Income earned from mutual fund investments could be (i) dividend income and (ii) capital gain income

Also see – Capital Gains Tax | Dividend Income Tax In India

DIVIDEND INCOME

For equity mutual funds, dividend received is tax free in the hands of the investor but the company pays a Dividend Distribution Tax (DDT) at the time of recommending the dividend. (DDT@17.647 + Surcharge @ 12% + education cess @ 3%) hence effective tax rate on dividends is @20.358%. But if dividend income of individual is over Rs. 10 lacs, then such income will be taxable in the hands of investors@10%, in addition to the DDT.

Equity mutual funds are those, where total investment in equities (of the fund) is more than 65% of total portfolio.

In case of money market liquid schemes and debt schemes dividend is taxed @25% +12% surcharge + 3 % cess =28.84% (for Individual & HUF) and is payable by the MF schemes.

Debt Mutual Funds are the funds other than equity mutual funds includes fund of funds (when mutual funds have invested in other funds) and International funds (having international exposure more than 35%).

CAPITAL GAIN INCOME

Capital gain income is incurred due to appreciation of investment value during the time from the date of purchase to the date of sale of an asset.

Example – Mr. A purchased 1000 units of mutual fund @ Rs.100 on 1 June 2015 and on date 31st December 2015, the price of each unit increased to Rs.150. Mr. A’s capital gain is Rs.5000 (15000-10000).

Taxation on Capital Gain:

For equity mutual fund schemes when the fund is held for less than one year, the profits are taxed as Short Term Capital Gain (STCG) and are taxed @15%; if holding period is more than one year the profits are considered Long Term Capital Gain (LTCG) and are tax free in the hands of the investor.

For debt mutual fund schemes when funds are held for less than 3 years (i.e. 36 months) the profits are included in the income of the investor and are taxed as per the slab in which the investor belongs (i.e. there is no lesser taxation in case of STCG for debt funds).

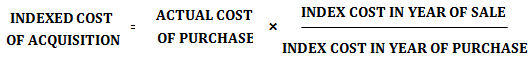

LTCG are liable to tax subject to benefit of indexation. If investor takes the benefit of benefit of indexation then profits are taxed @20% of capital gains after indexations +3% education cess.

For most debt funds that earn 8-10%, the net effect of indexation is such that profit earned over 3 years is almost tax free in all cases (since indexation amount grows ~ 10 year on year).

Indexation Calculation

Example – Mr. A bought a debt fund for Rs. 50,000 on 1 June 2012. On 31 December 2015 he sold his debt fund for Rs. 70,000.

Capital Gain = Rs.20,000/-

= 50,000 × 1,024 /785 = 65,223

Capital Gain = Cost of Sale – Indexed Cost of Acquisition

= 70,000 – 65,223

= 4,777

Capital Gain Tax = 20% of 4,777 = Rs. 955

Taxation of PMS Schemes

PMS A/C is an investment portfolio in stock, debt, fixed income products managed by professional fund managers, that can potentially meet the investment objectives of investor by providing freedom and flexibility for customize portfolio that can meet their financial needs

For more on PMS Schemes – Visit here

The minimum investment size in PMS is set at Rs. 25 lacs by SEBI.

PMS is classified on basis of control as

Discretionary Portfolio: where portfolio manager has full discretion regarding investment decisions.

Non-Discretionary Portfolio: under this type of PMS, portfolio manager will only suggest investment ideas to client however client has full discretion regarding investment decisions. The PMS only executes the orders.

Taxation on Investors Availing PMS Schemes

There are various court rulings whether gain/loss from using PMS would be treated as business income (hence charged under head of Profit from Gains of Business and Profession i.e. PGBP) or treated as income from capital gain.

A Delhi High Court ruling gives clearer view with respect of taxation of PMS income by classifying investment objective into two:

Wealth maximization – If Investment is made with the purpose of maximization of wealth of client and not with the intention of encashing the profits when capital amount appreciates; then income from such kind of transaction will be taxed under the head of capital gains.

Profit Maximization – if investment was made with the objective of encashing profits on capital appreciation; then income from such kind of transaction will be taxed under the head of capital gains.

As a thumb rule – tax officers will look at how income from PMS scheme was being treated in the books of accounts of the assessee IN PRIOR YEARS. Investors should not change the treatment of income generated from PMS.

Nice article. What are the documents that I should request from the PMS provider that would assist me in calculating the tax? They have shared a profit and loss statement, a payout statement and TDS applicability statement which are in custom format. I am unable to calculate the tax based on these. It would be great if you could let me know the documents that I could request them to share to assist me in tax return filing.

Thanks.

Call them

Good article Rajat. A question on PMS – if we stay invested for a longer period (say 3 years). Will we be required to pay tax on capital gains every year? Even though there is no redemption done in first 3 years?