The year that started with great optimism is ending on a somewhat somber note for stocks. Here’s a look back at the year that was. In all we recommended 63 stocks and closed 54* stocks in 2015 (Jan- Dec). Average Gain % from total calls closed = 26.71%.

*Note: 54 calls closed include 22 calls initiated in the year 2014 and 32 calls initiated in 2015.

Top 20 Calls Closed in Profit in 2015

| Stocks | Gain |

| Indian Hotels | 169.07% |

| Manali Petrochemicals | 153.16% |

| Tourism Finance | 137.38% |

| Milton Plastics | 101.31% |

| Pipavav Defence | 97.42% |

| DCW | 75.47% |

| Maral Overseas | 69.05% |

| Transcorp International | 64.24% |

| Wockhardt | 59.72% |

| Caplin Point | 58.89% |

| IDFC | 56.66% |

| Genus Power | 52.63% |

| Dharamsi Morarji | 41.70% |

| Delta Corp | 40.03% |

| Colgate | 37.50% |

| APM Industries | 36.00% |

| TTK Healthcare | 32.56% |

| Kitex Garments | 30.17% |

| Jubilant FoodWorks | 29.92% |

We removed 2 stocks – Cairn India and Vedanta from our recommendation list on account of bad corporate governance standard with these companies. We would like to avoid these types of stocks from our recommendations in future. This disclosure was made on the track record page.

Total Calls Closed in Losses in 2015

Only 10 calls were closed in losses (out of total 54 calls closed)

| Stocks | Loss |

| Rallis India | (7.00%) |

| Gail India | (7.06%) |

| ONGC | (13.45%) |

| SAIL | (15.20%) |

| NHC Foods Limited | (16.00%) |

| AVT Natural | (19.22%) |

| BGR Energy | (25.43%) |

| GMR Infra | (28.71%) |

| Orbit Corporation | (47.04%) |

| Jaiprakash Power | (50.93%) |

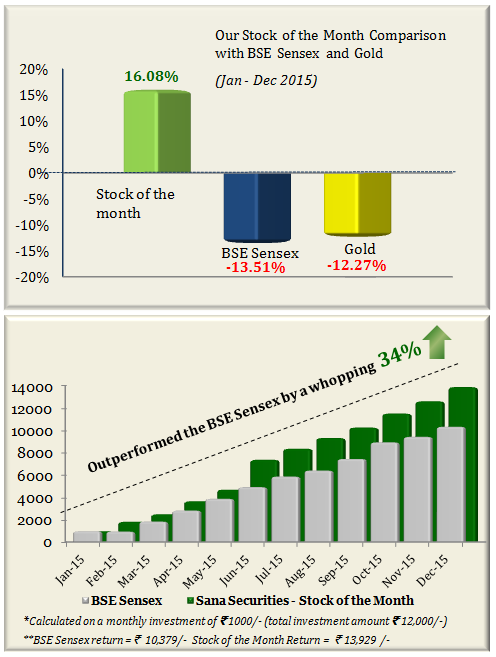

Performance of our Flagship Stock of the Month Recommendation

Stock of the Month performance is based on the returns generated by our investing portfolio in which we recommend one top stock idea for the month. Note that this is suitable for investors looking to create a long term portfolio.

Calculation Methodology for Stock of The Month Return

Returns are calculated on the basis of (assumed) investment of Rs. 1000 in each stock at its recommendation price vis-a-vis an equal investment of Rs. 1000 in the BSE Sensex and gold (made on the same date).

Stock Market Outlook for the Year 2016 and Beyond

- Sectors to stay away from: Metals, Telecom and Aviation. I am particularly negative on telecom space.

Related Post: Are telecom stocks heading for a crash?

- Sectors of interest: 2016 will be ‘a model year for bottom-up stock picking’. More bullish on Infrastructure (particularly power stocks) with manageable debt (this will cut out 95% of your hunt!), Internet themed stocks and healthcare, food & nutrition, security and surveillance.

- Contra view: Large cap stocks will outperform mid/small caps.

- Expect gold and real estate to continue to fall over 2016.

- Finally, as I have maintained for most of this year (see coverage here), improvement in corporate earnings will be the key for markets to move higher on a sustainable basis. Avoid investing on the basis of events like RBI rate action, GST, FED Rate, China, Oil and other global data points etc.