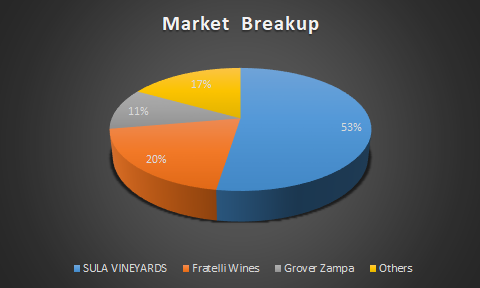

Sula Vineyards – Industry leader with over 52% market share in the unfortified wine and 61% in the Elite and Premium segment.

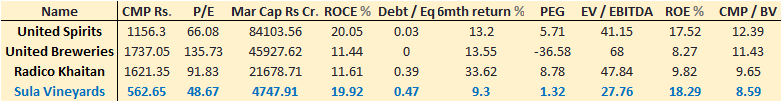

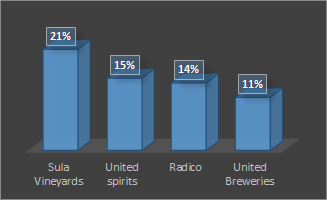

PEER COMPARISON

(As of 22-02-2024)

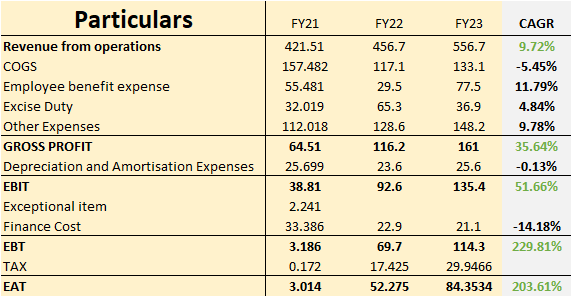

INCOME STATEMENT

(Rs in Crore)

VALUATIONS

Sula Vineyards is trading at a cheap PE Multiple of 48.67, compared to its closest peers and is available at a PEG of 1.32. The company is currently experiencing a high growth phase. We anticipate a 15% increase in Sula wine consumption, and we believe that Sula will maintain its market leadership position. With significant operating leverage already in place, we expect Sula to expand its EPS faster than its peers.

We recommend BUY even at current levels.

The way Sula’s, stock price has gone up over the past 12 months (almost 70%). There is every likelihood of a correction in the short term. But even then, and after this run up – it is still trading at valuations cheaper than its peers.

NUMBERS AND NARRATIVE

NARRATIVE

- Sula Vineyards have established an incredibly dominant position in the Indian wine industry. While Fratelli Wines has a total land acreage of 240 acres and Grover Zampa has 460 acres, Sula alone boasts an acreage of 2800+ acres, more than its next 2 competitors combined.

- Sula Vineyards currently holds the largest installed wine capacity in India, which is 167 lakh liters as of FY23. Grover Zampa Wines comes in second place with an installed capacity of 47 lakh liters, followed by Fratelli Wines with 14 lakh liters. This explains why Sula Wines is the dominant player in the market.

- Sula Vineyards produces 5-10 times more wine than its competitors, it manages to sell its products much faster. Sula’s average inventory time is only 465 days, while Fratelli takes 595 days and Grover takes 878 days.

- Sula sources grapes from over 2,800 acres of land and from more than 500 farmers over 60% to 70% of the wine grape farmers are in partnership with Sula.

NOT JUST YOUR ORDINARY ALCO- BEVERAGE COMPANY

Sula Vineyards is not just a wine company, it’s beating most benchmarks in the hospitality sector. Sula Vineyards has two resorts The boutique resorts located at Nashik –” The Source at Sula” and “Beyond Sula” have capacities of 100+ rooms.

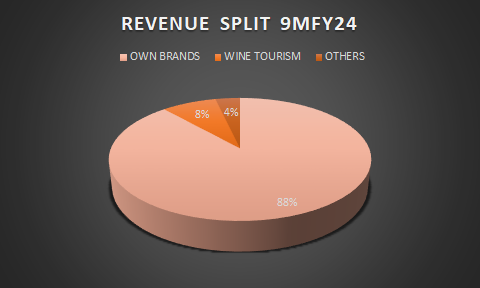

In FY23, Sula did almost Rs 45 crores of revenue just from its wine tourism business, which contributed to 8% of its total top line of Rs 550 crores, which is unique for an alco-bev company

Sula says it has almost 82% occupancy rates with an average room tariff of INR 10000+.

India saw the highest occupancy rates at hotels in the past decade at 70-72% in FY23, with average tariff at top properties being Rs 7k per night. And these are occupancy rates are for cities like Mumbai and Delhi. Tier 2 towns do even lower at around 60-65%. Which means, Sula beats the hotel industry not just in occupancy, but also average revenue per guest per night.

