, The only rule I knew was ‘ you have to buy low and sell high’. Looking at price charts, I saw that most blue chip stocks were like rubber balls, the harder you throw them down, the greater they bounce back .My little investment of 50,000 went to 75,000 within first year with a maximum of 5000 investment per stock 😀 I kept searching for stocks which were temporarily down. If I was the same ‘me’, I would be buying Cairn, Jain Irrigation, KPIT or Apollo tyre now ( trading near 52 week low) . But now that I have read a lot about fundementals, ratios, valuatins….. I am now afraid of investing without taking advice. So much calculations n assumptions to be done before buying stocks

How can I know that a particular stock has a high (institutional) Investor base?