I have lost count of the number of times I have been asked about the ‘target price’ and ‘nifty levels’. Some of you have written to me about adding a target price column in the subscription section of the site. The omission to add such a column is deliberate.

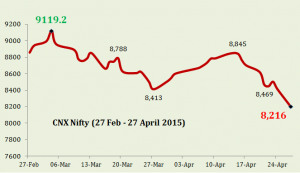

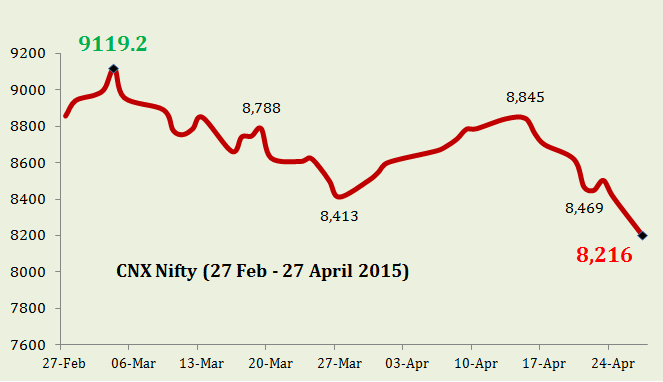

While I love writing my long term view on stocks and economy, I have never had the urge to give out stock markets predictions for the short term. Cartelisation, manipulation and human behavior have the combined effect of making anybody look stupid with stock market predictions particularly in the short term. Think about it – from 4th March 2015, Nifty has dipped from a high of 9,100 to 8,200 (that’s in 32 trading sessions!). Anybody who believes this to be fundamentally driven price movement will be doing serious injustice to common sense.

Why I Never Give Stock Market Predictions for the Short Term

Unfortunately no matter how smart or how well intended a person, no one can individually control the markets. Markets are open to all. Anyone can buy any stock so long as they have the capital to do so. When people buy something its price goes up for everyone and when they sell something it becomes cheap. Sometime last week I read news about the stock of Kingfisher Airlines doing well. In fact since the beginning of February 2015 it has been up by more than 50%. That’s right; Kingfisher Airlines has run up over 50% in 2 months, despite the overall markets falling by over 10% in the same period. Practically, Kingfisher does not exist anymore and it is unlikely that anybody in their senses would acquire the company. What then explains the phenomena? Frankly, these things have no explanation other than this – some people are buying this share.

What makes short term stock market predictions even more enigmatic is the fact that investors repeatedly react to them when some well known research houses come up with views similar to one another. One may wonder then …… would it not be easy for fund houses to pre-judge a rise and fall of the market at least in the short term? Will the markets not move based on their research?

Sometime back I wrote an article on how the price earnings ratio of Nifty is a good indicator of the overall market valuation. I don’t see any reason why my views should change even remotely from what I had expressed in that article. But who knows, the markets may well go far above 9,000 in the short term (may be in the next 32 sessions!) and it won’t be the first time something unreasonable would have happened.

Note: While the 50 stocks which constitute the S&P CNX Nifty (Nifty) are a good indicator of the overall market trend keep in mind that this is where maximum buying happens at the beginning of any bull market. In other words while the index wide PE ratio may look super expensive, there could be hundreds of stocks which are trading at extremely low valuations – those are stocks which do not form part of the Nifty or of any other major index.

Short vs Long Term Predictions

Many market participants study human behavior and trade on that basis. While there has been no conclusive evidence to suggest that technical trading works, for all its worth, it is taught as a subject in top business schools around the globe. Long term predictions on the other hand have more to do with well established economic and financial principles.

While markets may move in 1-15% range in the short term, over a period of time markets will adjust on the basis of the overall economic and corporate performance. This is why it is easy (and more accurate) when predictions are made for a longer term. Below I am listing some of my past major long term predictions along with a link to the date on which I made them:

[1.] Relationship Between Stock Prices and the Real Economy – January 22, 2013

[2.] Asset Quality Concerns in Public Sector Banks – April 15, 2013

[3.] Sensex Target for 2020 – March 6, 2014

[4.] Hope Government and the Next Bull Market – June 10, 2014

[5.] Nifty PE Ratio – Why Stocks are looking Super Expensive – April 16, 2015

My Major Forecasts for the next 5-7 Years

As I had mentioned in my previous articles:

I believe that over the next 4-8 quarters the stock markets will go up and down in 10-15 % range – i.e. 25,000 – 30,000 range. If I must, I will speculate with some downside bias. Corporate earnings will have to improve substantially before we see the overall markets breaking out above 30,000 (on the BSE Sensex). At the same time, I believe that this is the best time to accumulate high quality stocks which do not form part of an index and are available at deep discount.

I remain extremely negative on gold and believe that it will prove to be the worst performing asset class over the next 5-7 years irrespective of how good or bad other asset classes perform.

I am long term positive on large cap IT companies and extremely bullish in financial services.

For list of recommended stocks, subscribe here