Systematic Investment Plan (SIP) is a regular and disciplined way of investing money in mutual funds. SIP allows you to invest a certain pre-determined amount at a regular interval (weekly, monthly, quarterly, etc). An SIP is a planned approach to investments and more than anything it helps the investor inculcate the habit of saving and building wealth for the future.

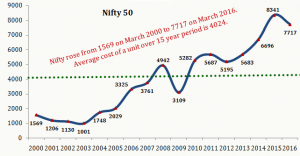

Assume a SIP of Rs. 2,000 per month growing @ 10%, 12% & 14% p.a.– Notice above how compounding takes effect over a longer period.

To calculate future value of your SIP investment – visit here

How does an SIP work?

SIP is a flexible and easy investment plan. The amount you wish to invest systematically gets auto-debited from your bank account at your chosen dates and you are allocated number of units of specific mutual fund scheme based on the ongoing market rate (called NAV or net asset value) for the day.

List of documents to Start Systematic Investment Plan (SIP) in Mutual Funds

[1] KYC Compliance

Effective from1 January 2012, know-your-client (KYC) norms have been made mandatory for everyone who wishes to invest in mutual fund. Investors need to submit their KYC acknowledgement along with investment form. Fortunately, this is a onetime procedure, so if you have got your mutual fund KYC done once, you will not have to do it again

How to check your KYC status?

Existing investors and those who have submitted their applications can check their KYC status here: https://www.cvlkra.com/ — click on ‘KYC Inquiry’—- Enter your pan card details and —- submit. If your KYC is approved, you will get a notification on the screen.

How to get KYC compliant?

Download the applicable KYC application form from a KRA website. Alternately, your Mutual Fund advisor can provide KYC application forms as well. Documents required to be submitted along with KYC application:

- Recent passport size photograph

- Proof of identity – copy of pan card / Aadhaar/ passport/ voter ID / driving licence

- Proof of address – passport / driving license /ration card / registered lease/sale agreement of residence /latest bank A/C statement / passbook

- You will need to submit copies of all these documents by self-attesting them along with originals for verification.

[2] Application Form – If you are investing for the first time in a mutual fund scheme, then you needs to fill– (1) mutual fund application form and (2) SIP enrolment form. Naturally, existing investors are required to fill only an SIP enrolments form.

Suppose you want to start an SIP in DSP Microcap Fund, you will need to fill both the forms; one form to open your account in DSP Microcap Fund and another one to start an SIP.

Benefits of Investing Through Start Systematic Investment Plan (SIP)

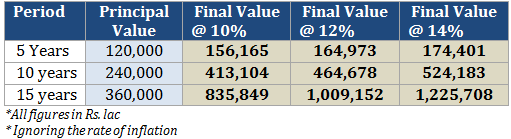

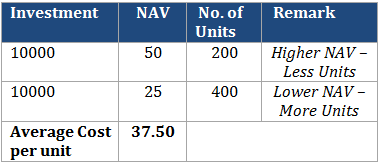

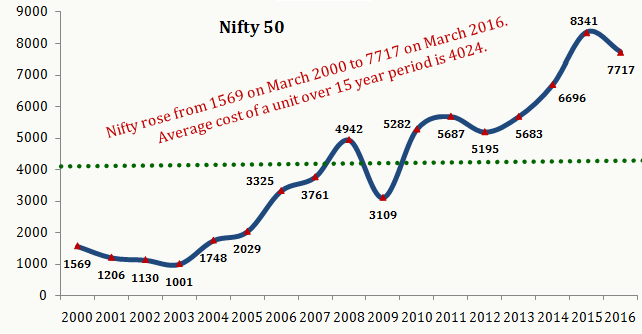

[1] Rupee Cost Averaging – With volatile markets, most investors remain doubtful about the best time to invest in the market. SIP helps them to invest and make profits through rupee-cost averaging. The concept of rupee-cost averaging allows an investor to keep the purchase cost averaged by buying units at different prices based on market circumstances.

By investing a fixed sum at fixed intervals, you can buy fewer units when the price is higher and more units when the price is lower.

[2] Benefits of Compounding

“Compound interest is the eighth wonder of the world. He who understands it, earns it… he who doesn’t… pays it.” – Albert Einstein

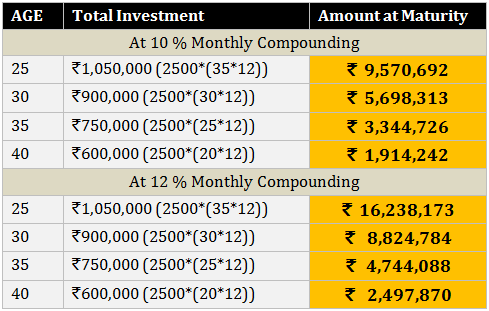

Suppose, an investor invested Rs. 2500 per month. The table below shows the returns generated at different rates when invested at different points of time.

[3] Small is Good: systematic investment plans do not seek a large amount of investment and investors can start investing with a low sum each month (as low as Rs. 500), depending on their financial circumstances. Start early to get the maximum benefit of compounding.

[4] Disciplined Investor – When you invest through a SIP, you commit a fixed sum of money (minimum of Rs. 500 and in multiples of Rs. 100 thereof) to be invested every month in the mutual fund scheme. You are far more likely to get used to a certain discipline of investing this way. Small (regular) investment is one of the best ways to start attaining your financial objectives/goals, particularly for first time investors.

[5] Convenience – SIP is a hassle-free mode of investment. You can issue a standing instruction to your bank to facilitate auto-debits from your bank account at fixed intervals (monthly, quarterly). No paperwork, no hassles.

To start investing via an SIP and for other related questions, you can write in to me at –rajat@sanasecurities.com or call me at +91 11 41517078.

The content in the post is very nice. Thanks for the valuable post.

Thanks Tradeindia Research team

Its actually quite easy to get into mutual funds as all that’s needed is submitting an application form along with necessary proof documents online or to an agent which offers investment services. Once started, you can pick any fund you want and initiate monthly or lump sum investment. I opted for monthly investment as I gave me greater control over how much I wanted to save every month.