Gulf Oil Lubricants India

CMP- 735 (12-01-24)

- Gulf Oil Lubricants is the fastest-growing lubricant major in India. It is India’s 2nd-largest lubricant company after Castrol

- Gulf Oil achieved 10-12% CAGR volume growth in the last decade, significantly outperforming the lubricants Industry growth rate. ~25% CAGR PBT growth in the last decade

- The Company has gained market share consistently over the years and has taken the lead in making a foray into EV fluids for electronic vehicles.

- Gulf Oil is proactively expanding its dealer network in new geographies to enhance the scope of its B2C lubricant business, which generates 60-65% of its lubricant & oil volumes at better margins compared to its B2B business.

- Gulf Oil has also acquired companies including Tirex Transmission, Indra Renewable Technologies, and Electreefi to build its charging infrastructure capabilities

- Gulf Oil is aggressively expanding its battery distribution business by localizing battery production.

- With strong volumes coming in, a strong supply chain, distribution strength, and continuous investments in branding activities, Gulf Oil Lubricants expects to grow at 2-3x of the industry.

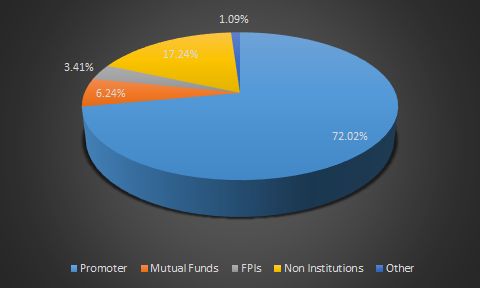

- What we like about the stock is its clean ownership structure (held 72% by Gulf Oil International), and its foray into EV fluids.

VALUATION study for Gulf Oil Lubricants (as of 14-01-2024)

-

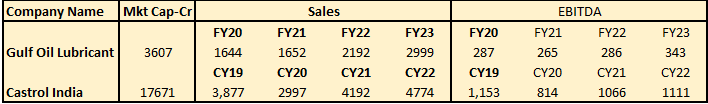

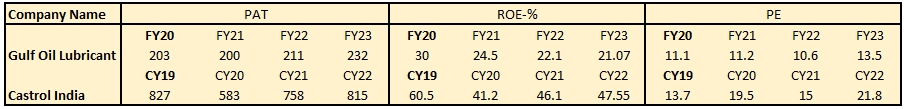

Gulf Oil Lubricants is trading at a cheap PE Multiple of 13.5, compared to a high PE multiple of 21.8 of its closest peer,Castrol. The company is in a high growth phase and has a steep valuation discount of >30% to Castrol. And we believe going forward this gap will become narrower as the growth story for Gulf oil plays out.

- Considering the PE multiple of Gulf Oil in isolation, it is evident that it is currently trading below its median PE of 14. However, a PE rerating towards its mean is highly likely, which would undoubtedly result in an upside in the stock price.

- According to industry reports, the Lubricant Industry is expected to grow at a CAGR of 3%. Gulf Oil Lubricants, on the other hand, expects to grow at a rate of 2-3 times that of the industry. Taking into account only the lubricant segment, it can be expected that the growth in terms of volume will be between 6-9%, but due to the highly competitive market pricing, growth will not exceed 5%. Therefore, the total revenue growth is expected to be in the range of 11%-14%.

- Considering a PE of 13.5 and a PEG of 1.69, the market currently attributes an anticipated growth of 8%.

- However, we hold the perspective that given improved margins, Gulf Oil Lubricants has the potential to achieve a growth rate of 20%.

BULL CASE SCENARIO FOR FY26

Considering a growth rate of 20%, Gulf Oil Lubricants can probably do ~Rs.80-81 EPS in FY26 and with a rerating of PE at least towards its historical median of 14.

PRICE = EPS * PE

1120 = 80 * 14

Now considering it a slightly risky business, a discount rate of 15% and discounting back the price to today’s price gives us a Fair value of stock @736.418

CMP = 735

We believe that the stock is fairly valued at current levels, Investors should add more on dips.

