The Tata Motors stock has been rallying over the past week, and it has given a cumulative return of around 4.5%, significantly outperforming the Nifty Auto index as well. The stock hit a 52-week high of Rs 536 on November 17, 2021, but it failed to hold on to the momentum. It found support near Rs 360-370 levels back in March and May 2022 from where it bounced back.

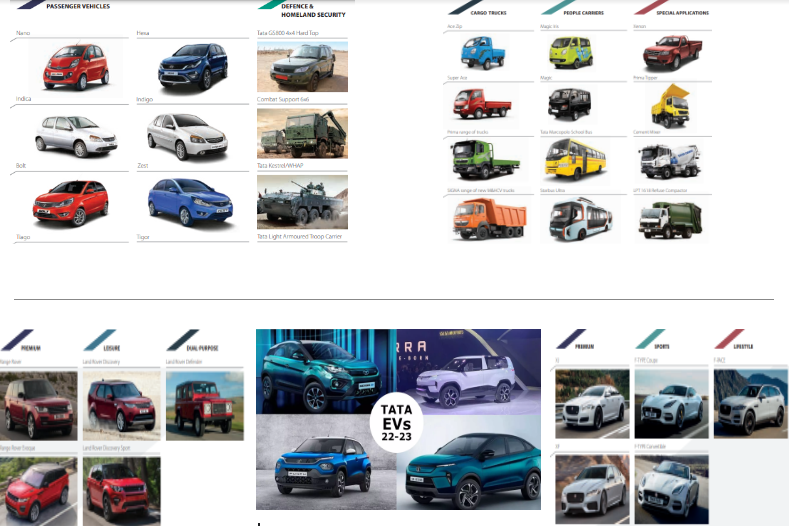

Tata Motors is one of the biggest automobile companies in India with a diverse portfolio of products such as passenger cars, trucks, vans, coaches, buses, luxury cars, sports cars, and construction equipment.

From Passenger vehicles or Commercial vehicles or Electric vehicles to Luxury vehicles Tata Motors has dominated the automobile industry, with impressive market share in EV and the Commercial automobile industry in India.

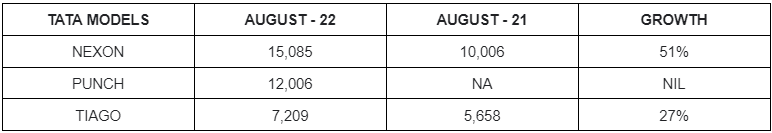

The festive season has surged the sales of the auto industry and India registered a growth of 26.4 per cent with 3,28,079 unit sales in August 2022 as against 2,59,555 unit sales in the same period last year. Tata Motors registered around 47,170 unit sales in August 2022 compared to 28,017 unit sales in the same period last year. The company also saw a strong growth of 68.4 per cent last month. The top three Tata models sold in India in August 2022 are:

TATA MOTORS PRODUCT PORTFOLIO

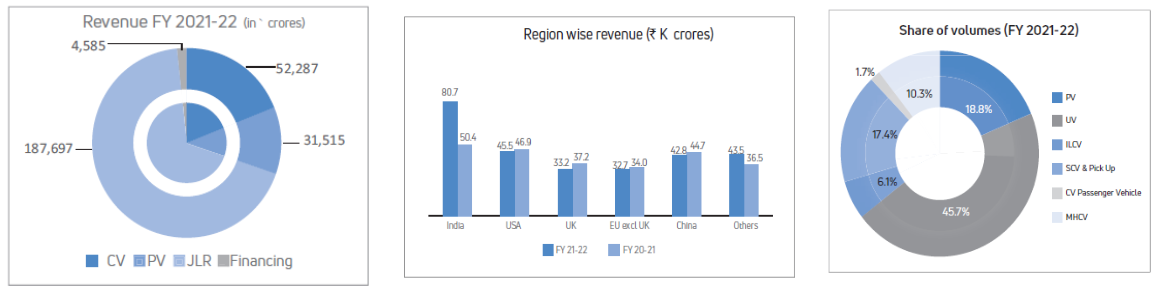

Tata Motors generates its revenue primarily from its Jaguar Land Rover segment which accounts for almost 73% of total revenues, while Tata Motors’ domestic segment contributes around 27% to the top line. Utility vehicles (UV) consist of the most significant volume of sales at around 45.7%, and most of Tata Motors’ revenue is generated from India, followed by USA and UK. Let’s have a look at some of the key financials of the Tata Motors stock.

