Shareholder Activism – What is?

Any act of the shareholder(s) of a company which results in either influencing or changing the behavior and / or decision of the company, either through its management or otherwise.

Issues on shareholder activism and corporate governance have been a point of debate in the United States and Europe for many years. In India however, these issues have come to the fore only in the last couple of years. In fact the amendment passed in the companies act in 2013 seek to acknowledge and rectify issues relating to corporate governance which highlights the need for stringency in this area.

Shareholder Activism and the Board of Directors

Regulation meant for improving performance of the Board of Directors seeks to increase powers given to the minority shareholders to turn down certain decisions of the board as also put pressure by filing legal proceedings against the board. Minority shareholders can use their equity stake in the company to put public pressure on the management. For this purpose, minority shareholders = those together holding less than 10% of the outstanding shares of the company.

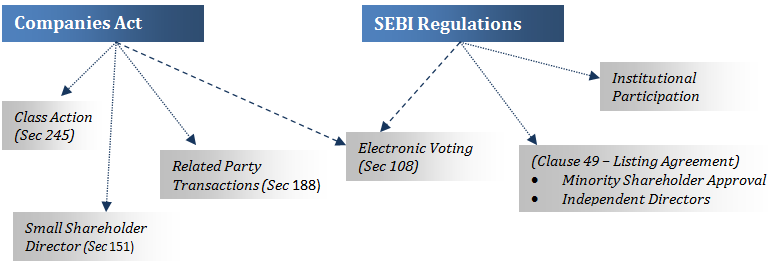

Recent developments in the Indian corporate sphere – Satyam Computers being the prime example – have raised several calls for instilling the culture of shareholder activism in India. One key form of such activism that keeps companies under check is the availability of class action lawsuits for securities law violations by companies, their promoters or managers. Many such gateways have opened up for minority shareholders through the companies act and by way of SEBI regulations.

How Companies Act and SEBI are Empowering Shareholders

New capital market rules and procedures are finally changing the system, making it possible for minority shareholders to make their views known, and more actively defend their interests. Institutional Activism: The development of shareholder activism has been aided both by the efforts on the part the regulators to encourage shareholder participation in corporate decision making, and by the growth of the activist stance of institutional investors in the Indian markets.

- Electronic Voting: India’s new Companies Act (of 2013), requires all listed companies under section 108 to provide for electronic voting on shareholder resolutions, allowing minority stakeholders to have their say, without arduous treks to far-flung locations, or unreliable postal ballots. Further, SEBI amended the listing agreement requiring large companies to provide electronic voting (e-voting) facilities in respect of matters requiring postal ballot. The top 500 listed companies on the Bombay Stock Exchange and the National Stock Exchange now provide e-voting facility and this is quickly being extended by all listed companies. General meetings of companies are held at their registered offices and it is not possible for every member to travel to the registered office. In particular, members holding a few shares of the company find it futile to travel so far to cast their vote. E-voting does not eliminate member’s right to physically attend and vote at the general meeting however member can cast his vote through one mode only. A member after casting his vote through e-voting can go and attend the general meeting but cannot cast vote in that general meeting.

- Related Party Transactions to be Approved by Minority Shareholders: Section 188 of the new Companies Act requires all related party transactions to be approved by shareholders through special resolution. In November last year, Siemens India proposed to sell the company’s Metals Technologies Business to its German parent. Since the proposal was a related party transaction, it required approval of minority shareholders, via a special resolution. The minority shareholders rejected the offer price as too little. Consequently, Siemens Germany revised the offer price from Rs 857.2 Cr. to Rs 1,023.27 Cr. Further, In the case of United Spirits, last month minority shareholders rejected as many as 9 related party transactions with Vijay Mallya entities.

- Clause 49 of the listings agreement (75% Minority Shareholder Approval Rule): A significant change in this regard has also been made to clause 49 of the listings agreement by SEBI, to inculcate the essence of the new companies act for greater participation of minority shareholders in crucial decisions of the company. One such regulation requires all related party transactions to be approved by 75% of the minority shareholders. This regulation however, has been felt by many to be very stringent hence the cabinet recently passed an amendment wherein the threshold would be brought down from 75% to 51%. This amendment is yet to receive approval from the Parliament of India.

- Small Shareholders Director: Section 151 of the Companies Act 2013 requires listed companies to appoint at least one director elected by small shareholders. Small shareholders for this purpose means shareholder holding shares of nominal value of not more than twenty thousand rupees or such other sum as may be prescribed. This is in addition to clause 49 of the stock exchange’s listing agreement which prescribes for half the board of directors to be independent (in case the chairman of the board is a non-executive director, then at least one-third of the Board should comprise of independent directors).