ABOUT THE COMPANY

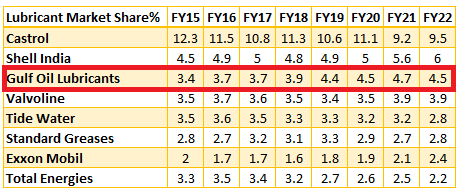

Gulf Oil Lubricants India Ltd, a Hinduja group company is an established lubricant company with a 7% plus market share (improved from 3.4% in FY15) and is engaged in the business of manufacturing, marketing, and trading of automotive and non-automotive lubricants.

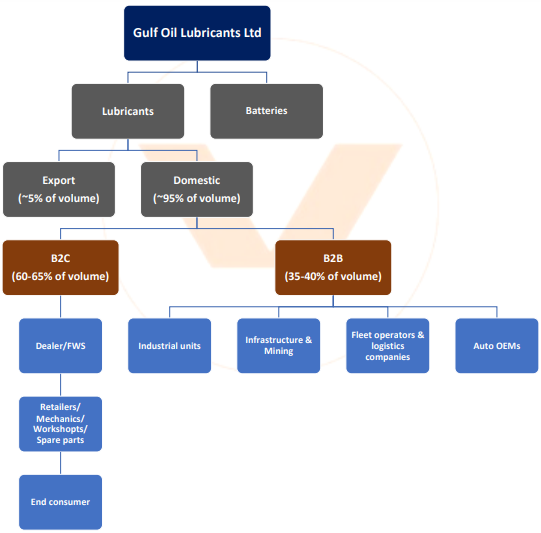

Business Structure

Gulf Oil Lubricants generates ~95% of its sales volumes from the domestic market, while the rest comes from exports.

• In the export market, Gulf Oil Lubricants is leveraging its relations with automotive and industrial MNCs to expand its export network. The company is currently exporting its products to over 25 countries and expanding its product mix for better revenue visibility.

• In the domestic market, the company earns 60-65% of its business from the B2C segment, where the operating margins are higher compared to the B2B segment (35- 40% contribution to business).

- The B2C segment generates stable and recurring revenues, even during the downcycle of OEM sales and industrial output. Hence, the company is focusing more on B2C and expanding its dealer network across India to improve brand

visibility. - When comparing B2C to B2B, it is important to note that B2B is a volume-based business in which Gulf Oil maintains long-term relationships with auto OEMs, heavy industries, and organized logistics companies. Although it is a cyclical industry, it experiences strong growth during upcycled.

PRODUCT PORTFOLIO

- Automotive Lubricants: Gulf Oil Lubricants has developed a wide range of engine oils, gear oils, greases, and specialties for Bikes, Scooters, Cars, Light and Heavy Commercial Vehicles, and tractors. It is blended with advanced additive technologies and every product is designed to enhance performance, reliability, and longevity.

- Commercial Vehicles: Ashok Leyland (India’s No.2 & Global No.3)

Tractor: Mahindra (Global No. 1) & Sonalika (India’s largest exporter)

Motorcycle: Bajaj (India’s No. 2, Global No. 3 & India’s largest exporter)

- Commercial Vehicles: Ashok Leyland (India’s No.2 & Global No.3)

- Industrial Lubricants: Gulf Oil Lubricants provides a range of industrial applications like Hydraulic Oils, Bearing and Circulating Oil, Industrial gear Oil, Metal Working fluids, Turbine Oil, Compressor Oil, Refrigeration Oil, Rust Preventives, Quenching Oil, Greases, Thermic Fluid and slideway Oils.

- Batteries: Gulf Oil Lubricants’ journey with batteries began in 2013, intending to close the large gap between demand and supply for quality batteries in the two-wheeler segment. Since its launch, Gulf Pride batteries have won the trust of over 2 million customers. The Gulf Pride range of two-wheeler batteries is designed using advanced VRLA technology.

- Marine: Gulf Oil Lubricants is an established marine lubricant supplier to the global shipping industry. Since 2008, the company has been providing the shipping industry with high-quality marine lubricants and a large range of complementary technical services. In India, Gulf Oil has been supplying quality Marine Products through its Blend Plant at Silvassa and several depots spread across various ports in India.