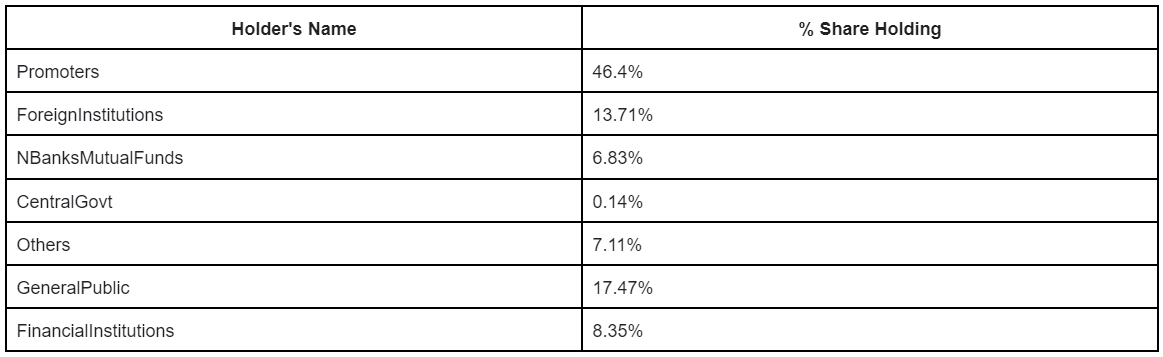

SHAREHOLDING PATTERN

- Tata Motors has had almost a consistent share of promoter holdings over the span of the last 3 years of around 46%, which indicates that the promoters are very positive and certain about the company’s future prospects, and have the utmost trust in the company which is a good sign.

- The FII holdings have decreased quite a bit from 18% in 2019 to around 13% in 2022, and the DII holdings have fluctuated at times, but have almost remained constant at around 15%.

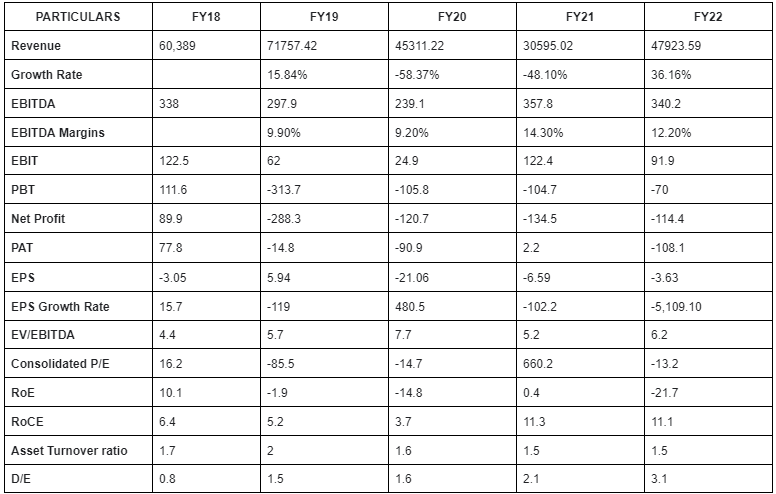

KEY FINANCIAL PERFORMANCE

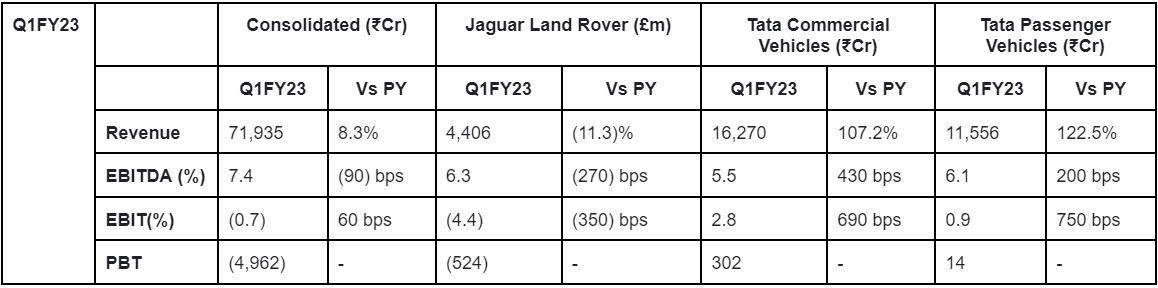

LATEST QUARTERLY RESULTS

Q1FY23 Highlights

- JLR revenues were down 11.3%, impacted by supply challenges including semiconductor shortages, slower than expected ramp-up of the New Range Rover and New Range Rover Sport production and China lockdowns.

- The Revenue in Q1FY23 increased by 8.3%, but at a slower rate compared to volume growth on account of lower Jaguar Land Rover volumes. Overall, a strong product mix and price increases continued to support growth.

- Consolidated net loss of ₹5,006.60 crore reported for the April-June quarter (Q1FY23) due to a steep rise in commodity costs and loss in production due to shortage of semiconductors.

- The Commercial Vehicles space witnessed very consistent growth with increasing demand for last-mile connectivity. The business recorded a vigorous 37% volume growth and 58% revenue growth, but with a lowering of EBITDA margins of up to 50 bps y-o-y growth.

