While majority of the sorting centres are leased, it owns around 10 sorting centres at strategic locations and plans to develop sorting centres at various strategic locations.

The Company caters to clients in sectors like consumer electronics, retail, apparel & lifestyle, automobile, pharmaceuticals, engineering, e-commerce, energy/power, and telecommunications.

B2B – 95%

|

B2C – 5%

ECOMMERCE EXPRESS · Last mile delivery service · Tech driven · Multi-modal network · Value added feature of Cash on Delivery · Focus on tier II and III cities |

The Company got listed on 15th December 2016 after demerger from Transport Corporation of India.

Financial Position

| Particulars | FY17 | FY18 |

| Revenue (In Rs. Cr.) | 750.27 | 885.08 |

| Growth | – | 17.97% |

| EBITDA (In Rs. Cr.) | 61.89 | 90.65 |

| EBITDA Margin | 8.25% | 10.24% |

| EBIT (In Rs. Cr.) | 57.58 | 85.44 |

| EBIT Margin | 7.67% | 9.65% |

| PBT (In Rs. Cr.) | 56.51 | 83.76 |

| PAT (In Rs. Cr.) | 37.49 | 58.40 |

| PAT Margin | 5.00% | 6.60% |

| EPS (In Rs.) | 9.79 | 15.24 |

| EPS Growth Rate | – | 55.7% |

| Historic P/E (Closing Price of 31st March) | 40.64 | 31.07 |

| CURRENT P/E (based on price of 11th March – Rs. 720 and EPS TTM –Rs. 17.95) | 40.11 | |

| Shareholder funds (In Rs. Cr.) | 160.77 | 251.52 |

| Minority Interest (In Rs. Cr.) | 0.00 | 0.00 |

| Debt (In Rs. Cr.) | 31.04 | 28.53 |

| Cash (In Rs. Cr.) | 8.78 | 17.51 |

| D/E | 0.19 | 0.11 |

| Interest Coverage | 25.36 | 24.11 |

| ROCE | 30.02% | 30.51% |

| ROE | 23.32% | 23.22% |

Quarterly Performance

| Quarterly Results | Q3 FY 2018 | Q2 FY 2019 | Q3 FY 2019 | Q-o-Q % | Y-o-Y % |

| Revenue (In Rs. Cr.) | 229.00 | 247.20 | 263.15 | 6.45% | 14.91% |

| EBITDA (In Rs. Cr.) | 24.06 | 27.30 | 30.97 | 13.44% | 28.72% |

| EBITDA Margin | 10.51% | 11.04% | 11.77% | ||

| PAT (In Rs. Cr.) | 15.43 | 16.27 | 18.72 | 15.06% | 21.32% |

| PAT Margin | 6.74% | 6.58% | 7.11% | ||

| EPS (In Rs.) | 4.03 | 4.24 | 4.87 | 14.86% | 20.84% |

Q3 FY 2019 Highlights:

- Revenue for the quarter increased 15% to Rs. 263.15 Cr. on the back of 11% growth in business volume.

- EBITDA came in 29% higher than last year at Rs. 30.97 Cr. as margin expanded further to 11.8%. The expansion indicates its ability to pass on the fuel price hikes amid volatility in crude oil prices.

- Within the auto segment, TCI Express generates revenue from transportation of spare parts and other automotive components. Replacement demand in the sector continues to be the key revenue driver. The management has highlighted that the slowdown in auto sector is unlikely to have a major impact on the Company.

WHAT’S DRIVING THE STOCK?

Pricing Power

The express logistics operator enjoys strong pricing power and is largely insulated by diesel price movements as it follows a fuel surcharge-based pricing mechanism with its vendors and customers.

Growth in E-Commerce which requires a faster turnaround time is another key driver for express delivery companies which mainly operate in the road segment.

Express Services Continues To Command Premium Over Other Services

Express segment has been growing in double digits, primarily due to the benefits of reduced delivery time, growing preference for just-in-time approach (reducing inventory costs), minimisation of loss of sale opportunities and rising end-consumer demand for quality logistics services. Express delivery services are increasingly becoming the preferred mode of logistics for a large number of users. Hence, it commands premium over other transport services (air express: 4x of surface transport, surface express: 2x).

Expansion Plans

The capital expenditure for nine months-ended December 2018 stood at Rs 22 Cr. The Company has guided for Rs. 400 Cr. capex spend in 5 years which would be utilised to expand its reach in Tier II, III cities (hub & spoke model – reach 1000 offices count), open newer sorting centres, develop in-house analytics (target to map 1 million customers to its database), etc. The investments will primarily be financed through internal accruals.

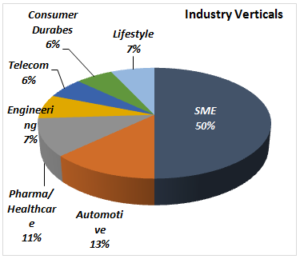

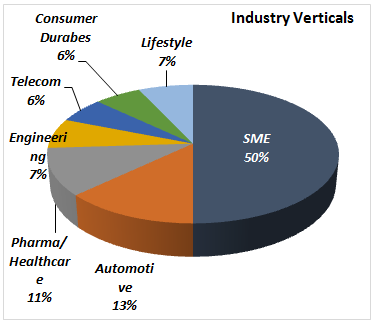

Providing Logistic Services Across Industries – The Company offers express logistics services for high value products to companies operating in the pharma, automobile spare parts, lifestyle, retail and engineering industries. The Company derives more than half of its revenue from small and medium enterprises (SME).

Strong Clientele

Strong Network, Brand, and Asset-Light Business

TCI Express has 28 hubs, 550 branches and a fleet of 4000+ vehicles at its disposal with minimal operational asset ownership.

WHAT’S DRAGGING THE STOCK?

Intense Competition

TCI Express competes in its B2B business (95% of revenues) with organised (such as Gati, BlueDart, Rivigo, etc) and unorganised players. The Company also face competition from (private equity funded players entering B2B space).