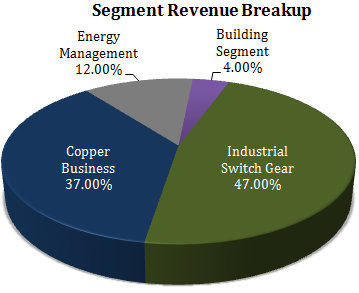

Salzer Electronics (“Salzer” or the “Company”) manufacture cam operated rotary switches. The Company operates in four segments – Switchgear, Building Segment, Wires and Cables, and Energy Management. Salzer was the largest manufacturer of CAM operated rotary switch and wire ducts, for FY15 with market share of 25% and 20% in each category, respectively. The Company caters to a wide range of products with five in-house manufacturing facilities, located in Coimbatore and Himachal Pradesh.

The Company has its own state-of-the-art R&D facilities, recognized by the Department of Science and Technology, Government of India and a strong R&D team that focuses on developing and commercializing product technologies and as a result, can offer total customized electrical solutions to customers.

WHAT’S DRIVING THE STOCK?

Safety in Numbers – Strong Financial Growth

Salzer has shown consistent growth over the last ten years (i.e. 2011-12 to 2015-16). Its operating profit (EBITDA) over this period grew at an CAGR of 8.32 %. The Company’s revenue from operations stands at Rs 361.1 Cr in FY 2016 as compared to Rs 283.3 Cr in FY 2015(~28% increase). The Company’s net worth has surged by massive 83%, i.e. from Rs 107.1 Cr in FY 2015 to Rs 195.3 Cr in FY 2016 and it operates with negligible debt (0.29- debt to equity) on its books. The Company has been consistently paying dividends for more than 10 years.

For Financial Report – click here

Salzer Electronics has been able to fend and monetize the increasing demands from increasing industrialization throughout the globe.

Wide Distribution Network – Local and Global

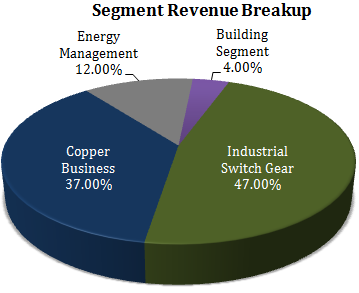

The Company has a wide distribution network locally and globally, exporting to more than 45 countries. In India, Salzer markets its products through its own distributors and more than 350 local distributors of L&T. This gives Salzer leverage over other players in electrical industry.

Export Performance

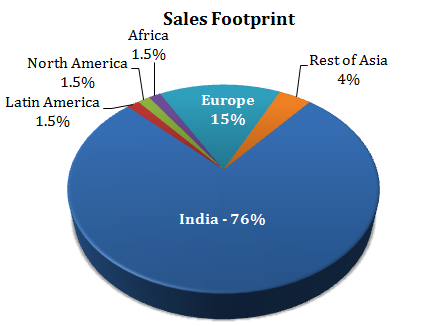

The Company has increased its export revenue with a CAGR of 33.16% from FY10 to FY16. These include countries from Europe, North America, Latin America, Africa and Rest of Asia.

Unparalleled Customer Profile

Salzer’s customer profile has the best array of clients that features BHEL, ABB – Swedish-Swiss multinational, Elgi Equipment, Schneider Electric, Yokohama, Honeywell – American conglomerate, and Phillips. Production of highest quality products among peers is enforced by Salzer’s distribution network.

Technical Advancements and Result Oriented R&D

To keep up with fierce competition in electric equipment sector, Salzer’s well developed R&D have enabled it to create innovative and cost reductive manufacturing process. Salzer is the first company in the sector to bring torodial transformers technology in India via technical collaboration with Canadian company Plitron.

Salzer also signed a technical alliance with Trafomodern – an Austrian company – one of leading manufacturers of transformers in Europe and created a joint venture with CRControls, US manufacturer of electric controls, for contractor and relays. By continued product innovation and superb quality standard, Salzer’s products has achieved the feat of being universally accepted and internationally certified.

Growth in Energy Management Business

The Company has achieved quick growth in Energy Management Sector that helps in reduction of energy consumption and thus supporting the ‘Make in India’ initiative. The sector has immense scope in the upcoming and current market, and the company has thus increased its revenue from Rs 5.7 Cr in FY15 to Rs. 42.0 Cr in FY, i.e. 638% YoY growth.

WHAT’S DRAGGING THE STOCK

Commodity Price Volatility Risks

A segment of Salzer’s business is essentially dependent on copper, and factors that could affect copper price controls the cost of the respective products. High price of copper can substantially increase the cost and thus the price of products in the market.

The government may impose an anti-dumping duty on copper, as it did with steel after petitions from Indian steel makers. This could cause havoc in electric equipment industry and result in complete transfer of cost to the customers.

Competition from Indian and Foreign Players

The Company faces different levels of competition in each business segment from domestic as well as multinational companies. The Company’s geographical expansion also has increased competition on the global level. However, the Company’s established brand name is attained tag of ‘Preferred Supplier’ status with GE and Schneider who source their products from Salzer on a global basis.

| Company Name | Share Price* (Rs.) | Market Cap (Rs. Cr.) | Net Profit** (Rs. Cr.) |

| Havells India | 366.80 | 22,929.51 | 715.35 |

| Crompton Greave | 73.80 | 4626.29 | -1,091.97 |

| Techno Electric | 568.55 | 3,245.92 | 124.68 |

| HBL Power | 35.20 | 890.56 | 19.43 |

| Salzer Electronics | 223.55 | 307.26 | 17.04 |

Cheap Imports from China

Over three-fourth of Salzer’s total revenue is generated by Indian consumption. The whole electrical equipment sector, along with Salzer, faces difficulty to compete with Chinese prices. Last year, Indian Electronics and Electricals Manufacturers’ Association (IEEMA), the representative body of power equipment makers, sent out a letter to the National Security Advisor Ajit Doval asking for a complete ban of Chinese equipment in Indian power sector on account of national security concerns. If these prices are not regulated, the company could lose some share of market that could cause unexpected decline in revenue.

Export figures there appears to be a mismatch

Which export figures, can you help me with it so we can correct.

We have corrected the export figures numbers in the graph.