- Class Action Suit: Section 245 of the Companies Act allows minority shareholders and depositors in the company to file class action suit against the company and its auditors. This act enables minority shareholders to file a class action suit against decisions of the board which might be contrary to the Articles or Memorandum of the Company or which seems to be violating the provisions of the Companies Act. Minority shareholders / depositors for this purpose = 100 members / depositors.

- Oppression and Mismanagement: The new Companies Act allows any number of minority shareholders to file proceedings against the company under section 241 of the Act. It is interesting to note that what constitutes minority in this regard is left to the discretion of the tribunal. Earlier this decision was left to the central Government which is probably why not many oppression and mismanagement cases were filed.

- Greater participation of Institutional Investors: Continuous efforts are being made by both SEBI and the Government to encourage participation of mutual funds in corporate decision making. For example in 2010, SEBI issued a circular to mutual funds requiring them to play an active role to exercise their voting rights in the investee company in a responsible manner. Further this circular requires the asset management companies of these mutual funds to disclose on their websites and their annual reports, their general policies and procedures regarding the exercise of their votes in the listed companies[1]. While the SEBI circular applies essentially to mutual funds, its broader message could well pave the way for greater participation from all types of institutional investors.

Recent instances and cases of Shareholder activism

- In 2012 an institutional investor namely The children investment fund (TCI), which held 2% stake in Coal India – making it the second biggest shareholder in the company (after the Government of India which held 90%) – wrote a letter to Coal India, accusing them of committing “breach of fiduciary duties” towards minority shareholders by reversing an earlier steep increase in the price it charged for coal. This letter was seen as a wake up call for the Government to inculcate values of corporate governance within the regime controlling legal acts of the company.

- In November 2014 the world’s largest spirits group – Diageo had to change certain plans when minority shareholders of United Spirits, its recently acquired Indian subsidiary, rejected a proposal to make, sell and distribute spirits with some of the brands of its UK-based parent company. Mostly, Diageo’s plan did not specify any financial details on the basis of which a genuine assessment could be conducted which led to this action.

- In July 2014, minority shareholders of Tata Motors rejected proposed executive compensation package for several of the company’s directors, after the company reported a net loss for the year.

- In the same year, Siemens was forced to raise the offer price at which it wanted to buy out the metal technologies business of its listed Indian subsidiary. This was after minority shareholders rejected the initial offer.

- In January, Japan’s Suzuki Motor Corp. said it will invest Rs.3, 000 Cr in a factory in Gujarat and sell cars to Maruti Suzuki India Ltd. It marked a significant change from an earlier plan where the local company was supposed to have built the plant. The announcement raised concerns that Suzuki could sell the cars at a higher price to Maruti than it would have cost the latter to produce them itself. Some shareholders alleged that the proposal was a tactic to shift revenues from the Mumbai-listed company to the offshore parent. Minority shareholders, including institutional ones, came together to oppose the plan, forcing the company to alter its proposal.

- The Bombay high court on 17th July, 2014 directed Cadbury India Ltd to pay Rs.2,014.50 per share to buy back its share. This was 50% more than its original offer of Rs.1,340 made in 2009. Shareholders of the company clearly feel that they deserve a higher price for their shares in the company and have challenged the buyback price on numerous occasions.

I would like to hear about cases of bad corporate governance in Indian companies. In case you have a grievance or if you are aware of a company being mismanaged, do let me know by leaving a comment under this post or by writing in to me. My background and My contact details on this page.

[1] Securities and Exchange Board of India, Circular for Mutual Funds, SEBI/IMD/CIR No 18 / 198647/2010 (Mar. 15, 2010)

Dear Sir, wanted to highlight serious corporate governance issues with Camson bio and Camson seeds, listed cos on BSE. The promoter Dhirendra Kumar is the biggest fraud of all times. He has siphoned off investor money as well as bank funds which is a reflection on the BL. More importantly has acquired shares thru dubious manner in the last 2 fund raise without bringing in any money and round routing alone. SEBI is investigating the first episode of 2009/10 and ther is already some progress. The same needs to be investigated for the 12/13 fund raise as well.

Apart from the same, there is no real business being transacted in the company but fraudulent billing being accounted as sales for both companies. Bills are produced inhouse thru dummy buyers and sellers, hence bloating the inventory and receivables.

The company hasn’t being paying salaries and statutory obligations…not depositing the PF collected from employees since years now making it obvious that employees have been leaving the company in hordes.

The promoter thru his network in the operator circles has been managing the stock prices without any significant story. Thru this he is finding a way to exit his dubious holding from dummy accounts…pls see the last couple of months movement..

As and on behalf of 100 of aggrieved employee/investor needed to highlight this in the interest of small share holders…

Pls try and get this man Dhiren Kumar out … he is a pest and needs to be punished.