TATA ELXSI STOCK PRICE: Rs. 778

Tata Elxsi Limited (“Tata Elxsi” or the “Company”) is amongst the world’s leading providers of design and technology services across industries including Automotive, Broadcast, Communications and Healthcare.

Tata Elxsi is helping customers through design thinking and application of digital technologies such as IoT (Internet of Things), Cloud, Mobility, Virtual Reality and Artificial Intelligence.

Key Services:

[1] Technology Services & Product Engineering – Tata Elxsi provides technology consulting, new product design, development, and testing services for the broadcast, consumer electronics, healthcare, telecom and transportation industries.

[2] Design – Tata Elxsi creates innovative products, services and experiences to build brands and help businesses grow.

[3] Systems Integration Services – Tata Elxsi implements and integrates complete systems and solutions for High-Performance Computing, CAD/ CAM/ CAE/ PLM, Broadcast, Virtual Reality, Storage, and Disaster Recovery.

Financial Performance

| Particulars | FY16 | FY17 | FY18 | FY19 | FY20 | |||||

| Revenue (In Rs. Cr.) | 1,075.21 | 1,237.31 | 1,386.30 | 1,596.93 | 1,609.86 | |||||

| Growth | – | 15.08% | 12.04% | 15.19% | 0.81% | |||||

| EBITDA (In Rs. Cr.) | 247.09 | 296.59 | 346.01 | 415.04 | 343.00 | |||||

| EBITDA Margin | 22.98% | 23.97% | 24.96% | 25.99% | 21.31% | |||||

| EBIT (In Rs. Cr.) | 224.49 | 269.67 | 320.66 | 389.94 | 299.59 | |||||

| EBIT Margin | 20.88% | 21.79% | 23.13% | 24.42% | 18.61% | |||||

| PBT (In Rs. Cr.) | 236.34 | 264.26 | 363.91 | 433.40 | 352.44 | |||||

| PAT (In Rs. Cr.) | 154.81 | 174.78 | 240.04 | 289.97 | 256.10 | |||||

| PAT Margin | 14.40% | 14.13% | 17.32% | 18.16% | 15.91% | |||||

| EPS (In Rs.) | 24.86 | 28.07 | 38.54 | 46.56 | 41.12 | |||||

| EPS Growth Rate | – | 12.90% | 37.34% | 20.80% | -11.68% | |||||

| Historic P/E (Closing Price of 31st March) | 23.66 | 33.54 | 19.00 | 21.16 | 23.42 | |||||

| CURRENT P/E | 19.74 | |||||||||

| D/E | 0.00 | 0.00 | 0.00 | 0.00 | 0.01 | |||||

| Interest Coverage | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||

| ROCE | 58.20% | 48.36% | 43.43% | 41.36% | 27.15% | |||||

| ROE | 40.14% | 31.34% | 32.51% | 30.76% | 23.49% | |||||

Quarterly Performance

| Q4 FY 2019 | Q1 FY 2020 | Q2 FY 2020 | Q3 FY 2020 | Q4 FY 2020 | TTM | Q-o-Q % | Y-o-Y % | |

| Revenue | 405.10 | 361.71 | 385.83 | 423.44 | 438.89 | 1,609.87 | 3.65% | 8.34% |

| EBITDA | 98.47 | 69.85 | 70.36 | 94.19 | 108.60 | 343.00 | 15.30% | 10.29% |

| EBITDA Margin | 24.31% | 19.31% | 18.24% | 22.24% | 24.74% | 21.31% | ||

| PAT | 71.29 | 48.79 | 49.81 | 75.42 | 82.08 | 256.10 | 8.83% | 15.14% |

| PAT Margin | 17.60% | 13.49% | 12.91% | 17.81% | 18.70% | 15.91% | ||

| EPS | 11.45 | 7.83 | 8.00 | 12.11 | 13.18 | 41.12 | 8.83% | 15.14% |

Q4 FY2020 Highlights:

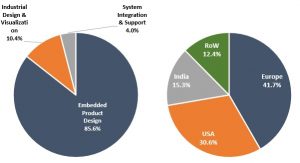

- Embedded Product Design grew by 4.1% QoQ, 10.6% YoY

- Industrial Design & Visualization grew by 7.6% QoQ, 5.4% YoY

- Media & Communication vertical grew by 8.6% QoQ, 25.5% YoY

- Transportation vertical was flat showing initial signs of Covid-19 impact. Healthcare delivered another steady quarter.

