Tanla Platforms Limited (“Tanla” or the “Company”) is a leading cloud communications provider enabling businesses to communicate with their customers, stakeholders and intended recipients.

Tanla Platforms processes more than 800bn interactions annually and about 62% of India’s A2P SMS traffic is processed through its distributed ledger platform – Trubloq, a blockchain-based solution aimed at filtering spam SMSs. Tanla recently acquired Karix, the market leader in the Indian CPaaS space, and marketing automation company Gamooga to expand its bouquet of services.

The Company launched Wisely in Jan’21, a CPaaS platform offering a digital marketplace for enterprises and suppliers, with global edge-to-edge network, delivering private, secure and trusted experience.

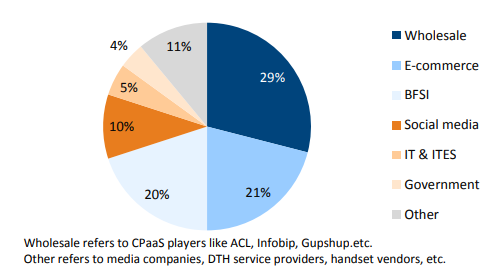

The Company derives its revenues from two main sources – platforms and enterprises. Its platforms are deployed with all major telecom operators in India, providing it access to the entire subscriber base of the operators. It serves enterprise customers spread across a diverse spectrum of businesses, including but not limited to BFSI, social media, e-commerce, government sector and aggregators based on multi-year contracts with an automatic renewal clause, unless specified otherwise.

PRODUCT OFFERINGS

[1] Wisely – Wisely is a Communication Platform as a Service, (CPaaS) offering a digital marketplace for enterprises and suppliers, with a global edge-to-edge network delivering private, secure and trusted experiences.

[2] Trubloq is a blockchain-based Stack that empowers individuals to truly own, control and manage

their Commercial Communications, enabling businesses to build trusted relationships with their consumers.

[3] Messaging – Reliable and Robust Messaging products for Enterprises & Mobile Operators such as SMS Firewall, SMS Hubbing (simplifies SMS interoperability, manages number portability and introduces real-time online monitoring to manage large volumes of SMS), Push notifications etc

[4] Voice – Enterprise class cloud telephony with improved user interaction, flows, features and voice applications.

[5] IOT – Tanla IOT platform enables the business transformation by creating a smart connection between people, machines and processes for a unified functioning by harnessing the growing potential of IOT development

INDUSTRY VERTICALS

Financial Performance

| Particulars | FY17 | FY18 | FY19 | FY20 | FY21 |

| Revenue (In Rs. Cr.) | 579.30 | 791.61 | 1,003.96 | 1,942.84 | 2,341.47 |

| Growth | – | 36.65% | 26.83% | 93.52% | 20.52% |

| EBITDA (In Rs. Cr.) | 56.10 | 65.19 | 96.72 | 185.03 | 433.46 |

| EBITDA Margin | 9.68% | 8.24% | 9.63% | 9.52% | 18.51% |

| EBIT (In Rs. Cr.) | 55.99 | 65.08 | 96.63 | 184.28 | 432.63 |

| EBIT Margin | 9.67% | 8.22% | 9.62% | 9.49% | 18.48% |

| PBT (In Rs. Cr.) | 39.00 | 12.62 | 33.78 | -186.82 | 414.75 |

| PAT (In Rs. Cr.) | 40.91 | 19.11 | 29.82 | -211.17 | 356.14 |

| PAT Margin | 7.06% | 2.41% | 2.97% | -10.87% | 15.21% |

| EPS (In Rs.) | 3.02 | 1.41 | 2.20 | -15.60 | 26.32 |

| EPS Growth Rate | – | -53.29% | 56.04% | – | – |

| Historic P/E (Closing Price of 31st March) | 16.71 | 21.63 | 16.77 | – | 32.46 |

| CURRENT P/E | 38.32 | ||||

| CURRENT PE/ROE | 0.96 | ||||

| EV/Sales | 0.52 | 0.39 | 0.51 | 2.27 | 6.87 |

| PE/ROE | 2.68 | 7.78 | 4.08 | – | 0.81 |

| D/E | 0.00 | 0.00 | 0.06 | 0.00 | 0.00 |

| Interest Coverage | NA | ||||

| ROCE | 8.55% | 9.48% | 12.52% | 26.37% | 48.53% |

| ROE | 6.23% | 2.78% | 4.11% | -30.09% | 39.88% |

CPaaS or Communication Platform as a Service offering is leveraged by the enterprises to communicate and engage with their customers through multiple channels. Digitalization is the opportunity of this generation and the management sees high adoption of CPaaS across enterprises as a move towards digital transformation.

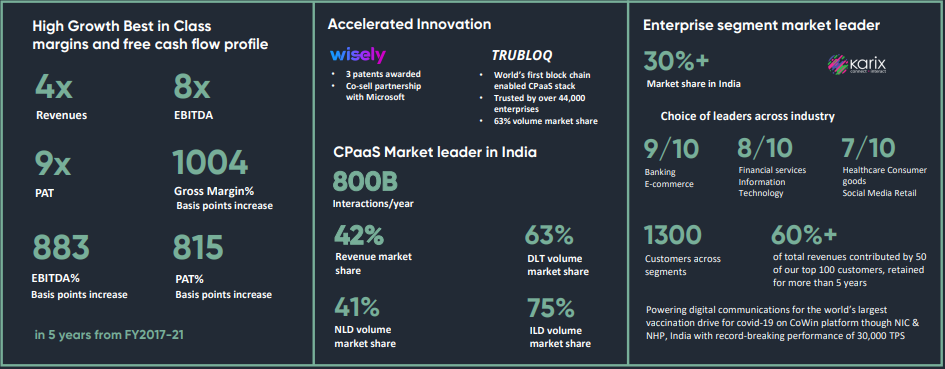

Tanla Platforms is the only Company to have a play in every touchpoint of the CPaaS ecosystem and it has undisputed leadership in India. It is innovation-led platform-based Company, driving industry leading profitability and cash flow, with focus on organic growth and building business through internal accruals and not raising capital.

