We all do it, or at least have done it at some point of time or the other.

Average share price

– Average your buying price by purchasing more shares at a price lower than your original purchase price.

In an ideal world, you should of course be buying stocks where you see value. In other words, if you believe that a stock will rise from a certain level and for whatever reason it is in an oversold territory, you will / should buy it.

Naturally then, when it falls below your original purchase price, you have every reason to believe that you should average share price so long as your original purchase decision was correct.

Rule of Averaging Your Purchase Price

If nothing has changed for the company’s fundamentals since your original purchase decision, you should buy more and average at 10 – 15 – 20% lower price or at whatever lower threshold you are comfortable at buying. Of course, the economy, industry and the overall sentiment of the market should also be broadly the same as before to justify such purchase decision.

For most part the above statement may be true but I recently got a question from a subscriber, the answer to which would probably throw more light on this aspect.

Exception: When Should You Not Average

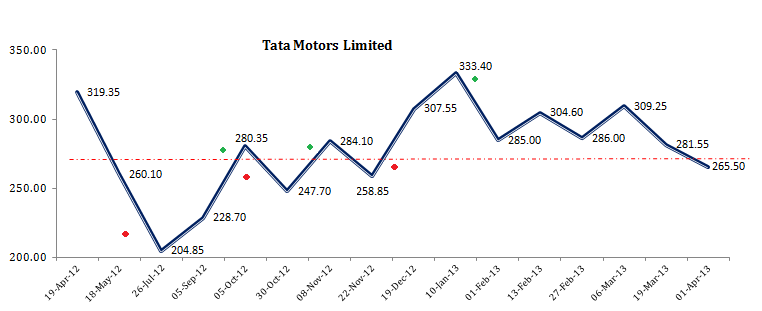

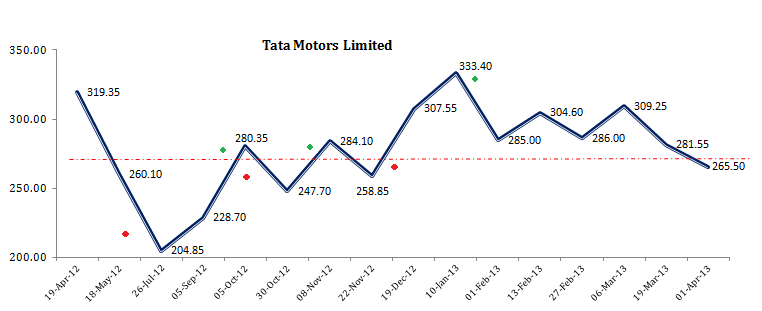

Idea: Buy on green & try to average share price on red?

This morning I got a mail from a subscriber which is mostly why I thought of writing this piece. I will reproduce our interaction below:

Question:

How much downside is still left with ‘ORBIT CORP’?

It’s almost 30% down from your Multibagger pick BUY price. Should I do Cost Averaging at current price of around rs17.50 with Equal Investment Amount as done at price of Rs. 24?

Or should I wait for further downfall??

My Answer:

Why do you want to average it?

As I understand, you purchased Orbit Corp at Rs. 24. Now this is a little speculative in that if their business and the real estate market in Mumbai revive, then this could trade substantially higher. Let’s for a moment assume this happens. The share trades at Rs. 150 in the year 2018. Then do you care if it was at Rs. 24 or Rs. 14 or Rs. 18 when you bought it?

On the other hand, if the business and/ or industry do not revive, you may find this share trading below Rs. 10. Would you not feel odd about averaging between 17 and 24?

I would say, stop looking at your purchase at Rs. 24, it’s a good buying price given the risk-reward. Focus on blue chips too, you know – ITC, Cairn India, L&T etc.

Now again, if you have a lot of speculative money, sure go ahead and buy some more in Orbit.

And then I received this:

My general practice is cost averaging at every 15% fall for 2 times from 1st Buy price; & if market price rises by 10% from 1st Buy price, then invest remaining equal amount of money at this 10% rise price.

But, as you clarified with present status of this stock, will wait for further worst-case downside possibilities with this particular stock.

The take away as I would say it is – learn to differentiate between speculative investments and fundamentally sound investments. As for Orbit Corp – I still believe that irrespective of all the worries around – promoter selling stake, bad real estate market and possibly some unconfirmed reports of operators at play in the stock, it still makes a good speculative investment.