- The Company’s performance was aided by key wins in OTT video, broadband technology and digital transformation in the Media & Communications space, Regulatory compliance and new product development in the Healthcare vertical and connected car and infotainment programs in the automotive segment.

EMBEDDED PRODUCT DESIGN (EPD) – REVENUE BY INDUSTRY

| Industry Verticals | Q4 FY19 | Q3 FY20 | Q4 FY20 |

| Transportation | 53.4% | 48.6% | 47.1% |

| Broadcast & Communications | 36.0% | 39.2% | 40.9% |

| Healthcare & Medical Devices | 5.2% | 8.3% | 7.7% |

| Others | 5.4% | 3.9% | 4.4% |

WHAT’S DRIVING THE STOCK?

Increases Focus on Healthcare Innovation

The Company has decided to increase its focus on the healthcare segment and reduce its dependence on the automotive segment. Currently healthcare accounts for less than 10% of its total business, but it has been the fastest-growing segment for the Tata Elxsi. The Company builds prototypes and then it transfers the technology to its customers. The Company has marquee names like GE, Philips and Siemens among its customers to which it supplies the medical technologies developed by it.

Developing Presence in Media & Communication

Tata Elxsi has developed good presence in the Media & Communication space. FTH and 5G has opened up new opportunities for service providers across both communications and media space. In September 2019, Tata Elxsi has integrated its OTT solutions SaaS, TEPlay, with Azure Media Services to deliver OTT content from the cloud. The Company has also partnered Airtel’s DTH service arm – Airtel Digital TV, to deliver an engaging digital platform for customers with an innovative hybrid DTH set-top-box – ‘Internet TV’. During Q4 FY 2020, Media & Communication vertical grew by 8.6% QoQ, 25.5% YoY.

Strong Financial Position

The Company operates with ZERO debt and has cash and cash equivalents of Rs. 664.22 Cr. The Company has also shown consistent profit growth record of 31% over 5 years and has also maintained a healthy dividend pay-out of 28.68%.

Available at a discount of 23% from its 5 year average.

| 5-year Average P/E = 24.16 | |||||

| FY15 | FY16 | FY17 | FY18 | FY19 | |

| Price | 588.10 | 941.43 | 732.45 | 985.35 | 963.10 |

| EPS | 24.86 | 28.07 | 38.54 | 46.56 | 41.12 |

| P/E | 23.66 | 33.54 | 19.00 | 21.16 | 23.42 |

| CMP | 770.15 | ||||

| EPS | 41.12 | ||||

| Current PE | 18.73 | ||||

Recent Partnership

On 17th February 2020, the Company partnered with Tata Motors in developing their unified Connected Vehicle Platform that powers the Nexon EV range of electric cars. Through a collaboration, Tata Motors and Tata Elxsi developed a cloud-based internet of things (IoT) platform that provides the automobile major with a common standard technology stack that delivers the scalability and high performance required to support the entire range of electric, commercial and passenger vehicles

A BIG RISK:

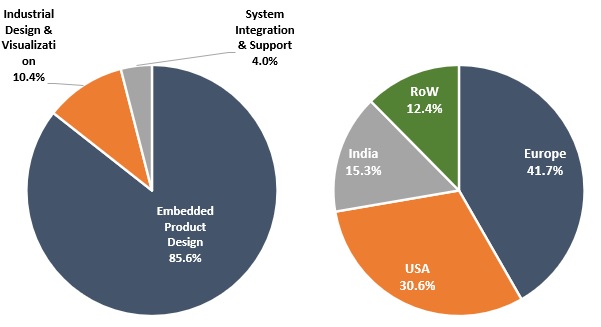

Currently around 47% of its revenue comes from the automotive and transportation segment. Within automotive vertical, 60% of revenue comes from Europe, 30% from US, 10% from Japan, and Korea. JLR, being the largest client contributes to 14.5% of the total revenue of Tata Elxsi, it is amongst top preferred client and the only Indian supplier to JLR. The ongoing global slowdown in the automobile space, will negatively impact the financials of the Company. Further, Tata Motors has been having its own issues with leverage and problems in China, its largest market.

buy medication without an rx cipa canadian pharmacies lasix online pharmacy

trustworthy online pharmacy Urispas best us online pharmacy