Hexaware Technologies Limited (“Hexaware” or the “Company”) is a global provider of IT, BPO and consulting services. Company’s key domains include Banking and Financial Services (“BFS“), insurance, logistics and transportation.

The factors considered below present a stock analysis of Hexaware Technologies Limited.

WHAT’S DRIVING THE STOCK

Combination of Existing & New Clients | Large deals to drive revenue

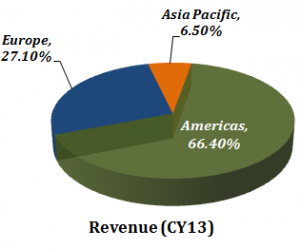

Hexaware has an impressive client base spread across diverse geographies, including in the United States, Europe and Asia Pacific region. Currently, the Company has 233 active clients setting the base for healthy revenue growth going forward. 48 new clients were added in FY 2013.

Hexaware’s long standing relationship with existing clients is likely to be a key factor in attracting new clients in the coming years. The Company has a healthy deal pipeline with 95.5% repeat business customers. With several large deals in the pipeline (deals with a total contract value in excess of US $ 25 million spread over 3-5 years) and a strong base of confirmed business based on deals signed in 2010–2013, we expect the Company to grow over the estimated industry growth of 11 % – 14 %. Hexaware’s impressive run of large deal wins and a healthy pipeline will continue to provide improved revenue visibility in the coming years.

Entering New Geographies and Service Offerings

The Company is also planning to strengthen its industry-specific service offering in the Business Intelligence and Analytics (BA/ BI) and Quality Assurance and Testing (QATS) space. Hexaware’s revenue growth has been driven by strong growth in its major service line of enterprise solutions, mainly on the back of PeopleSoft group of products (which contributes around 70 % of its enterprise solutions revenue).

New Initiatives

Hexaware is investing significantly in Cloud and Mobility as a separate dedicated practice in order to tap into the huge market potential of these emerging technologies.

Cloud Computing Practice

Over the last few quarters, Hexaware has announced multiple initiatives on the Cloud such as Rainmaker, the Company’s private cloud, Cloudview, and cloud-based Software as a Service (SaaS) platform for offering HR services. The Company also provides infrastructure consulting to its customers to help them devise and implement an enterprise wide cloud strategy. The Company is actively working on various client engagements on migrating applications to public cloud platforms such as Amazon, Google, and Microsoft.

Impressive Dividend Payout ratio

Hexaware has maintained a policy of paying out nearly half its reported PAT as dividends. Given its financial strength and growth prospects we believe that the current dividend policy is likely to continue in the future as well. Over FY 06-13, the Company paid out 51 % of its aggregated profits as dividends to investors. Total dividend for FY 2013 is Rs. 11.10 per share (555%) as against Rs. 5.40 per share (270%) for FY 2012.

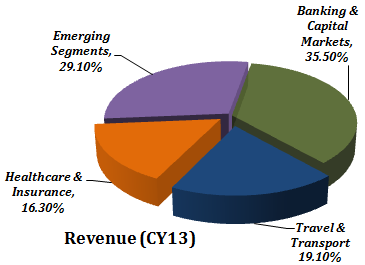

Vertical Focus – Banking & Financial Services and Travel & Transportation to be key drivers

The revenue from banking and capital markets segments grew 16.39 %, making it the best performing vertical for the year ended December 2013.

WHAT’S DRAGGING THE STOCK

Revenue Concentration

The largest clients for IT services are based in North America. 2/3rd of the company’s total revenues come from the United States. Any further deterioration in the U.S. economy would adversely impact IT and discretionary spending. This is a key risk for Hexaware owing to its high revenue concentration in the North American region.

~ 93.50 % of Hexaware’s revenue comes from the U.S. and Europe. The Company remains exposed to the risk of foreign currency fluctuations. Foreign Exchange markets continue to be volatile and have witnessed severe movements in both directions over the last few years. The Company’s foreign revenues remains exposed to the risk of rupee appreciation vs. the U.S. Dollar, the Euro and other foreign currencies.

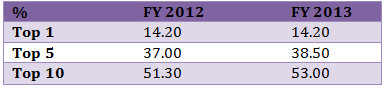

High client concentration

Hexaware gets nearly 15% of revenue from one client and its top 10 clients accounted for 53 % of the total revenues for FY 2013. The Company’s client are concentrated in certain industries like Banking and Financial Services (BFS) (around 35.00 %). An economic slowdown or other factors that affect those industries or the growth of such industries may affect Hexaware’s business and may negatively impacts its margins.

____________________________

** The stock analysis of Hexaware Technologies including the financial analysis report linked above, is for informational purpose only. This analysis should not be taken as a buy/sell recommendation. The circumstances of the company and the economic environment may have changed since the date of this stock analysis