The Company has delivered unprecedented financial performance – its metrics are at all-time highs. It crossed the revenue milestone of Rs. 2,000 Cr. in FY21, delivering strong growth with best-in-class margin and free cash flow profile. It has crossed the Rs. 100 Cr. quarterly run rate of net income. The Company’s asset lite model helps it operate at best in class return on capital employed. Its strong financial discipline has resulted in having an enviable balance sheet with strong cash balance.

Quarterly Performance

| Q2 FY 2021 | Q3 FY 2021 | Q4 FY 2021 | Q1 FY 2022 | Q2 FY 2022 | TTM | Q-o-Q % | Y-o-Y % | |

| Revenue | 583.25 | 654.11 | 648.56 | 626.38 | 841.62 | 2,770.67 | 34.36% | 44.30% |

| EBITDA | 97.53 | 126.88 | 134.04 | 134.53 | 178.68 | 574.13 | 32.82% | 83.21% |

| EBITDA Margin | 16.72% | 19.40% | 20.67% | 21.48% | 21.23% | 20.72% | ||

| PAT | 81.47 | 93.52 | 102.54 | 104.48 | 136.17 | 436.71 | 30.33% | 67.14% |

| PAT Margin | 13.97% | 14.30% | 15.81% | 16.68% | 16.18% | 15.76% | ||

| EPS | 5.85 | 6.87 | 7.54 | 7.68 | 10.04 | 32.13 | 30.73% | 71.62% |

Q2 FY 2022 Highlights:

- The Company’s stellar performance was contributed by higher wallet share from existing customers and additional market share expansion from newer clients

- Closed two significant partnerships on Wisely platform, which will be announced during the quarter

- The customer base has expanded with addition of 87 new customers. Revenues from > Rs.10Mn+ customers grew by 46% year-over-year

- Completed buyback of equity shares. Total of 705,677 shares were bought back at an average price of Rs. 907 per equity share. Rs. 801 million was incurred towards buyback, out of which, Rs. 649.8 million was returned to shareholders, Rs. 151 million was paid as buyback tax@ 23.36% on distributed amount and Rs. 16 million was paid towards transaction cost. The buyback was closed on September 06, 2021.

INVESTMENT RATIONALE

Established Market Position

Tanla Platforms fortified its position within the CPaaS industry, its acquisition with Karix providing an enviable 42% revenue market share coupled with steady year-on-year growth. A large and ever-increasing share of time-sensitive one-time messages is now delivered via its platform. Most global tech giants now use its proprietary long-distance platform to deliver critical communications to their users in India.

The Company operates in majorly two segments; Mobile VAS (Value Added Services) (which consists of messaging, ecommerce and e-payments) & Software and Property Development. Over the years, the company has established itself with major telecom operators and content aggregators. Furthermore, Tanla Platforms had launched Trubloq, world’s first block chain enabled commercial communications stack that empowers individual mobile subscribers to truly own, control and manage commercial communications. In addition, the Company announced the launch of Wisely on January 20, 2021, a blockchain-enabled communications platform-as-a-service (CPaaS) offering built on Microsoft Azure.

TRUBLOQ – Largest blockchain platform in the world with 63% market share in-terms of scale, transactions, and capacity. Protecting billion+ mobile subscribers from unsolicited commercial communication including spam & fraud.

Strong Growth, High Margins

Multiple revenue streams are created from within its CPaaS ecosystem, which provides Tanla with a high growth rate, best-in-class profitability, with its platform business operating at a high gross margin. Optimizing efficiency with scale has allowed it to deliver 67% CAGR EBITDA growth and strong revenue growth of 42% CAGR over the past five years. This revenue growth, coupled with admirable financial discipline, has improved net income by 72% CAGR, over the past five years. The Company’s operating cash flow to EBITDA conversion is at 129%, which reflects the asset lite model of operation. Zero-Debt Company which means that all growth has been funded from internal accruals.

Diversified and Strong Customer Base

Tanla Platforms serves ~1,300 enterprise clients in India and at least 6 out of 10 customers across major industries (BFSI, e-commerce, retail, social media, DTH, Pharma, government, etc.). The Company derives 60% of its revenues from Top-50 customers. The Company added 160 new customers in H1 FY22 and has executed its land and expand strategy very well by ensuring growth from existing deployments, cross-selling of new products and upselling of products.

Strong Industry Tailwinds

CPaaS industry in India is expected to grow 3.5x over 2020-23, from ~$320mn in 2020 to ~$1.1bn in 2023. Global CPaaS market is expected to reach ~$47bn by 2023. The addressable market is evolving as enterprises and CPaaS players continuously innovate, broaden their offerings, acquire new capabilities through M&A, and create new use cases. Further, the Covid-19 crisis has led to the digitization of activities like commerce and business transactions, resulting in a surge in demand for CPaaS.

Impact of OTT Services

The OTT (Over-the-Top) services changed the way of communication in a broader sense and people have gradually shifted from P2P (Person to Person) messaging to OTT communication which uses the internet on the smartphone of the subscriber rather than using the service provider’s network, directly. Users find OTT platform based applications like WhatsApp, Facebook messenger, Skype, Hike, etc. a cheaper way of communication than using P2P messaging which directly uses the mobile network, charged at a higher tariff rate. Hence, there had been a potential threat to the revenue of the company from P2P segment.