And this is not even its core business. Just a way to acquire customers, make them experience the wines, and build loyalties for the brand.

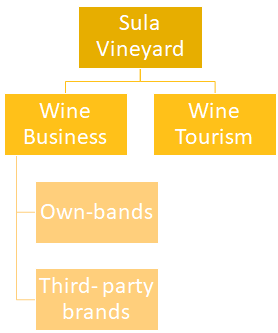

SULA VINEYARDS BUSINESS OVERVIEW

- Sula Vineyards operates a wine business with 56 own wines and 21 international third-party labels. They also have two wine tourism resorts.

- The wine business involves the production and sales of proprietary wines, as well as the importing and distribution of third-party wines and spirits in India.

- In the wine tourism business, Sula offers an experience of vineyard tours, boutique resorts, wine tasting, and gourmet restaurants, at Nashik and Bangalore facilities.

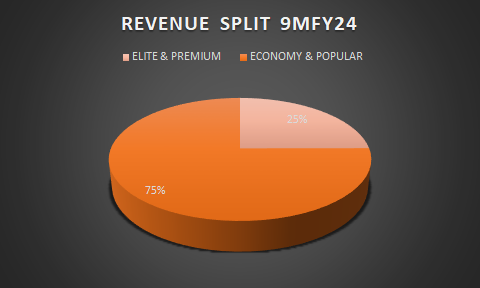

Sula Vineyards generates 92% of its revenue from its wine business, with the Elite & Premium segment holding a 75% share in its own brands.

PRODUCT PORTFOLIO

Of all the labels, ‘Sula Shiraz Cabernet’ has been the largest-selling wine in India, contributing ~24% of its own brand revenue in FY23.

GROWTH TRIGGERS

- The wine industry in India is projected to double its current ~1% contribution in the beverage alcohol market as of FY23 to ~2% in value terms in the next 6-7 years, indicating significant growth prospects.

- Sula grew by 18% in volume and 8% in value in FY23, crossing a million cases. Going forward, the Company anticipates a value growth of a little higher than 15%, with volume growth of ~15%.

- To capitalize on underpenetrated markets, the Company has outlined a strategic approach targeting specific states, and tier 1 & 2 cities across India such as launching three of our iconic Sula Vineyards brands in 250 ml cans for the first time. Sula Chenin Blanc, which is India’s number one selling white wine, Rosé Zin, which is India’s number one selling rosé, and Red Zin, which is short for Zinfandel, cans.

- While wines have traditionally been popular with an older age group, this trend is slowly changing with younger customers experimenting with this alco-bev, thereby increasing the overall customer base for manufacturers in the market.

- To increase consumption and penetration, Sula recently launched a wine-by-the-glass program for institutions and on-trade accounts, yielding positive responses. Apart from on-trade expansion, the Company penetrates via wine-tasting

events like Little Free, Mumbai, and becoming wine partners at events such as India Art Fair, Delhi. Further, music festivals and sports stadiums are also what the Company counts on. - ESG – 3MW installed solar PV capacity, providing 50%+ of annual energy needs in FY23, Optimizing packaging materials using lightweight bottles

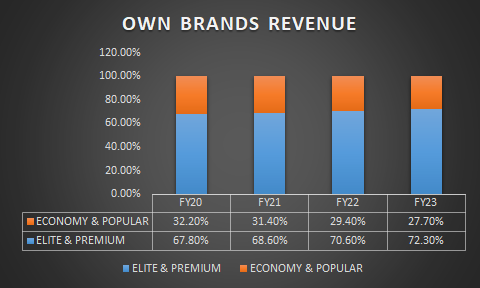

- Premiumization is a key area of focus for management because consumers are increasingly willing to spend more on higher-quality products across all alcohol categories. This trend towards premiumization is expected in the

sparkling wine category as well. Also visible in the graph below. The share of Elite & Premium segment has grown significantly from 67% to 72%- Higher margins and better growth realization.

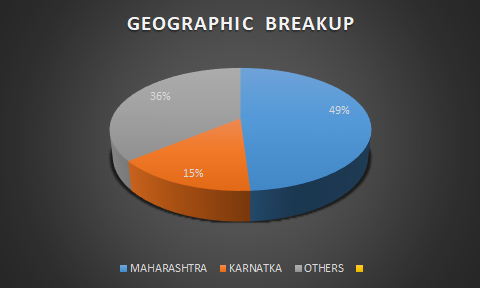

- One of the main drivers of the growth of the wine industry in India is the favorable regulations that treat wine as a distinct and separate category from other alco-Bevrage. These regulations have been particularly favorable in the states of Maharashtra and Karnataka, contributing significantly to the growth of the domestic wine industry

Among the top 3 states spending on wine, SULA is an outright leader with ~60% value share in Maharashtra, ~45% in Karnataka, and ~40% in Delhi.

