I always found the concept of ‘Value at Risk’ pretty interesting. Usually nobody ever pays attention to it until it is breached. I am not sure how many of you are buying this one but the value at risk for this political outfit is zero as it usually is for start-ups.

Which means what?

For starters, other firms operating within this sector, and mainly the industry leaders – INC and BJP may see some significant lack of interest in the months ahead. Over the last few days , actually ever since Kejriwal took office in Delhi, there has been uncertainty in the stock markets. Not because he has no prior experience of running an organization like this one. The fact is that a lot of investors fear that he may just impact the long term plans of the ‘market’ or of the ‘market participants’.

Markets like everyone like certainty. Certain they were that a Gujrati Manager with impeccable administration record and with the backing of a fantastic marketing and sales team will take office. So far, his opponents were either busy teaching business leaders “how to conduct business” or trying to convince the majority shareholder that “poverty was a state of mind”.

The road to the top office looked easy. Long term investment plans were being made. Indian economy was back on track.

Some Background

Then in a case of shareholder oppression, one shareholder galvanized many others like him to form a unit of activists. In order to solve the problem this created, the former bosses felt the need to come together in order to devise some serious measures. After much deliberation and high level negotiations, they eventually kept up with their record of coming up with the most absurd solutions – Convince the activists to have their own company, realizing little that – (i) the activists were their very own shareholders, and (ii) that they are not only smart and educated but also have a very viable solution to the problem.

I mean did you really expect them not to have a solution to the problem they engineered for over a year?

I can safely add here that the team of activists put absolutely no step wrong. In fact, here is how they modified the start-up rules for me:

- Look for a problem

- Develop a methodology to solve it

- Forget the plan

- Start lean and small (and) forget about the numbers

- Test it with a small number

- Start planning

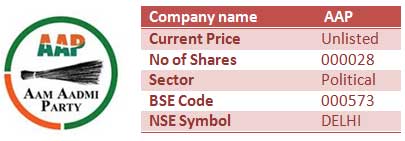

Now that the bunch of activists have unified as AAP and have entered phase 6, some interesting things have started happening. Prime amongst them is the market interest which they have already generated. Analysts from BKC to Fort are all factoring them into their stock market outlook for 2014.

The road which so far looked easy for the Gujrati Manager, now has new hurdles. As for the former bosses, they are still at it. In a desperate bid to rebuild most of what they have already destroyed, they have now agreed to fully support the very unit of activists who had toppled them over.

(Seriously – who does this? A 17 year old buddy at my gym put it the best – It’s just lame to support now dude).

Napoleon Bonaparte had once said – “Never interrupt your enemy when he is making a mistake.”

He was totally wrong. Only if the Gujrati Manager had stopped this from happening earlier.

As for the Stock Market Outlook for 2014, I am looking at global cues again. One good thing is that we have gotten so used to government in-action that our markets find a way – one way or the other.

For my views on the Indian Economic Outlook for 2014 visit here

The Shareprice of AAP has comedown drastically ! Is it right time to buy ? Or should I wait it to comedown more ? Or will it get delisted soon ? 😛

Very unsure on this really.