Sintex Industries (“Sintex” or the “Company”) has a strong presence in the plastic processing and fabric manufacturing industries. The Company enjoys a global presence through its subsidiaries – Sintex NP SAS (Europe) and Sintex Wausaukee Composites Inc. (in the U.S.). Sintex’s Indian subsidiaries include Sintex-BAPL Ltd. for custom moulding and Sintex Infra Projects Ltd which undertakes EPC contracts for various infrastructure projects across the nation.

CAVEAT: In March 2015, about 52% of the promoter’s equity was pledged, which has gradually reduced to 47% in March 2016 and 40.24% currently.

Business verticals

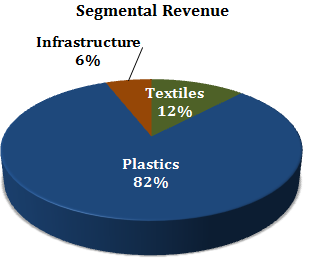

Sintex enjoys a strong presence across diverse sectors. Its plastic-based products are used across fast-growing segments while the textile business’ focus is on manufacturing premium structured fabrics.

[I] Building Products: Products from this business vertical find application in residential, commercial and industrial purposes. The sub-verticals in this space are:

- Prefabricated structures

- Cold chain network

- Plastic sections

- Water storage solutions

- Sub-ground structures

- Environment-friendly products

[II] Custom Moulding Products: Within the custom moulding space, this sub-vertical generates maximum volumes and includes the following:

- SMC products

- Industrial containers

- Pallets

- Insulated boxes

[2] Textile – Sintex’s fibre-to-fabric (composite mill) facility at Kalol (Gujarat) manufactures high-end, yarn-dyed structured fabrics for men’s shirting, yarn-dyed corduroy, and fabrics for ladies wear. This contributes about 12% to the Company’s topline.

The Company’s client list includes major international players like Armani, Diesel, Hugo Boss, Burberry, DKNY, Zara, Mexx, Massimo Dutti, Royal Mint, Canali, Tommy Hilfiger, Versace, Oliver, Max Europe, Banana Republic, Marks & Spencer, IKEA, H&M, Ann Taylor, Colour Plus, Pepe Jeans and Nike. Its reputed Indian customers comprise Arrow, ITC Wills Lifestyle, Allen Solly, Zodiac, Van Heusen, Reid & Taylor and Louis Philippe.

WHAT’S GOING FOR THE STOCK

Demerger – An Attractive Opportunity

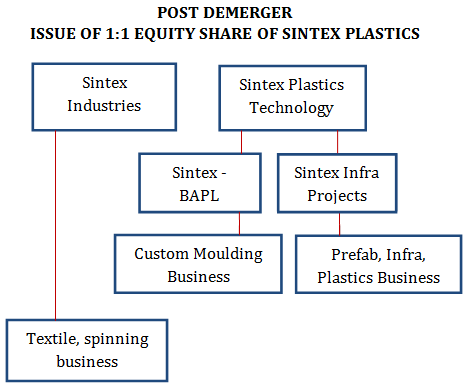

Important Note – On 29 September 2016, Sintex announced demerger of its plastic business from Sintex Industries. Post-demerger, there will be two companies [1] Sintex Industries (textile and spinning businesses) and [2] Sintex Plastics Technology Limited, operating through two subsidiaries – Sintex-BAPL and Sintex Infra Projects.

Shareholders of Sintex Industries will get one equity share of Sintex Plastics Technology against one equity share held in Sintex Industries; and these will be listed on the BSE and the NSE.

Post the demerger, the plastic segment could trade higher given the strong growth potential and return profile.

| In Rs. Cr. | Plastics | Textile |

| Sales | 6,848 | 946 |

| EBITDA | 1,068 | 217 |

| Net Profit | 931.21 | 148.00 |

| Net Profit (%) | 13.60 | 15.64 |

Leadership Position in Water Storage Solutions

Sintex brand is synonymous with water storage tanks. The Company occupies leadership position in this space with more than 60% market share. Its huge product range comprises water tanks for every conceivable application – loft tanks in individual apartments to water storage solutions for building complexes as well as underground storage tanks in various sizes.

The Company markets its products under three brands Sintex (premium tanks which includes the recently launched white triple wall water tanks), Reno (standard tanks) and Renotuf (value-for money tanks. In FY 2016, the Company launched a new product with the brand name of Titus, a mid-priced water storage solution which was eagerly accepted by the target customer segment.

Custom Molding – A Diversified Play

Sintex entered the custom moulding business in 2008 and has grown internationally through a series of acquisitions.

In FY 2016, custom molding business contributed 50% to the total revenue. In FY 2016, custom molding business has seen revenue growth of 21% on consolidated basis with 22% and 20% growth in international and domestic business respectively. Sintex caters to automotive, electrical, Aerospace & Defense, Medical Imaging, Industrial trucks & tractors and retail segments.