- Robust demand for the New Forever range and agile actions taken on the supply side drove volumes growth as the Passenger vehicles business delivered a strong performance leading to the highest quarterly and annual sales in Tata Motors’ history, recording revenues of 31,515 crores in FY22 (+ 90% y-o-y as compared to 16,606 crores in FY21.

INVESTMENT RATIONALE

Rising CV and PV market share

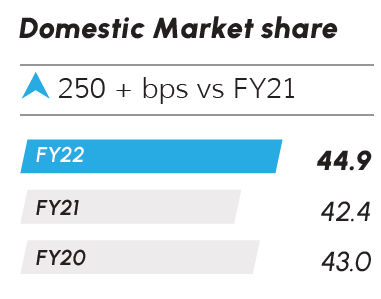

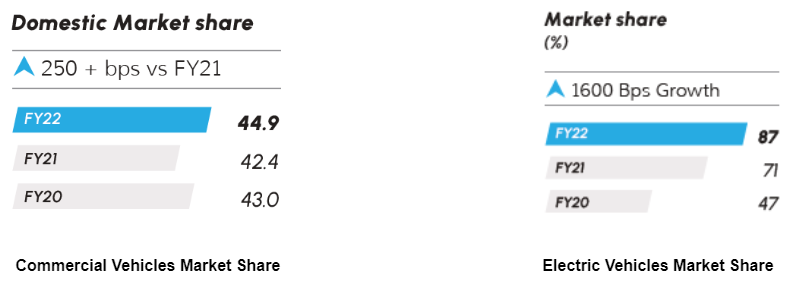

- In Commercial Vehicles the company launched over 80 new products and 120 variants across segments. It gained domestic market share in all segments vs FY21 – M&HCV to 58.2% (+10 bps), ILCV to 49.0% (+310 bps), Buses and Vans to 44.8% (+420 bps) and turned around SCV to 39.1% (+160 bps), to record a consolidated 44.9% (+250 bps). The Commercial Vehicles segment volumes grew by 37% in FY22, revenues grewby 58%, while EBIT margins improved by modest 130 bps, affected by the sharp commodity inflation.

- Whereas, in the Passenger Vehicles segment Tata Motors introduced over 25 new products and variants. PV recorded its highest ever domestic annual sales of 3,70,354 units in FY22. Overall domestic market share increased to 12.1% (+390 bps vs FY21) and further to 13.4% in Q4 FY22. The Passenger Vehicles segment grew volumes by 67%, revenues by 90% and EBIT margins improved by 750 bps with positive free cash flows in FY22.

Bright future prospects

- According to the Chief Financial Officer of Tata Motors, PB Balaji, he mentions that “Demand is expected to remain strong; chip supply is expected to improve from Q2. Cooling commodity costs will improve margins. We aim to deliver strong cash flows from Q2 onwards.” Tata Motors is working to debottleneck supply constraints at JLR. It is aiming to effect price hikes and refocus actions to recover cost inflation to achieve 5 per cent EBIT margin and £1-billion positive free cash flows in FY23. The company has also already announced a capital expenditure of around ₹6,000 crore for FY23.

- The company is also projecting much stronger Free cash flow improvements to achieve the goal of near zero net debt till FY24.

Government, and sustainability throttles to get across the finish line

- Tata Motors has completed the delivery of ~100 e-buses and has successfully launched of the Ace EV, which provides a green and smart transport solution for a wide variety of intra-city applications. The company also signed a strategic Memorandum of Understanding with leading e-commerce companies and logistics service providers to deliver 39,000 units of the Ace EV along with its enabling ecosystem.

- Furthermore, the company has also received a letter of allocation of 1500 e-buses from Delhi Transport Corporation, as part of the larger entitled order of 5000 e-buses, from the recently won CESL tender.

- the recently announced Gati Shakti project along with the Government’s heightened focus on infrastructure projects, and fiscal support for capital expenditure to state Governments will boost the demand for M&HCVs. The Performance-Linked Incentives (PLI) scheme by the Government is another crucial element that will prove vital for the overall CV sector and its growth prospects.

- Electric buses through the GCC model (Gross Cost Contract, with ‘Own and Operate model) are already gaining traction in public transport applications across multiple cities. Today, more than 650 Tata Motors e-buses are running on Indian roads.

Focus on the EV market

- Tata Motors has been the front-runner in the EV segment in India. During FY22, it strengthened its position in the EV segment, driven by new product launches, strong acceptance and positive word-of-mouth from existing customers, offering exciting fleet mobility solutions, and strengthening sales and service networks.

