Sector investing can prove to be a useful and powerful portfolio construction strategy. Sector investing is an integral part of a well-diversified portfolio strategy. As economic variables and business cycles impact segments of the economy differently, sector-based investment strategies can help investors earn big based on economic conditions prevailing in specific pockets of the market.

Sectoral investment strategies have a huge advantage in that you take exposure to a whole sector that is undervalued and not expose yourself to a company specific risk. Such a strategy should be built on:

– Finding the sector facing temporary difficulties (like Pharma and IT in 2016-18 period when U.S. FDA and immigration policies created a negative sentiment for these sectors thereby keeping stock prices suppressed for long).

– Choosing either a fund or a bucket of leading stocks in the chosen sector.

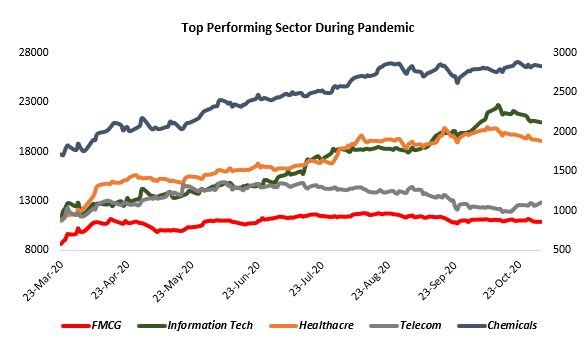

In the current pandemic, some sectors have converted this threat into an opportunity. These include sectors like FMCG, Speciality Chemicals, Pharma and Telecom/Technology. These sectors have gained as the pandemic led to an increase in demand for FMCG goods, medicines and has encouraged companies to focus on digital transformation. Equally then, automobile sales have been abysmal leading to supressed valuations in that sector. This may be a great time to buy into auto stocks. Another sector which has not performed well is the bunch of PSU stocks because of negative sentiment prevailing (for years) on the workings of government led companies.

Read More on Stock Investing and Sector Rotation.

Performance of Sectors Since March 2020

Thematic or Sector Investing: things to keep in mind:

[1] Portfolio Rebalancing – Rebalance (include/exclude) stocks in the portfolio to seek opportunities in a specific sector. For example, in a growing economy, investors should focus on utilities, infrastructure sector. Once the sector has run its initial course after being deeply undervalued, you may want to move part or all of your investment into another sector.

[2] Risk Management – Investors should build their sector specific portfolio keeping in mind that undervalued sectors can remain undervalued for a long time and bounce back sharply as things improve. It is difficult to predict when things will improve and you must stay the course.

[3] Portfolio Completion: This strategy should target sectors that have low/no weightage in a current portfolio. For example, if metals or real estate exposure is lacking, use sector investing to gain that exposure. Again, this money should be invested with at least a 2-3 year time frame.

Successful sector investing depends on an individual’s ability to consistently and accurately determine when to rotate in and out of the various sectors, which may be a challenge for most investors. Investors need to be skilled and knowledgeable in the art of picking the right stocks. Ideally stick to thematic mutual funds and you will outperform the broader market with ease.

Sectoral Mutual Fund – To deal with the above challenge of picking right stocks and benefit from thematic investing, investors can opt for sectoral mutual funds. Sector Funds are mutual fund schemes that invest in a specific industry or sector only. Rightly chosen sector fund can result in very high returns. With sector funds, the timing for investments and the sector is crucial.

Take a look at the performance of Diversified Equity Funds vis-à-vis Sector Funds

| Average Returns | 1 M | 3 M | 6 M | 1 Y | 2 Y | 3 Y |

| Well Diversified Equity Fund | 1.18% | 6.74% | 18.13% | -0.63% | 3.88% | 0.80% |

| Some Sectoral Funds | ||||||

| Pharma Fund | -2.62% | 6.38% | 24.70% | 50.12% | 49.17% | 51.36% |

| Technology Fund | 2.60% | 15.50% | 46.68% | 37.81% | 44.69% | 89.32% |

| FMCG Fund | -0.86% | 3.01% | 9.04% | -11.87% | -2.14% | 3.85% |

| Infrastructure Fund | -1.35% | 0.84% | 8.04% | -3.04% | 2.21% | -2.72% |

| Gold Fund | 1.03% | -5.51% | 6.03% | 29.70% | 57.14% | 68.47% |

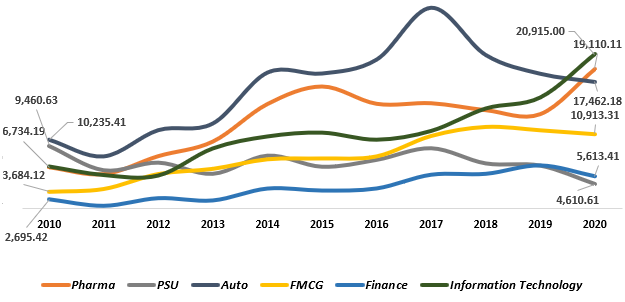

Interesting Graph to Look at – 10 Year Performance of Different Sectors

| Year | Pharma | PSU | Auto | FMCG | Finance | IT |

| 2010 | 6,734.19 | 9,460.63 | 10,235.41 | 3,684.12 | 2,695.42 | 6,824.82 |

| 2011 | 5,870.52 | 6,364.89 | 8,143.65 | 4,035.31 | 1,864.69 | 5,751.93 |

| 2012 | 8,132.35 | 7,334.71 | 11,426.21 | 5,916.22 | 2,833.41 | 5,684.08 |

| 2013 | 9,966.26 | 5,909.74 | 12,258.83 | 6,567.01 | 2,546.99 | 9,081.78 |

| 2014 | 14,692.95 | 8,226.81 | 18,630.84 | 7,766.57 | 4,057.22 | 10,583.98 |

| 2015 | 16,905.20 | 6,813.67 | 18,519.08 | 7,871.83 | 3,803.50 | 11,061.31 |

| 2016 | 14,727.59 | 7,691.27 | 20,257.43 | 8,130.87 | 4,068.97 | 10,176.05 |

| 2017 | 14,799.42 | 9,173.30 | 26,751.20 | 10,695.18 | 5,813.73 | 11,277.81 |

| 2018 | 13,923.37 | 7,236.53 | 20,833.73 | 11,829.07 | 5,928.97 | 14,089.56 |

| 2019 | 13,429.11 | 6,955.57 | 18,485.00 | 11,405.88 | 6,996.14 | 15,475.81 |

| 2020 | 19,110.11 | 4,610.61 | 17,462.18 | 10,913.31 | 5,613.41 | 20,915.00 |

| 10 Year Gain | 184% | -51% | 71% | 196% | 108% | 206% |

Interesting Fact – Rs. 10,000 invested in each of these sectors in 2010 (total Rs. 60,000) would now have become Rs. 1,31,405.

How Sector investing Can Help to Beat the Market?

Investors with a longer time horizon can immensely advantages over diversified equity investing. At any given point of time, some pockets of the market offer deep value and future growth potential.

With sector specific or thematic investing, investors need to prepare for a longer-term commitment to a theme. Do not mistake thematic investing with growth alone. Avoid overvalued sectors no matter how bright or rosy the future for such a sector may look. The whole premise of thematic investing is to buy undervalued sectors that are facing temporary difficulties and to cut down on company specific risks. This is also because when a sector is facing challenges, while some companies will come out of it and deliver big, certain others will perish too.