Tata Technologies is a global engineering and product development digital services company and a part of the Tata Group. The company provides a wide range of services to help businesses across various industries with their engineering and innovation needs. Tata Technologies operates in a niche and a rather new industry referred to as Engineering, Research and Development (ER&D) Sector.

A recurring theme in my research on this stock particularly while assessing its earnings growth potential was the fact that going forward, business models for ER&D companies can evolve. Perhaps newer sectors and newer lines of works can and will open up.

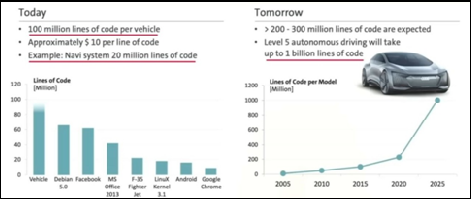

A key area in which Tata Technologies operates is automative engineering and solutions..The global automotive industry is getting disrupted by digitization/automation/electrification and new business models led by new-age automotive players like Tesla and technology companies like Google, Apple, etc. venturing into the digital mobility space. To keep pace with the disruptions, existing automotive companies have raised their R&D investments focusing on technologies of Autonomous, Electrification, Connected, etc.

When you look at this sector and this company, think about the possibilities- we are talking of a world of driverless cars, a complete shift from petrol/diesel to Electronic Vehicles (EVs), better design components, home automation where your entire home (including electrification, air conditioning and security) can be operated from your phone. The possibilities for scaling up are immense.

The key components of Tata Technologies’ business model include:

- Engineering Services:

- Tata Technologies offers a variety of engineering services to help companies design, develop, and optimize products. This can include product lifecycle management, computer-aided design, and other engineering solutions.

- IT Services:

- The company provides information technology services to support the digital transformation of its clients. This can involve the implementation of IT systems, software development, and other technology-related solutions.

- Product Development:

- Tata Technologies is involved in assisting companies with end-to-end product development process. This includes everything from conceptualization and design to prototyping and manufacturing support.

- Consulting and Advisory Services:

- The company may offer consulting and advisory services to help clients improve their business processes, enhance efficiency, and stay competitive in their respective industries.

- Automotive Solutions:

- Given its historical association with the automotive industry, Tata Technologies has a strong focus on providing solutions tailored to the automotive sector. This includes services related to vehicle design, engineering, and manufacturing.

- Digital Manufacturing:

- Tata Technologies may provide digital manufacturing solutions, leveraging technologies such as simulation, virtual reality, and digital twins to optimize the manufacturing processes for its clients.

- Global Presence:

- Tata Technologies operates globally, serving clients in various regions. This global presence allows the company to tap into diverse markets and cater to the specific needs of clients around the world.

- Collaboration and Partnerships:

- Like many companies in the technology and engineering sectors, Tata Technologies may engage in collaborations and partnerships with other organizations, leveraging synergies and expanding its service offerings.

___________

ER&D Segment has been growing at a CAGR of ~ 12% over the past 5 years and is expected to pick up pace and grow at 14-17% over the next decade. In today’s world, the role of software in car production is becoming increasingly significant. As per McKinsey’s analysis, while the global automotive market is set to grow by 3% CAGR over the next decade (2020-2030), software development and verification and validation services will see faster 9-10% CAGR, mainly due to increasing usage of software in vehicles driven by the development and adoption of autonomous driving (ADAS, Level 1-5 autonomy) connected cars (infotainment), and electrification of powertrain (EVs)

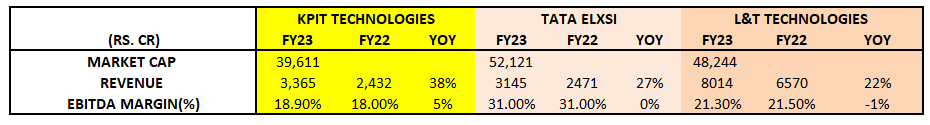

This offers a window of opportunity for players like KPIT, TATA ELXSI, and L&T Tech who have built competencies in the space over the years.