- Ev Fluids: Gulf Oil Lubricants has a global EV Fluid range that has been formulated especially for the

optimal performance of electric vehicles. It provides an innovative range of EV fluids that align with the new needs of mobility for hybrid and fully electric vehicles globally and in India. - AdBlue: Gulf Adblue is an environment-friendly product that significantly reduces the emittance of hazardous NOx from vehicles. This usage is compulsory for all medium and heavy-duty BS-VI diesel vehicles. (This product has been a major focus for the company recently with high growth but low margins.)

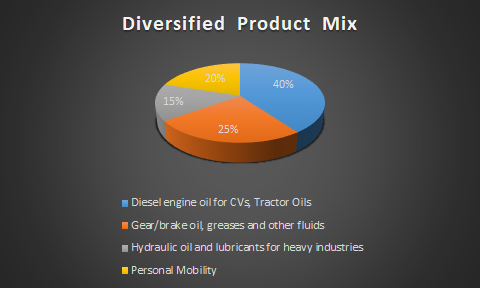

Diversified Product Mix (FY23)

Gulf Oil Lubricants is a well-diversified player in the lubricant segment, catering to various industries and segments.

Strong Relationships with OEMs and B2B Customers:

Collaborations (long-standing) with top OEMs (~40) and B2B (500+) customers.

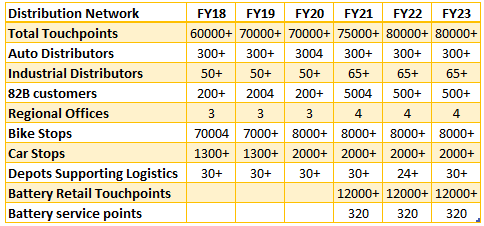

Pan-India Distribution Network

A robust distribution network of 80,000+ touchpoints helps to reach the remotest corners of the country.

The expansion of touchpoints has helped the company gain market share in the lubricant segment. While the marquee brands, like Castrol (market leader) and Tide Water, lost their market share since FY15, Gulf Oil Lubricant has been consistently gaining market share due to its expansion in the dealer network.

Manufacturing Facilities

Gulf Oil Lubricants has two production facilities at

• Silvassa Plant (West India)- Lubricants manufacturing Capacity of 90,000 KL per annum, AdBlue manufacturing capacity of 12,000 KL per annum

• Chennai Plant – • Lubricants manufacturing Capacity of 50,000 KL per annum and AdBlue manufacturing capacity of 18,000 KL per annum

Currently, the plants are operating at 95% capacity utilization and the company has the flexibility to ramp up production quickly in response to any sudden surge in demand, with existing capacity capable of operating in 2-3 shifts.

Global Presence – Gulf Oil International

KEY GROWTH DRIVERS

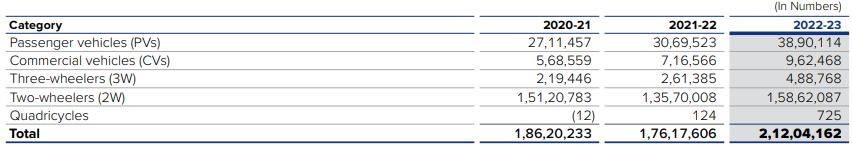

- The demand for lubricants is expected to surge due to the pick-up in the commercial vehicle (CV) cycle, improving freight movement on national highways, rising industrial output, and increasing sales of utility vehicles (UVs).

