The factors considered below present stock analysis of Dr Reddys Laboratories Limited. For a financial report: visit here – Dr Reddys Laboratories Limited.

WHAT’S DRIVING THE STOCK

Strong financial position

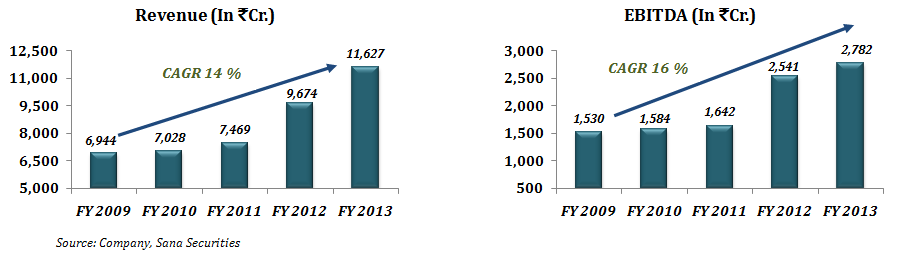

Dr Reddy’s Laboratories Limited (“Dr Reddy” or the “Company”) has grown consistently over the last few years and continued to expand its operation despite the subdued economic environment. Dr Reddy’s revenue from operations over the 5 year period (i.e. 2008-09 to 2012-13) grew at an impressive CAGR of 14 %. For FY 2013, income from operations increased by 20.19 % to Rs. 11,626.60 Cr. from Rs. 9,673.70 Cr. and EBITDA has increased by 9.48 % to Rs. 2,781.90 Cr. from Rs. 2,540.90 Cr. Dr Reddy has reserves in excess of Rs. 6,284.20 Cr.

Robust growth in the U.S. ahead

Over the Counter (OTC) market in India was worth about US$1.8 billion in 2009, and PwC estimates that by 2020, it will grow to US$11 billion – a CAGR of 18 %, with the potential to reach US$13 billion– at an aggressive CAGR of 20 %. The Company is working to strengthen its OTC product basket further, which contributed around US$100 million for FY2013, almost 25 % to the Company’s overall sales. The Company’s market share on Metoprolol (generic Toprol- XL) has increased to 15 %. Total market for Metoprolol is still large at US$450 million and, therefore, a doubling of the market share is significant for Dr Reddy’s. Due to significant launches in late FY14, growth in the US is likely to be stronger in FY15 in comparison to FY14.

Strategic alliances to provide long-term growth

In order to tap the emerging market opportunities, Dr Reddy entered into an alliance with GSK in FY2011 to develop and market more than 100 branded formulations on an exclusive basis across an extensive number of emerging markets, excluding India. On the biogeneric front, the Company has developed nine products (four products launched in India) on mammalian cell culture with global brand sales of US$30bn.

The Company has also entered into supply agreement with JB Chemicals for manufacture and supply of products associated with acquired brands. As per the agreement, the Company would acquire 20 brands from JB Chemicals including key brands Metrogyl and Jocet. Dr. Reddy’s Laboratories Ltd and Merck Serono, a division of Merck KGaA, Darmstadt,Germany, has also announced a partnership to co-develop a portfolio of biosimilar compounds in oncology, primarily focused on monoclonal antibodies (MAbs).

Manufacturing Capacity

Dr. Reddy’s Laboratories, is planning to invest around US$100 million (around Rs. 500 Cr.) as capital expenditure in FY 2014 to expand its manufacturing capacity for meeting the increasing demand of pharmaceutical products. The Company is setting up a formulation manufacturing plant in Vizag and Biologics manufacturing facility in Hyderabad. Currently, the Company has 18 manufacturing facilities of which 14 are in India and rest are outside India. The Company has also expanded its manufacturing operations in the United Kingdom to provide a better network of manufacturing to support its global customer base. The Company has 8 API manufacturing facilities, all approved by health regulator FDA. Of these, 6 plants are in India and one each in Mexico and The U.K.

WHAT’S DRAGGING THE STOCK

Changes in the pricing policy regulations

The Government of India is currently in the process of introducing a change in the manner of pricing drugs in the country. It has announced the draft National Pharmaceutical Pricing Policy, 2012 (NPPP), to put in place a regulatory framework for drug pricing. The list of drugs proposed to be regulated by this policy is based on the importance of drugs as contained in the National List of Essential Medicines (NLEM). There are genuine and universally shared concerns within all sections of the industry that its implementation could not only impact the availability of ‘essential drugs’ but also affect the competitive dynamics in the Indian pharmaceutical market. The Government of India may make certain formulations and drugs cheap which may put pressure on the profit margins of the Company.

Recent Quality Concerns in the United States

Food and Drug Administration (FDA) in the United States has been increasingly scrutinizing Indian pharmaceutical companies finding concerns with the quality of the medicines. Recently the FDA imposed a ban on Ranbaxy and Sun Pharmaceuticals Limited for not meeting their quality guidelines.

India is the second largest exporter of drugs to the U.S. market after Canada and supplies 40 % of drugs consumed by the U.S. market. FDA and even the U.S. doctor are becoming concerned about the quality of generic drugs supplied by Indian manufacturers. Dr. Reddy is also in the process of recalling about 58,656 bottles of the heartburn drug Lansoprazole in the United States due to a microbial contamination. More stringent measure will impose more challenges on Indian pharmaceutical industry.

________________________

** The stock analysis of Dr Reddys Laboratories Limited including the financial report linked above, is for informational purpose only. This analysis should not be taken as a buy/sell recommendation. The circumstances of the company and the economic environment may have changed since the date of this stock analysis.