A lot of research goes into predicting future prices and Sensex targets. Analysis of past data for such predictions suggests that analysts are far more accurate over a longer term. Shorter your time frames, higher are the chances of error. Yet, analysts and market commentators regularly throw out targets for anywhere between a few years to a few months, end of week targets and end of day targets.

A lot of these projections may well be the result of commercial realities. Brokers and fund managers must constantly keep their audience engaged. That said, if you are correct with your end of day projections 6 out of 10 times, it makes perfect sense to do it.

While such targets (with their 6 out of 10 winning odds) will work well for traders who follow and trade the markets on a daily basis, for those who wish to invest systematically over a period of time, a little more certainty is both, desirable and advisable.

Below, I will share some of my observations and make the most bullish case for Indian equities over the next 5-7 year timeline. While this may sound a little exaggerated today, I think the projections are fairly modest.

Note – All calculations were made on the 5th March 2014 (yearly compounding used).

Since its inception in 1979, the Sensex has grown at an annual rate of 16.55%. Over the last 10 years, the growth has been at an annual rate of 13.71%. I will not get into any great detail about how the last 10 years have played out. In short, Over the last 10-15 years, Indian stock markets have seen about 3-4 crashes and an equal number of booms, this included a massive bull run (between 2003-2008) followed by an epic crash (in 2008 -09).

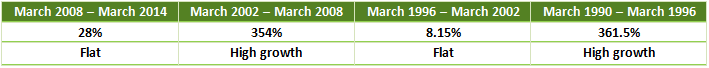

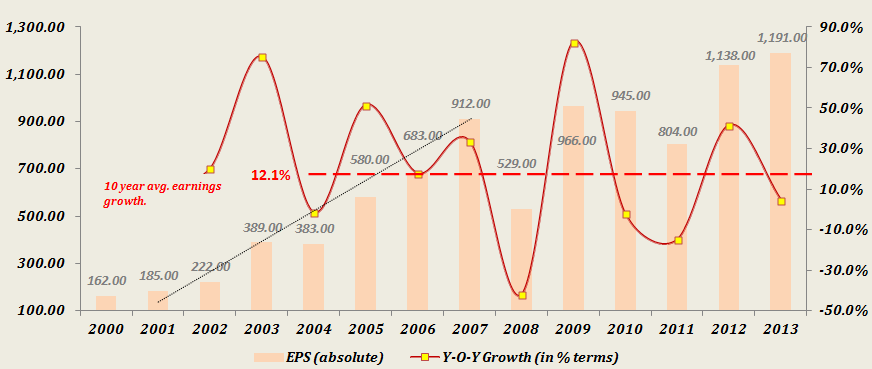

Since I am talking of a 6 year projection (i.e. 2014 – 2020), let’s also look at how much the Sensex has grown in six year periods going back from today:

What’s the point?

We all probably know this – It’s all Cyclical.

[I] Historic Trends

Quiet apart from looking at corporate earnings and macro factors, which I do get into looking at below, the simple observation above suggests something which I am sure most of us are well aware. Markets move in cycles. The fact that they have given no returns whatsoever over the last 6 years should if at all be looked at as a positive sign. Why many investors do not act on this principle is something that has eluded the smartest fund managers since the beginning of markets.

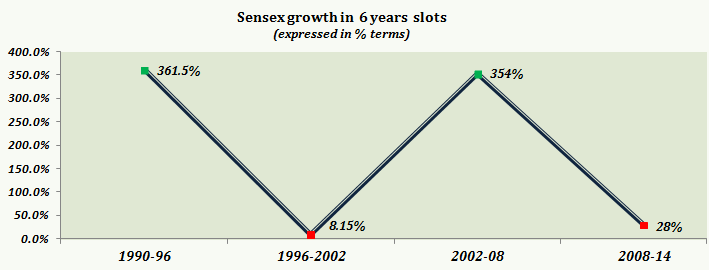

Stocks and markets regularly rise above and dip below the average PE multiples and usually continue such trend until faced with a big event. I tried to test this with some more historical numbers.

Click here to read about Index PE Ratios.

About the Chart

The current Price Earnings [PE] multiple for the BSE Sensex = 17.6 (as of today, i.e. 5 March 2014).

It is generally accepted that the Sensex is oversold when Sensex wide PE value is below 13.5 and is overbought when it rises above 22.5.

The average PE ratio of the Sensex over the last 10 years has been ~ 19.35.

Note: The average PE ratio for the last 20 years is 21.28 but a bit of that is because of the big Bull Run in the wild Harshad Mehta days which resulted in a massive correction which lasted until 1995-96. During that time the Sensex wide PE reached as high as 45. I have discounted that in this analysis.