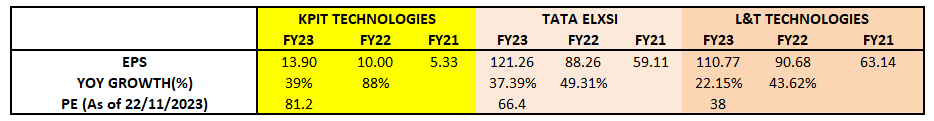

Tata Technologies – Peer Comparison

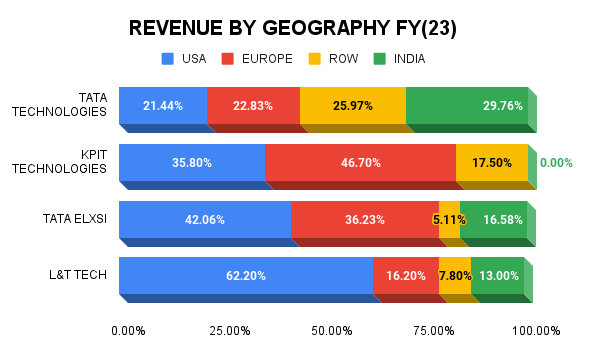

In terms of geographical revenue, ER&D companies earn a major part of their revenue from USA and Europe. Tata Technologies, being a subsidiary of Tata Motors gets a large part of its revenue from India. Its top clients include – Tata Motors, Jaguar Land Rover, Vinfast (these 3 contribute 57% revenue for the company) and Airbus.

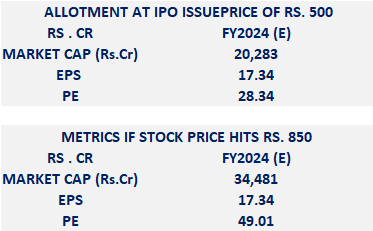

In terms of valuations, Tata Technologies is the cheapest if we consider its issue price of Rs. 500 per share. This price gives the company a PE multiple of 28.34 (Note: We have taken earnings for the first six months for FY 2024 and simply doubled it to calculate the full year EPS OF 17.34 per share).

Assuming that the stock gets listed at a premium of 70% (expected) i.e. at a price of Rs. 850 per share, it will still be trading at a PE Multiple of 49. This is still much cheaper when you compare it with its listed peers namely, KPIT, Tata ELXSI and L&T Technologies.

(LONG PRESS IMAGES BELOW TO OPEN IN NEW WINDOW OR PREVIEW)

VIEW:

- If I take the average PE Multiple of this sector (i.e. 61) then it is safe to assume that Tata Technologies should be trading at a price of Rs. 1068.

- That said, I find the overall sector to be trading above normal / justifiable valuations.

- As a long term investor, if you get the allotment in the IPO, it would be safe to sell the stock and re-enter at a lower level in a few months when the frenzy around this sector settles down.

- I believe that the stock will open above Rs. 800 and can reach 1000+ levels upon listing on Thursday, 30th November 2023.

Happy Investing.

Tata Technologies is a long-term play. However, as you mentioned those who got the allocation can sell it at a profit and re-enter it later at a lower price. Thanks for your wise advice.

Nice dissection of the proposed Listing. Almost all aspects have been discussed.

Good Analysis

Wonderful analysis. Precise. You could have mentioned market price of the Peer Companies. For any layman to understand, simplest thing is CMP

1200 my expectations today

Your analysis of Tata Technologies stock is GOOD.

However I still believe that since allotment is of only 30 shares it is better to retain these shares rather than sell & await for entry at lower levels.

This entry was not possible for Dmart shares on listing of IPO.

Nice analysis 🌿🍃

Vinfast incurred heavy downfall. What will be knee jerk reaction on tata tec. Shares?

I dont think this will have an impact.

Excellent job

Excellent comments

Love to buy this great script.

Is it right time to enter?

May be a little too expensive at this point.