[1] SMC Products – Sintex products address the critical issue of power theft and caters to power transmission customers (State Electricity Boards and private players in the power transmission space). Sintex has strong portfolio of electrical products including junction boxes, meter boxes, SMC distribution boxes, SMC distribution pillar boxes, water meter boxes among others. In FY 2016, The Company started trading operations for MCBs, RCBs and CCBs.

[2] Industrial Containers and (Fiberglass Reinforced Plastics) FRP Tanks – The Company manufactures large industrial tanks to store dyes, colors and chemicals in multiple sizes to suit diverse industrial uses. Rising industrialization and increasing thrust towards a safe working environment has accelerated the demand for these products. In FY 2016, the Company received approvals from leading oil marketing companies namely IOC, HPCL and BPCL for installation in new dispensing stations, pan-India. In FY 2016, the Company supplied these niche storage solutions to Shell outlets.

[3] Products Customized For Specific Customers – Sintex develops customized products for corporate including:

- Fuel tanks and mud guards for M&M, AMW, Ashok Leyland and Escorts (off-road vehicles)

- Fuel tanks for gensets of Kirloskar and Cummins

- Packaging crates for the engineering sector; primarily for some of the Tata Group companies

- Enclosures for leading corporates in the electrical equipment sector

- Starter panel boxes for pumps and motors for the agro industry

- Components for cooling towers

Leveraging Global Manufacturing Bases

The Company is headquartered in Kalol (Gujarat) and enjoys a pan-India presence through 13 manufacturing facilities in India. Besides, its operations are spread across 12 countries in four continents through 37 manufacturing facilities and 30 global subsidiaries, which mainly includes Bright Autoplast Ltd., Sintex Infra Projects Limited, Sintex Wasaukee Composites Inc., USA & its subsidiaries and Sintex NP SAS, a French Company & its subsidiaries.

Available at Attractive Valuations

Sintex is available at an attractive valuation as compared to its peers. The Company’s trailing 12-month (TTM) EPS stood at Rs. 12.51 per share. At current CMP of 80.95, the stock is trading at a price-to-earnings (P/E) multiple of 6.47.

| Company | EPS | Price | P/E |

| Sintex Industries | 12.51 | 80.95 | 6.47 |

| Nilkamal | 74.28 | 1441.90 | 19.41 |

| Supreme Industries | 29.77 | 883.40 | 29.67 |

| Astral Poly | 9.26 | 392.45 | 40.21 |

Sintex’s presence across a spectrum of sectors and across geographies has helped Company in differentiating itself from its competitors. With growing emphasis of cleanliness, increasing corporate contributions towards improving social infrastructure and various government initiatives like the Swachh Bharat Abhiyan, Sarva Shiksha Abhiyan and the Clean Ganga Mission, its prefabrication segment is expected to see high growth opportunity.

INVESTMENT RISK FACTOR

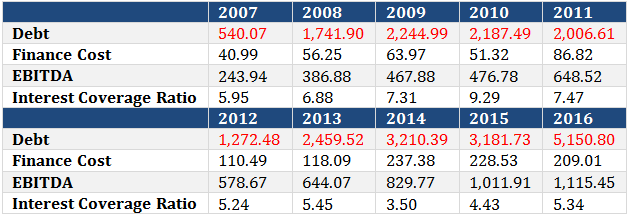

Rising Debt | Expansion Pain

Between 2007 and 2010, the Company’s long term borrowings jumped almost four-fold to about Rs. 2,100 Cr. because of several acquisitions made in the plastic business in the U.S. and European markets. Rising debt has also added other associated issues like pledging of shares. In March 2015, about 52% of the promoters equity was pledged, which has gradually reduced to 47% in March 2016 and 40.24% currently. While exact breakup of debt is not known, majority of the consolidated debt is in the textile business (according to our internal research based on various primary and secondary sources). In past, Sintex has also borrowed under the Technology Upgradation Fund Scheme for expanding its textile business.

PEERS

| Name | Price* | Market Cap.* (Rs. Cr.) | Net Profit** |

| Supreme Industries | 872.50 | 11,083.09 | 213.10 |

| Astral Poly Tec | 395.00 | 4,730.78 | 72.47 |

| Jain Irrigation | 93.15 | 4,466.17 | 71.25 |

| Sintex Industries | 81.15 | 4,247.98 | 549.61 |

| Nilkamal | 1,436.15 | 2,143.10 | 103.89 |

| VIP Industries | 124.50 | 1,759.40 | 63.42 |

| Mold-Tek Pack | 202.50 | 561.14 | 24.10 |

* As on 5 January 2017

**FY 2016