A few days back I received this Question –

“Is it a good idea to invest in Nifty or Sensex Index Fund? What are the pros and cons?”

______________________________________

What is an Index Fund

Index funds exactly replicate an equity index (Sensex or Nifty) by investing in the same stocks which constitute the underlying index. For instance, a fund that tracks the ‘Nifty’ will invest in the 50 stocks that comprise the CNX Nifty index.

The proportion of investment in each stock will be exactly in accordance with the weight of the stock in the index. For example, ITC has a weight-age of 7.59% in Sensex; a fund based on the Sensex would also allocate 7.59% of its portfolio to ITC.

Why Should You Not Invest In Nifty or Sensex Index Fund?

[1] Index Funds Never Beat the Index – Returns generated by these funds are in line with the benchmarked index. However there could be small difference in returns on account of tracking error.

Tracking error – It is the difference between returns generated by an Index fund and the Index itself due to expenses like transaction costs including brokers’ commission, and other related charges.

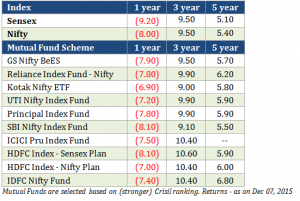

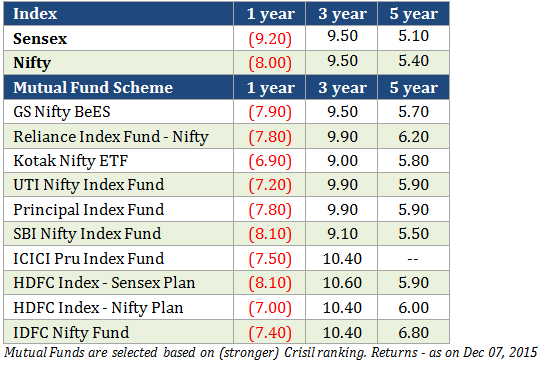

Also, index funds will usually not outperform an actively managed well diversified mutual fund. Average return given by top 10 index funds in the past 1 year period stood at (7.57) % whereas return given by top 10 large cap equity funds in 1 year stood at 0.07 %

Returns given by Top 10 Index Funds (In %)

Returns given by Top 10 Large Cap Equity Funds (In %)

[2] Lack of Expertise in Management – Index funds are passively managed funds where fund managers just buy and hold the stocks that form part of the index, exactly in the same proportion.

This is contrary to actively management, where the fund managers employ a variety of techniques based on research, sector picking and market timing to try and beat the market.

[3] Lack of Diversification – Index funds lack sector specific diversification. While investing in index funds, investors are tied down only to large-cap stocks in some selected sectors (as some of the sectors like agriculture, tourism, shipping, aviation and textiles are missing from both, Sensex and Nifty). There are also many small and mid-cap companies that can prove to be better investment options and certain exposure here is always a good idea for higher return potential.

[4] Index funds are bound to have the index specific stocks – Index funds can never get out of any stocks even when if the view on those stocks may be extremely negative. For example: Metal stocks have consistently lost market capitalization and their share price has eroded substantially over the past 52 week period. This was only expected with the slowdown in China. Recently Hindalco and Vedanta exited the CNX Nifty. An index fund replicating the Nifty would have held on to these stocks despite being very positive on their impending exit.

The only visible advantage (somewhat) of investing in index funds is the low transaction/ expense charges mainly on account of the limited role of fund managers. The average expense ratio of actively-managed fund is 2-2.5%, while for a typical index fund this will be in the range of 1-1.5%.

Thanks a ton for your balanced analysis, Rajat. It’s the best I’ve read on the subject. Hats off to you.

It is the best write up I have read on the topic. The in-depth details with the thorough analysis makes it really easy to understand even for the individuals completely new for online stock marketing.