The factors considered below present an overview of the Indian Automobile Industry in general and stock analysis of Tata Motors in particular.

Tata Motors operates in 2 business segments – Automotive Operations and Others

[1] Automotive operations accounted for 99.5% of the total revenues in FY 2015. The Company’s automotive operations segment is further divided into Tata and other brand vehicles (including vehicle financing) and Jaguar Land Rover.

Jaguar Land Rover contributed 83.2% of the Company’s total automotive revenue and only the remaining 16.8% came from Tata and other brand vehicles.

[2] Others – The other operations business segment includes information technology, machine tools and factory automation solutions.

Also Read: Should You Buy Tata Motors Stock At Current Price?

WHAT’S DRIVING THE STOCK

Dominant Market Position

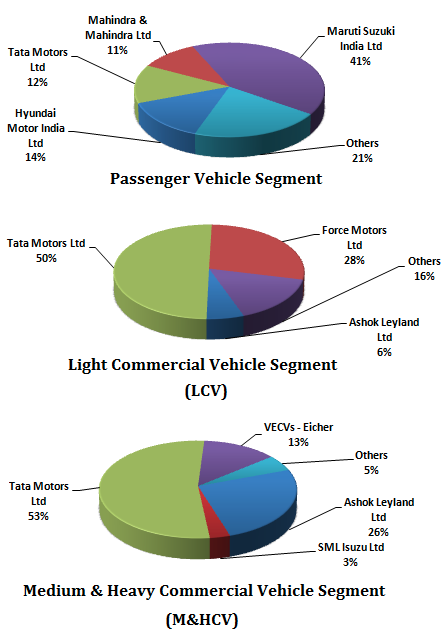

Tata Motors Limited (“Tata Motors” or “Company”) is the largest automobile manufacturing company in the world by volume, with presence across a range of passenger cars and Commercial Vehicles (“CV”s). It is the market leader in terms of volumes in CV Segment (including, Light Commercial Vehicles (“LCV”) + Medium & Heavy Commercial Vehicles (“M&HCV”) segments) and enjoys market share of roughly 12% in passenger cars segment which has been consistently growing over the last few years.

Rural Market Penetration & New Product launches

Tata Motors has been focusing on improving the mix of its products and markets. In India, future growth is expected to be driven largely by tier 2 and tier 3 markets. With growing rural affluence and broader connectivity, the Indian automobile industry is benefitting from an increased demand in the rural areas. Additionally, The Government of India has been focusing on improving road infrastructure through the National Highway Development Project (NHDP) and Pradhan Mantri Gram Sadak Yojna (PMGSY). Under the NHDP, the plan is to upgrade, widen and strengthen 55,000 km of road network. The PMGSY envisages development of 368,368 km of rural roads.

This improved connectivity presents a significant opportunity for Tata Motors with its wide product range in commercial, utility and passenger vehicles. Also, there is positive effect in terms of demand for both cargo and passenger segments from newly connected rural areas. Further progress in road development work including sanction of new projects will help to sustain growth in the CV industry.

Reasonable growth in a subdued market environment

Globally sales of passenger cars and commercial vehicles grew by 3.6% and 5.8% respectively in FY 2013. In the United States, car sales increased by 9.8% while commercial vehicles sales increased by 14%. In Europe, there was marginal increase in the sale of commercial vehicles but passenger car sales decreased. In Asia, both China and India registered growth, albeit at lower levels than the previous year.