- In India, EV penetration in our portfolio is likely to increase further to 25% in 5 years from 7.4% as of Q4 FY22. By 2025 Tata Motors will have 10 EVs. The unveiling of the long-range “Nexon EV Max”, showcase of “CURVV” Electric SUV concept and the unveil of the “AVINYA” concept, a pure EV based on GEN3 architecture, show the exciting possibilities ahead of us.

- EV sales continued to witness rapid growth in demand on the back of strong acceptance of Nexon EV and Tigor EV. The annual EV sales touched 19,105 units, a growth of 353% vs FY21. Quarterly sales of EVs were highest at 9,095 units, a growth of 432% vs Q4FY21 and EV sales for March 2022 was also the highest at 3,357 units, a growth of 377% vs March 2021.

- EV business consolidated a market share of 87% in FY22.

- Over the last two years, through Tata UniEVerse, Tata Motors have progressed well in establishing public charging network and home charging solution for our customers. In addition, the company has fulfilled localisation requirements laid down in the Phased Manufacturing plan notified by Government.

JLR in picture

- JLR retail sales were 3,76,381 vehicles in FY 2021-22, down 63,207 vehicles (14.4%) year-on-year. Retail sales were constrained by the industry-wide shortage of semi-conductors and declined in all regions year-on-year, including the UK (-23.6%), North America (-17.6%), China (-13.9%), Europe (-9.1%) and Overseas (-2.8%).

- The Ukraine conflict also has had an impact on production volume. While Tata Motors have a relatively small number of parts and commodities that are sourced from the affected countries, it is too early to say how future commodity supply and pricing could be impacted. New vehicle sales into Russia have been paused since the end of February 2022, and the Russian market accounts to around 2.5% of the global sales of JLR.

- Whereas, the demand to remain strong despite worries on inflation and geo-political risks while the supply situation is expected to improve further. This is demonstrated by the record-breaking order book of 168,471 orders at the end of the year, including 45,584 for New Range Rover and 40,618 for Defender. Cooling commodity prices are also expected to aid improvement in underlying margins.

- JLR announced its new partnership with NVIDIA. Together, this partnership will accelerate in-vehicle software strategy, delivering modern luxury experiences and enable a true leapfrog in automotive technology.

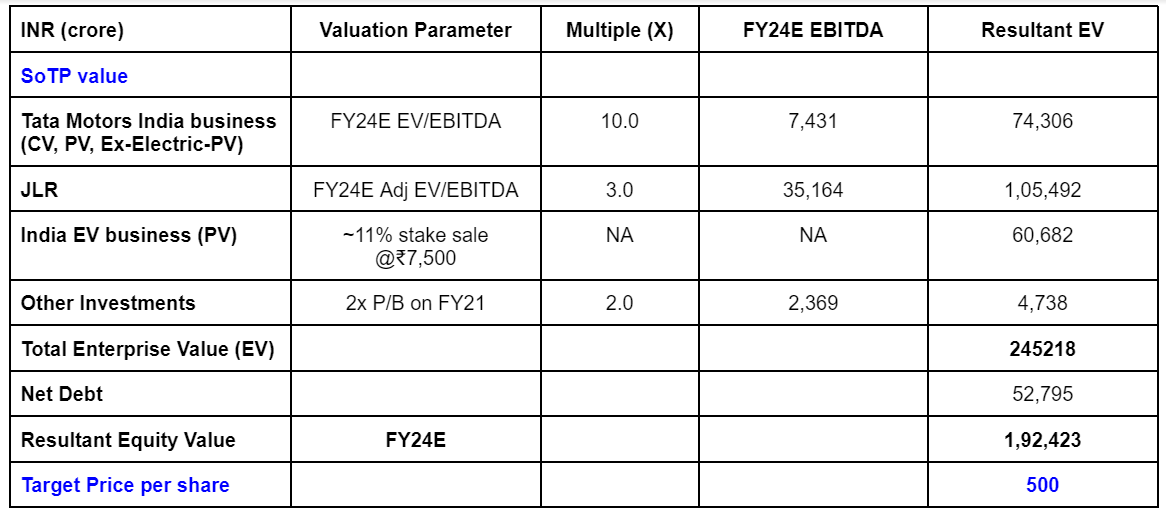

SOTP VALUATION

Investment Concerns

Financials: Flimsy financials over the past few years of the tata motors stock, like net loss and decrease in revenue in some of its subsidiaries like JLR, could be a slight hint of worry, but as the economic state of the world stabilizes, the supply bottlenecks of commodities and semiconductors shortages slowly ease in, it should be smooth sailing for TATA MOTORS.

Cutthroat competition: Tata Motors being one of the largest companies in the automobile sector, face intense competition from other large sharks in the tank, such as Maruti Suzuki, and Hyundai, as they offer the latest advanced designs and features at lower prices, which in turn result for them actually being in profit, whereas Tata Motors keeps dwindling in losses.