The consumption of Sula wines is concentrated geographically, with a split of 97:3, between India and other countries; and 49:15:36 between Maharashtra, Karnataka, and other states.

NUMBERS

(Rs in Cr)

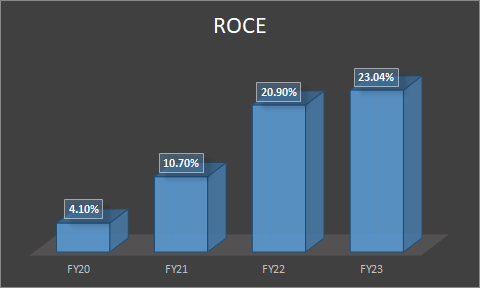

INVESTMENT RATIONALE

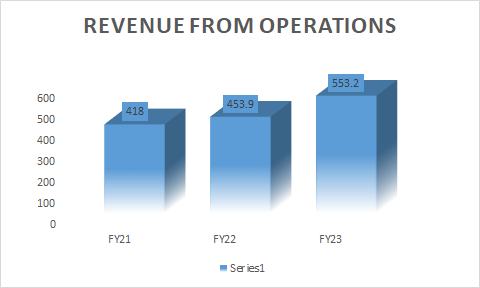

- Revenue from operations has grown at a CAGR of 15% since FY21. Going forward, the Company anticipates a value growth of a little higher than 15%, with volume growth of ~15%. Revenue growth is in line with its peers

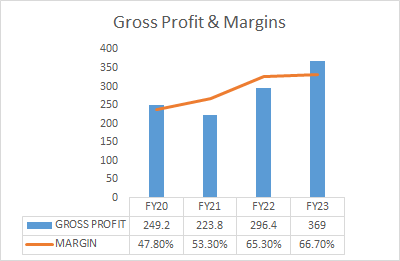

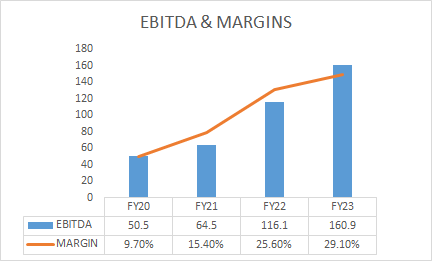

- EBITDA margins are significantly higher than its peers. Currently, EBITDA margins are at a peak of 30%

(Avg EBITDA MARGIN FY20-23)

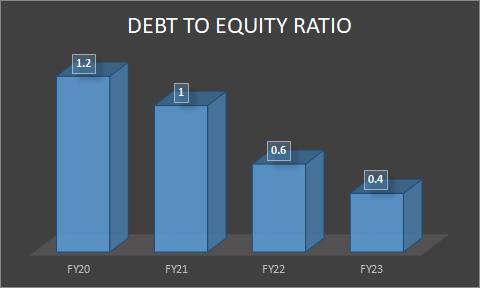

- Low leverage- Sula has been able to significantly reduce its Debt to equity from 1.2 to 0.4

- Good Corporate Governance- Very good management – Rajeev Samant started this company in 1996 and has got it to a point where Sula has become synonymous with wine in India, all in about 3 decades. First generation entrepreneur

- Strong moat: Strong bargaining power across the supply chain. Sula has higher negotiating power over its suppliers because it has long-term contracts with more than 500 farmers over 60% to 70% of the wine grape farmers are in partnership with Sula.

- Growing market in India – Only about 15-18% of Indians consume alcohol. Further, out of this 27% of drinkers are men and only 1.6% of women in India consume alcohol. Alcohol remains one of the highest-growing markets in India growing at 7% p.a.. Given India’s population, rising disposable income, and urbanization, it is a no-brainer that this industry will grow a lot in the coming years. Further, Sula is a genuine pioneer in the wine space,

- Foray into other hard liquors – Not only does Sula have a first-mover advantage in the wine space, but there are talks of it venturing into hard liquors which will open up a huge market.

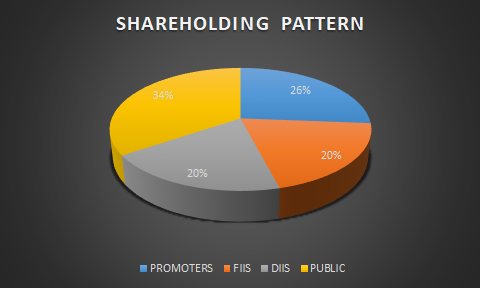

SHAREHOLDING PATTERN

Only negative scenario is the imported wine from EU or from US will be allowed in mear future which will reduce the Sula wine consumption in premium segment , which is likely to reduce the profit margins

Despite such facts, the market opportunity remains substantial. There is considerable room for growth and expansion within wine market.

Excellent!!! Great detailed explanation of the business growth aspects, future opportunities. I am an investor in Sula Vineyards this helped build my conviction in the company

Thanks Anup.