The factors considered below present an overview of the Indian chemical Industry in general and stock analysis of Gujarat Fluorochemicals in particular. For a full financial analysis: visit here – Gujarat Fluorochemicals Financial Statements.

Gujarat Fluorochemicals Ltd (“GFL” or the “Company”) is part of the $2 billion INOX Group of Companies which manufactures and sells resins, chemicals and refrigerant gases. The Company operates in two segments: (i) chemicals, wherein it produces refrigerant gases, other chemicals and carbon credits; and (ii) power, wherein it generates power.

WHAT’ DRIVING THE STOCK

Healthy Growth

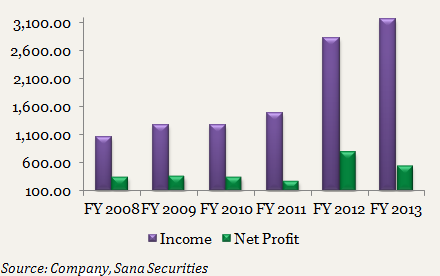

The Company has been able to maintain a healthy growth rate over the past few years. It has posted a five-year compounded annual growth rate (CAGR) of 21.74 % in income and 17.76 % in net profit in the period FY 2008 – FY 2013.

Gujarat Fluorochemicals: Segment-wise product-wise performance

Polytetrafluoroethylene (PTFE), used as a non-stick coating for pans and other cookware accounts for around 25 % of the Company’s sales in value terms. PTFE sales recorded an increase of 23% in volume terms and 138 % in value terms. Around 19 % of the Company’s PTFE sales last financial year came from the domestic market and 81 % of PTFE sales from the export markets. The Company witnessed a 25 % growth in its PTFE exports.

Key opportunities in the PTFE business include the vast undeveloped potential in the Indian markets that would be converted into market demand by new product and application development.

Caustic Soda (used mainly for the refining of petroleum, in making paper, in manufacturing textiles, in printing and dyeing and in the manufacture of soap) accounts for around 18 % of the Company’s sales in value terms. Caustic soda sales increased last financial year by 23 % in volume terms and by 56 % in value terms.

Chloromethanes (colorless extremely flammable gas used as a refrigerant) , account for around 12 % of the Company’s sales in value terms, increased last financial year by 84 % in volume terms and 66 % in value terms.

The Company expects to maintain a healthy sales growth rate going forward.

Competitive advantage

Indian market for PTFE is around 3,000 – 3,500 Tonnage Per Annum (tpa), and growing at a healthy 7 – 8 % per annum. The Company has ~ 80 % market share and enjoys a significant competitive advantage, because of its integrated operations. Gujarat Fluorochemicals is amongst the top 2 or 3 integrated players, giving it significant cost competiveness amongst other global players. The Company operates with the present capacity of 12,000 tpa and is planning to increase it further to 18,000 tpa. GFL is working to develop new products and applications to encourage higher growth and demand in the domestic market. The Company has adopted marketing strategies to be proximate with customers and provide value added services such as warehousing facilities in the US and EU markets, and technical services to drive value for customers.

The Company is also considering other product in the fluoropolymer space (used in wire insulation for computer networks, semi-conductor manufacturing equipment, and nonstick cookware) and would be taking an investment decision in these areas. This would provide an avenue of substantial growth in the near future.

WHAT’S DRAGGING THE STOCK

Intense competition from China

The key threat to the refrigerant gas business continues to be competition from China. India is disadvantaged in the production of refrigerant gas vis-à-vis China. China is now the market leader in the production of refrigerant gas whereas Indian companies meet most of its requirements through imports. Any further capacity expansions in China, may put cost pressure and deteriorate the margins of the Company.

Demand slowdown: Fragile state of economy

Besides the state of high inflation in India, the company is suffering on account of a prolonged slowdown in the global economic conditions. The recovery has been the slowest in recent times and even after 6 years, the economy is not yet back on track and many downside risks remain. Given that 56% of total revenues of Gujarat Fluorochemicals are from exports, the state of global economic environment affects GFL in a material way.

In the United States, unemployment is still high. In Europe, sovereign debt problems continue to be a concern and may derail the recovery. India has been struggling with record high inflation numbers which has restricted the RBI from cutting key interest rates. Global economic conditions and confidence in recovery affect the Company’s clients’ businesses and the markets they serve.

______________________________________

** The stock analysis of Gujarat Fluorochemicals including the financial analysis report linked above, is for information purpose only. This analysis should not be taken as a buy/sell recommendation. The circumstances of the company and the economic environment may have changed since the date of this stock analysis.