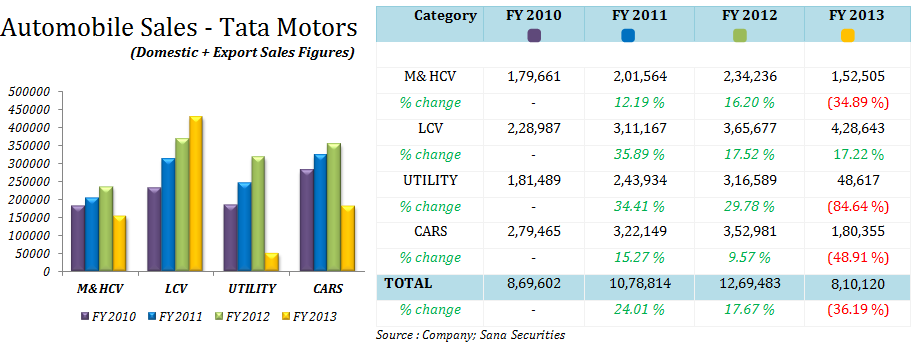

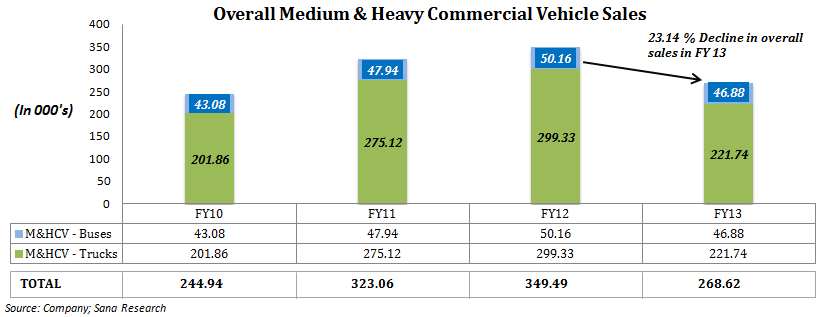

For Tata Motors, the M&HCV sales declined by 34.89 % in FY 2013. At the same time LCV segment registered a volume growth of 17.22 % for the same period on the back of good sales figures from its new line of light pick-up trucks – Ace and Magic. In the utility segment Tata Motors registered a decline of 84.64 % and passenger car sales declined by 48.91 % respectively. The decline in the M&HCV segment is mainly due to a general slowdown in that segment. After growing consecutively for 4 years at a CAGR of ~ 28 %, the overall M&HCV segment showed signs of cooling off in FY 2013. In FY 2012 this segment clocked a growth rate of 18 % mainly due to pre-Budget buying in the last quarter. In FY 2013, the overall M&HCV Sales declined by 23.14 %.

As development of new projects gets underway, developers will not only need support from commercial freight operators but will also need to tie-up back end supply chain for their products. This will benefit the Indian automobile industry over the next 2-3 years.

WHAT’S DRAGGING THE STOCK

General Slowdown in the Automobile Industry

(Click on image to enlarge)

This slowdown can be attributed mainly to (i) uncertainties in infrastructure projects which are a major demand driver for commercial vehicle sales; (ii) 5-7 % drop in truck freight rates on key routes; (iii) oversupply of commercial vehicles in the system in previous years; and, (iv) a young commercial vehicle fleet plying in the country as compared to 3-4 years ago. Until segments like infrastructure, agri-commodities and industrial growth revive, truck sales are likely to remain sluggish.

Intensifying Competition

While Tata Motors is the largest automobile manufacturing company in the world by volume, the global automobile industry is highly competitive and competition is likely to further intensify in view of the continuing globalization and consolidation in the worldwide automotive industry. The Indian automobile industry is one of the largest industrial sectors and contributes about 5% of India’s GDP. Many foreign automobile manufacturers, particularly in the passenger cars segment such as BMW, Mercedes Benz and Renault are aggressively entering high growth emerging markets such as India amidst slowing demand in the developed economies.

On the domestic front, Tata Motors competes primarily against Maruti Suzuki India Limited, Mahindra & Mahindra, Ashok Leyland, Hyundai Motors India and Force Motors. The competition within the industry is increasing further with new players entering the market and some smaller players catching up. Further, the industry as a whole faces competition from Indian Railways – the alternative freight carrier. With railways progressively improving its freight moving capacity, long – distance freight movement by surface transport faces some threat especially given the rising fuel prices.

Rising Fuel Prices

The crude oil price continued at about US$ 100 – 110 per barrel (Brent crude oil) throughout the first six months of FY 13. There are renewed concerns of rapid growth in oil demand in emerging economics and a downshift in oil supply trends. As a result, the oil prices are likely to continue at higher levels. The Indian Government has removed petrol from administered price mechanism and is mulling similar plans for diesel (i.e. removing subsidy). There are also talks of imposing levy on passenger cars running on diesel. If fuel prices are raised further as it is widely being contemplated, it would adversely impact the automobile industry in India, particularly the passenger cars segment.

Increase in the price of diesel will pose a significant challenge to automobile manufacturers in the commercial segment as freight business which is already suffering from under-utilization due to a slowdown in the economy will come under increased pressure which will ultimately have a negative impact on the sales of M&HCVs and consequently on the profitability and results of operations of Tata Motors.

________________________________________

** The stock analysis of Tata Motors including the financial analysis report linked above, is for informational purpose only. This analysis should not be taken as a buy/sell recommendation. The circumstances of the company and the economic environment may have changed since the date of this stock analysis.

Detail Informations are given people have less time for reading and understanding.It should be DATA graphical presentation and comments only

PRADEEP MEHROTRA