In which direction will the Sensex move over the next 6-10 years?

Nobody can predict when exactly the next hyper bull kind of run-up starts. To that extent I believe that month end / year end targets are at best an educated speculation. That said, if you have a 5+ year view on the markets, it would only be logical to allocate money to high quality stocks right now.

Think about it – January 2008 – Sensex @ 21,000. January 2014 – Sensex @ 21,000. What is your Sensex target for 2020?

21,000? Higher/ lower? Surely, it would depend on growth in corporate earnings which again depend on a host of other factors.

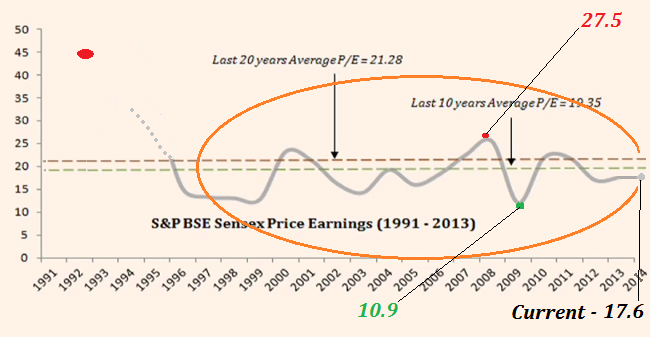

[II] Current Trend in Corporate Earnings

When earnings grow, so do stock prices.

Every time we near the end of a quarter or the financial year, a team of analysts burn a lot of office hours to up with a projection for corporate earnings. In the last few years, while corporate earnings have been growing at a moderate rate, the Indian economy has been struggling with high inflation. As a result, the earnings growth looks even more insignificant.

High inflation, lower consumption particularly in developed economies, lack of policy action on the domestic front coupled with a twin current and fiscal account deficit and a series of corruption scandals have all played a part in the stagnant-growth story of India.

Despite that, corporate earnings have been growing (albeit moderately). This surely does not get reflected in stock prices. This is yet another reason why I am extremely bullish on the Indian stock markets. In fact, at current levels, I am more positive on Indian stock markets than I am on the Indian economy (not to say that I am negative on the Indian economy – my views here).

However, for things to change significantly there has to be political certainty and a strong government –the kind that will not only be able to push reforms and legislation but one that will take the corporate sector along in policy making. In addition, a marked revival in global economic scenario is also significant. On the latter, while for now the world looks like a less risky place with some signs of growth in both the EU and the United States, the rising U.S. debt is sooner or later likely to create another global mess. While this could take a few years, it is an ever escalating risk which may eventually lead to the debasement of the U.S. Dollar.

In the more near term however (5-7 years), even marginal improvement in corporate earnings, coupled with some measure of control on inflation and a strong government will all prove to be a shot in the arm for stock prices.

Over the last 10 years, corporate earnings for Sensex companies grew @ CAGR of 12.1%.

Sensex Target for 2020

“Moderate growth“–

Corporate earnings for Sensex companies keep growing at a CAGR of 12.1% p.a. over the next 6 years, and the Sensex grows at a rate similar to the rate of growth of Sensex companies (i.e. 12.1% annually) then by 2020 it reaches – 42,540 points (yearly compounding used).

A more “rational growth view” (based on cyclical nature of markets) –

Corporate earnings for Sensex companies grow at a CAGR of 17% p.a. over the next 6 years, and the Sensex grows at a slightly higher rate of 19% during this time, then by 2020 it reaches – 54,286 points (yearly compounding used).

Whether you take a growth target in between the above two or you take a more aggressive view betting on the strong prospects for the Indian economy, it is unlikely that the Sensex will settle anywhere below the 50,000 point mark by 2020.

I will leave you with a thought I get every time a brave analyst comes out and tries to justify his projections:

“Saying results missed estimates is like blaming reality for your own imprudence.”

Excellent analysis.

Regards

Thanks Ratan. Hope you like today’s post here – http://www.blog.sanasecurities.com/how-to-prepare-for-the-next-stock-market-crash/

Ya…

Trgt for 2020 is 45000_53400.,

2017-6., trgt 27890

really sir , best article on the topic

Hi! I could have sworn I’ve been to this blog before but after looking at

a few of the posts I realized it’s new to me. Regardless,

I’m definitely happy I came across it and I’ll be bookmarking it and checking back frequently!

Thank you very much for the invitation :). Best wishes.

PS: How are you? I am from France 🙂

This blog is an absolute knowledge ocean. I have been watching this particular one but missed to add my appreciation earlier.

How can you be so resilient in terms of predictions , does not matter whether its a crash or a recovery after the the crash. You are a genious!