- The demand for lubricants from the industrial sector has increased over the years. Government initiatives such as Atmanirbhar Bharat, PLI, and Make in India and global strategies like China Plus One have increased industrial

push significantly. In the industrial sector, lubricants are used for numerous applications in various industries including the construction industry, auto components, textile, power generation, mining, food processing, light-heavy engineering, marine operations, and metalworking. Notably, industrial lubricants currently contribute 14% of GOLIL’s overall

revenue- Increasing domestic production and sales to uplift

industrial lubricant demand - Surging demand for specialized lubricants to meet

complex industrial needs will bolster industrial

lubricant sales - Higher adoption of automation and other advanced

technologies set to create new opportunities for

lubricant manufacturers - Growing usage of heavy construction machinery to

power up industrial lubricant sales

- Increasing domestic production and sales to uplift

- The expansion of infrastructure in rural areas, coupled with enhanced internet connectivity and greater penetration of smartphones, has fueled the growth of e-commerce sales in India’s hinterland. As a result, there has been an uptick in demand for LCVs to facilitate last-mile delivery of goods ordered online. This surge in demand for LCVs has created a new market for lubricants in the space.

- India is witnessing solid infrastructure development with rapid expansion of roads, bridges, railways, metros, commercial and residential buildings, and industries. With a multitude of ongoing and proposed projects, the lubricants industry is poised for immense growth, finding applications in both on-highway vehicles and off-highway construction equipment, with substantial opportunities in this rapidly expanding sector.

- Gulf Oil Lubricant has expanded its business operations by venturing into the EV fluid space and acquiring Indra Renewable Technologies and ElectreeFi to bolster its EV charging and supporting infrastructure capabilities. This strategic move has transformed GOLIL into an EV-agnostic company, unlocking a new avenue for growth and driving sustainable revenue momentum in the years to come.

- Gulf Oil Lubricant is making strategic inroads into the battery business by leveraging its existing dealer network to ensure efficient distribution of batteries at minimal capital expenditure. In FY24, the company planning to localize the production to boost battery availability in the B2C market. This expansion is expected to fortify Gulf Oil position in the battery industry and drive growth in the coming years

PEER COMPARISON

INVESTMENT RATIONALE

Given the space that the Company operates in, We believe that this stock could perhaps present the best opportunity there is available to value investors who are looking for a low risk way to play an anticipated turn in the economic cycle.

- Company is aiming for an EBITDA margin band of 12% to 14% over time.

- Strong Balance Sheet – High cash generation from the business

- A large scalable opportunity with significant barriers to entry for any new entrant

- High Return Ratios Cash conversions Net debt Free Balance Sheet.

- Strong management focus on creating sustainable shareholder value by pursuing a clear market share growth strategy through visible brand building and regular capacity additions –

- Company can pass on the raw material hike to the end consumers

- Management Commentary(Q2FY24) – “On a plain calculation it will look lower as a GP because while we have been able to pass on per liter cost of input to the end consumers. On rupee terms per litre basis, we have been able to recover the entire increase in the input cost during those price increases.”

- Base oil is a raw material of lubricant. Base oil costs are stable; manageable as long as crude oil prices stay within $75 to $85 per barrel.- Which shows stability in the margins for coming quarters

- Growth in the lubricant market, projecting a 3% volume and 6% value growth over the next 8 to 9 years, even with the increasing penetration of electric vehicles (EVs).

- Objective to achieve 2x to 3x volume growth and outperform market growth rate.

-

KEY RISK

- Stiff competition in the lubricants market, slowdown in volume growth due to lower demand/high refill intervals due to technology improvement poor growth in the auto industry, and strict government emission norms are key concerns.

- Supply disruptions on account of base oil and raw materials availability, logistics challenges and rupee depreciation are likely to adversely impact demand and supply.

- Growing popularity of Electric Vehicles could dampen the demand for lubricants as EVs have very less moving parts and hence require minimal lubrication. The company remains exposed to the growing acceptance of electric vehicles around the world which could have some bearing on demand for lubricants. (Although the company has done several acquisitions to gain a significant advantage in the EV space)

- As per the Trademark License & Technical and Marketing service Agreement with Gulf Oil International (Mauritius) Inc. (promoter), the company is under obligation to pay royalty fee for the “Gulf” brand name. The royalty fee payable may change depending upon economic developments and as per business requirements. Any rise in royalty fee could impact its profitability going forward.

- Promoter has increased its ownership from 65% in FY16 —> 72.02% in FY23

SHAREHOLDING PATTERN