What is Structured Product?

Structured product is a hybrid investment instrument which combines investment instrument such as equity, commodities or derivative to earn a fixed or variable rate of return with pre decided minimum fixed return. The combination allows the product to maximize the probability of generating higher than expected return while keeping the downside in check.

The objective of structured product is to protect the principal and at the same time give stock market linked returns.

Return – The return of a structured product (which we will be talking about) is linked to the performance of Nifty. The returns generated by these products can range from 10–25% CAGR.

Ticket Size – Varies based on fund house.

Duration – Structured product requires an investor to stay invested in the product for a minimum amount of time to be able to reap the benefits of the product. For example – for 42 months.

Structured products are popular among HNIs looking to diversify their portfolio and aims to maximize the probability of achieving higher return at the same time proteting the downside risk i.e. principal protection. These products are issued by NBFCs such as Edelweiss Finance & Investment Limited, Reliance Capital and Anand Rathi Global Finance as non-convertible debentures.

Comparison with other Investment Options

| Instrument | Principal Protection | Liquidity | Risk | Potential of Maximizing Return | |

| Market Risk | Credit Risk | ||||

| Structured Products | Available | Low/None | Low | Low/Medium | High |

| Bank Fixed Deposits | Yes | Medium/High | None | Low | Low |

| Mutual Funds | No | High | Medium/High | None | High |

| Direct Equity | No | High | High | None | High |

| Derivatives | No | High | Very High | None | High |

Edelweiss Twin-Win Structured Solution – Fixed Return with Equity Upside

Edelweiss Twin Win guarantees higher of the two – fixed return (6.35% p.a. – Tax free) or whatever the Nifty returns over 3 years.

Twin-Win Structured Product will invest 92% of the Portfolio in Edelweiss Cumulative Coupon Bond and remaining 8% will be invested in Equity Linked Instruments. The amount invested in Cumulative Bonds will provide capital protection and the Equity Exposure will provide upside if Nifty grows.

| Your Investment (100%) | |

| 92% is invested in Edelweiss

Cumulative Coupon Bond |

8% Money is invested in Equity Linked Instruments |

| Provides Capital Protection and fixed return of 6.5% p.a. | Provides Nifty upside if Nifty gives > 6.35% p.a. return |

[1] Fixed Returns and Capital Protection – The product will provide a fixed return of 6.35% p.a. payable at maturity.

[2] Full Equity Upside | No Equity Downside –

Option 1 – Capital Protection

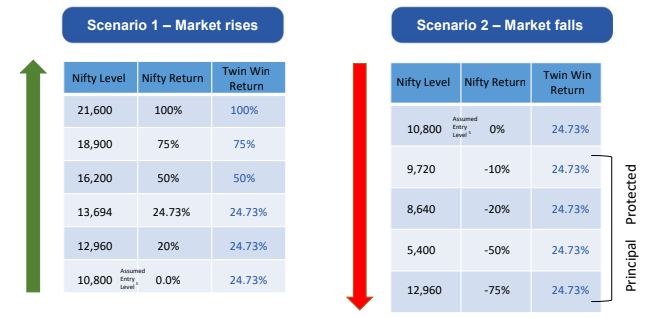

- Scenario 1 – If Nifty 50 index gives more than 6.35% p.a. returns over 3 years, Twin Win gives Nifty 50 returns.

- Scenario 2 – In case Nifty is down after 3 years, you still get Capital + Fixed return.

3] Taxation – 10% Long Term Capital Gain Tax

[4] Strategy Details –

- Invest in Listed, Rated and Principal Protected Market Linked Debentures

- Credit Rating : Minimum AA Rated

- Secured : Investment in Secured Debentures

- Listing on Stock Exchange

- Minimum Investment : Rs. 26 lakhs

- Tenure of Underlying Investment : 3.5 years

- Return Profile – Maximum of 6.35% (post tax) IRR basis issue price or Nifty Underlying Performance

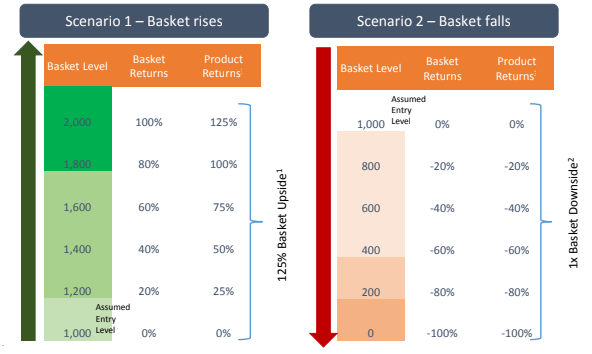

Option 2 – Alpha Generation – 125% upside of basket return with 1x loss on downside (Capital Protection is not present in this option)

____________________

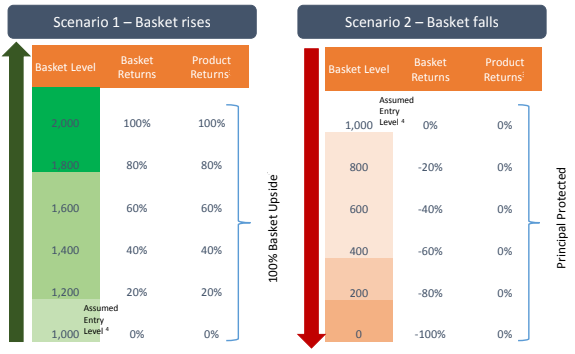

Edelweiss Large Cap Structured Product

Features:

- Underlying asset – Equi-Weighted basket of 6 stocks (mentioned below)

- Listing on Stock Exchange

- Minimum Investment : Rs. 26 lakhs

- Principal Protection – yes

- Tenure of Underlying Investment : 42 months

- Upside Participation – Whatever the 6 stocks generate over 42 months

In this category of structure product, the underlying investment will be equi-weighted basket of predefined 6 stocks (HDFC Bank, Kotak Bank, Reliance Industries, Britannia, Maruti Suzuki, TCS).