Price – Rs. 27.80

2 November, 2015

INVESTMENT RATIONALE

Diversification Efforts to Augment Growth

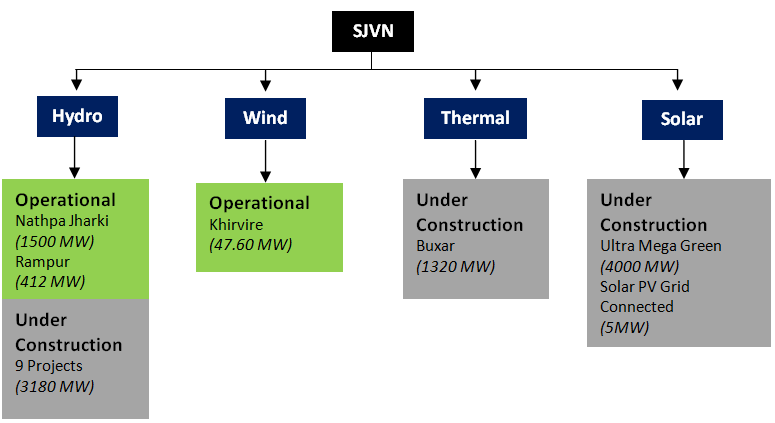

SJVN- diversified presence in different set of power projects.

The Company has 3 operational power plants projects with combined operational capacity of 1,959.60 MW including the country’s largest Hydropower plant (Nathpa Jhakri) with 1,500 MW of operational capacity. The Company has 12 projects under construction in India as well as overseas and plans to expand its capacity to 10,564.60 MW by FY 2022 (Source: Company).

Low Debt to Equity and High Interest Coverage Ratio

SJVN has the healthiest capital structure in the listed (power) space. The Company has reserve of Rs. 6,066.41 Cr. and outstanding long term borrowings of Rs. 2,435.42 Cr. Current debt to equity ratio stands at a healthy 0.24:1.

High EBITDA Margins Likely to Stay Consistent

SJVN has operated with consistently high EBITDA margins, mainly due to zero fuel costs on hydro power projects. Even if commissioning of thermal power projects brings down EBITDA margins in future (on account of raw material cost, i.e. coal), the high mix with hydro based projects will cushion the fall in this margin. Upon commissioning of all other projects which are under different stages of development, the Company is expected to maintain its high EBITDA margin in the coming years particularly because of high concentration of hydro and solar projects in the developmental stage.

Government Reforms

While the government is discussing various ways in which distribution companies and State Electricity Boards (SEBs) can fix power tariff based to reflect actual consumption, certain amendments to the Electricity Act, 2003 have also been proposed to benefit this sector:

[1] Separation of carriage and content in the distribution sector: To achieve the objectives of efficiency and for giving choice to consumers through competition in different segments of electricity market, concept of multiple supply licensees is proposed by segregating the carriage from content in the distribution sector and determination of tariff based on market principles.

[2] Promotion of renewal energy: In order to accelerate the development of renewable energy sources, a number of measures are proposed including – the provision for a separate National Renewable Energy Policy, development of renewable energy industry, separate penal provisions for non-compliance of renewal purchase obligation for coal and lignite-based thermal power plants. NOTE that a majority of SJVN’s current and under construction projects belong to renewable category.

[3] Tariff rationalization: Rationalizing the tariff structure on the basis of sound financial principles for the viability of distribution sector and ways for recovery of revenue of licensees without any gap is amongst key focus area of government reforms. The provisions of tariff policy are proposed to be made mandatory for the determination of tariff.

[4] Enhancing grid safety and security: In order to strengthen grid safety and security, specific measures regarding maintenance of spinning reserves have been envisaged.

INVESTMENT CONCERNS

Sale of Power to Debt Burdened State Electricity Boards (SEBs)

Approximately 90% of total revenue is attributable to the sales of electricity to SEBs pursuant to long term power purchase agreements between the Company and SEBs. In addition, the Company is required to provide approximately 12% of its annual generation to the state of Himachal Pradesh free-of-cost, and an additional 1% of generation from operational projects located in the state of Himachal Pradesh to a state-established local development fund.

The Company is not entitled to sell power generated by power plants in the open market or based on open market energy prices under prevailing Government policies. In case SEBs fail to pay the Company for the power produced by them, the Company will take a significant hit to their operating margins.

SEBs in India are cash strapped and while SJVN does not have interest payment obligations, it creates a negative business environment when your paymasters are not adequately capitalized.

Risks Relating to Power Projects

Power Sector is a highly capital-intensive industry with long gestation periods. Revenue generation could take many years after the initial conceptualization of a project. Since most of the projects have a long gestation period (4-5 years of construction period and operating period of over 25 years), the uncertainties and risks involved are high and often very unpredictable.

Delay in commissioning of projects is also a concern as it leads to delay in inflow of revenues. At the same time, power companies have to incur costs on the delayed projects, thus affecting margins and overall profitability which could have a negative impact on the share price.

VIEW

SJVN is currently trading at Price to Earnings multiple of 6.8 At Rs. 28.55 the dividend yield for the stock is at 3.70 %. The Company has maintained a consistent track record in terms of dividend payouts.

Read More:

Power Stocks: Deep Value or Junk Buying?

What Dividend Payouts Tell Us?

At these levels, SJVN provides good and safe long term investment opportunity.

The Company plans to increase its capacity by more than 5 times from current capacity of 1,959.60 to 10,564.60 by 2022. While the current capital structure of the Company is encouraging, it may have to incur additional debt to achieve its capacity expansion goals. Going by the experience of other players in the power sector, debt has been the primary reason for downfall of other players in this sector.

Key things to watch out for:

- Capital Structure: how the Company funds its capacity expansion.

- Debt levels.

- Government Reforms and financial health of SEBs

Hi Rajat,

Thanks for this detailed analysis.

It would be helpful if you could give a rating from 1 to 5 stars for the stocks that you analyze.

* = strong sell

** = sell

*** = hold

**** = buy

***** = strong buy

Thanks again and much metta,

Rohi

Thanks Rohi ****

Go ahead, you can rate my recos too!

Dear Sir,

Greetings!

I highly appreciate your Research Analysis on SJVN, Very helpful and Educative.

Thank You!

Regards,

Dr.Singh

Thanks Dr.

I sold my SJVN @28.10 today. If you have posted this yesterday , I would have saved my brokerage charges and capital gains tax. I have been holding it for 10 months. Now I have to buy it again .Lol.

Thanks for your nice article

Thank you sir for your detailed analysis. While reading your just previous banking report, planned to buy Federal and IDBI,but now an eye on SJVN!

Thanks Sunil.

I agree with your post. Nice information.Thanks.

Thanks Samip

With government holding at 90%,and SEBI guidelines to have minimum 25% public shareholding. The 15% off-holding by govt is a overhang on the stock. what is your view on this ?

Oh wow! You found a real gem. I recently invested in powergrid, wish I had found this sooner. I think GIPCL is also worth looking at, and would love your analysis on that.

Its been covered, you will find a report on that in the member section.