In synthetic long call option strategy – buy the underlying shares and a put option (of an equal number of shares).

When to use : When you are moderately bullish on the short term direction of the underlying stock and want to earn some fixed income from your investment in the underlying stock.

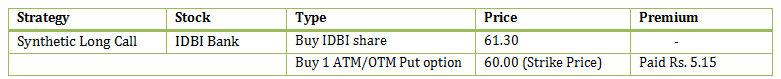

How it works: You buy IDBI Bank share on 14th September 2013, when the share trades at Rs. 61.30. You expect the share to rise in the long term but you are concerned about the downside risk. You decided to buy a put option at a premium of Rs. 5.15, expiring 26th September 2013 with a strike price of Rs. 60.

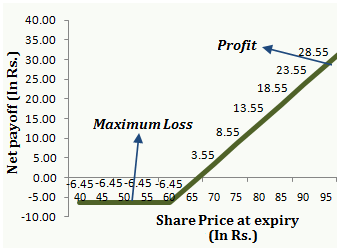

The synthetic long call option strategy limits the loss in case of fall in the share price but the potential profit remains unlimited when the stock price rises. In other words, the synthetic long call option aims to protect against a downside risk.

If the price of IDBI Bank stock falls below Rs. 60.00 (i.e. the strike price), you can exercise your put option. If the price falls below Rs. 54.85 (i.e. strike price – premium paid), you will start making profit by exercising the put option. On the other hand, if there is an appreciation in the stock price, you will make a profit on the underlying stock purchase. Thus you have capped your loss by purchasing a put option.

(click to enlarge)

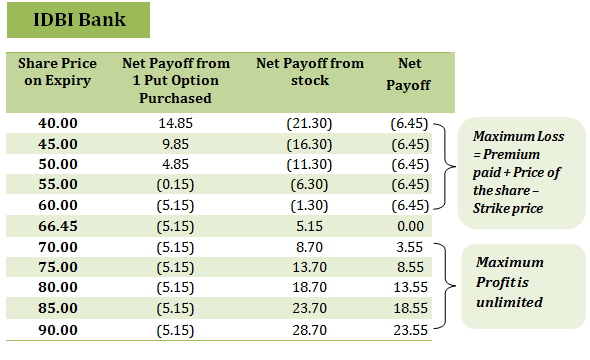

Risk / Reward: The maximum loss you can incur will be limited to the premium paid + the difference between the price paid for buying the stock and the strike price (i.e. in our example Rs. 5.15 + (Rs. 61.30 – Rs. 60.00) = Rs. 6.45 and the maximum profit is unlimited (based on how much the price of the underlying stock rise).

In the above example of synthetic long call option strategy, you will breakeven at Rs. 66.45 (i.e. Rs. 61.30 + Rs. 5.15).

The table below shows the net payoff of the synthetic long call option strategy at different spot prices on the expiry date:

How to use the Synthetic Long Call Option Strategy Excel calculator

Just enter your expected spot price on expiry, option strike price and the amount of premium, to estimate your net pay-off from the synthetic long call option strategy.

Note: The example and calculations are based assuming a single share though in reality options are based on lots of many shares. For example IDBI Bank’s option contract is for 4,000 shares. Accordingly the premium paid will be Rs. 20,600 for a lot (i.e. 5.15*4,000) in our example.