Tech Mahindra Limited (“Tech Mahindra” or the “Company”) offers innovative and customer-centric information technology experiences. Tech Mahindra is $5.2 billion company with 123,400+ professionals across 90 countries, helping 981 global customers including Fortune 500 companies. The Company’s portfolio of services ranges from designing a strategy to delivering impact including:

Infrastructure and Cloud Services, Integrated Engineering Solutions, Data Analytics, Network Services, Cyber Security, Business Process Services, Testing Services, Performance Engineering, Business Excellence Services (Consulting), Telecom Product Engineering, Digital Supply Chain.

Financial Performance

| Particulars | FY16 | FY17 | FY18 | FY19 | FY20 |

| Revenue (In Rs. Cr.) | 26,494.20 | 29,140.80 | 30,772.90 | 34,742.10 | 36,867.70 |

| Growth | – | 9.99% | 5.60% | 12.90% | 6.12% |

| EBITDA (In Rs. Cr.) | 4,270.60 | 4,184.40 | 4,709.60 | 6,336.90 | 5,508.60 |

| EBITDA Margin | 16.12% | 14.36% | 15.30% | 18.24% | 14.94% |

| EBIT (In Rs. Cr.) | 3,511.70 | 3,206.30 | 3,624.60 | 5,207.70 | 4,062.80 |

| EBIT Margin | 13.25% | 11.00% | 11.78% | 14.99% | 11.02% |

| PBT (In Rs. Cr.) | 3,854.10 | 3,855.30 | 4,878.70 | 5,608.70 | 5,063.30 |

| PAT (In Rs. Cr.) | 2992.90 | 2812.90 | 3799.80 | 4297.60 | 4033.00 |

| PAT Margin | 11.30% | 9.65% | 12.35% | 12.37% | 10.94% |

| EPS (In Rs.) | 30.98 | 29.11 | 39.33 | 44.48 | 41.74 |

| EPS Growth Rate | – | -6.01% | 35.08% | 13.10% | -6.16% |

| Historic P/E (Closing Price of 31st March) | 15.33 | 15.77 | 16.24 | 17.35 | 13.55 |

| CURRENT P/E | 15.86 | ||||

| EV/SALES | 1.56 | 1.37 | 2.23 | 1.89 | 1.90 |

| D/E | 0.07 | 0.07 | 0.09 | 0.07 | 0.11 |

| Interest Coverage | 44.03 | 32.54 | 29.00 | 47.57 | 28.71 |

| ROCE | 27.06% | 23.09% | 22.35% | 28.59% | 22.36% |

| ROE | 20.51% | 17.12% | 20.17% | 21.19% | 18.49% |

Quarterly Performance

| Q1 FY 2020 | Q4 FY 2020 | Q1 FY 2021 | Q-o-Q % | Y-o-Y % | |

| Revenue | 8,653.00 | 9,490.20 | 9,106.30 | -4.05% | 5.24% |

| EBITDA | 1,314.10 | 1,130.30 | 1,300.50 | 15.06% | -1.03% |

| EBITDA Margin | 15.19% | 11.91% | 14.28% | ||

| PAT | 959.30 | 803.90 | 972.30 | 20.95% | 1.36% |

| PAT Margin | 11.09% | 8.47% | 10.68% | ||

| EPS | 10.89 | 9.14 | 11.07 | 21.12% | 1.65% |

Q1 FY2021 Highlights:

- Despite demand uncertainty and volume reduction, the Company has been able to demonstrate operational resilience through cost optimization.

- The order book declined 43% QoQ due to delay in deal closure on the enterprise side.

- The communication order book declined ~40% mainly due to impact of lower deals from network services in communication and client specific issues due to Covid related impact. Enterprise order declined ~45% due to closure in deal wins. The Company expects Q2 and Q3 to see better deals due to traction in Hi Tech, Manufacturing and BFSI.

- The Company sees some near-term challenges in auto (Pininfarina) and healthcare segment (HCI) of its portfolio companies.

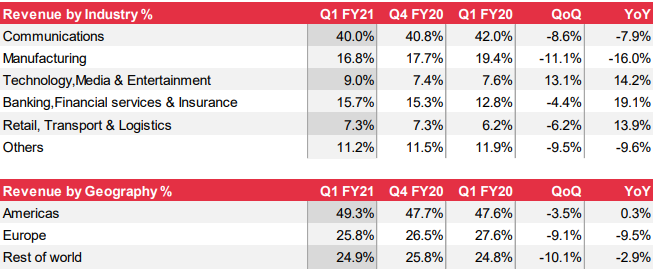

- Across geographies, Americas fared relatively well, while the other two geographies reported sharp declines.

WHAT’S DRIVING/DRAGGING THE STOCK?

Q1 Growth Impacted By Both Covid And Non-Covid Factors

The management stated that the drop in revenue was related 25% to the supply side and the remaining 75% coming from the demand side. However, the management believes that the supply side constraints are resolved now. Tech Mahindra also had incremental revenues coming in from some of the new acquisitions, which were integrated during the quarter. This was offset by currency headwinds and seasonal weakness in the mobility business – Comviva.

Key Wins During the Quarters

Tech Mahindra reported net new deal wins of US$290mn in 1QFY21, substantially lower than its deal wins in Q4 FY20 at $512 million. Of this $105 million was from the communications segment.

- Engaged by one of the largest healthcare providers in the U.S. as a managed service partner for IT operations

- A leading Communications Service Provider (CSP) based in UK has selected Tech Mahindra to enhance its operational systems leveraging next-gen Data and Analytics

- Tech Mahindra won a deal with a global leader in sustainable and innovative fibre solutions to provide end-to-end managed services for plant Infrastructure across the organization

- Engaged by a leading US telecom provider for cloud migration and application support

- Engaged by a leading North American security and VPN (Virtual Private Network) solution provider to enhance its customer experience globally leveraging Artificial Intelligence and Machine Learning

- Signed a deal with a network service provider in Japan for implementation and support of the digital billing support system (BSS)

- Engaged by a South African administrative division for SAP support and application maintenance

- Tech Mahindra has been selected by a leading American telecom player as an Automation partner for AIOps implementation and platform development.

- Tech Mahindra won a deal with a new age Electric Vehicle Manufacturer for complete vehicle engineering leveraging its strong domain expertise

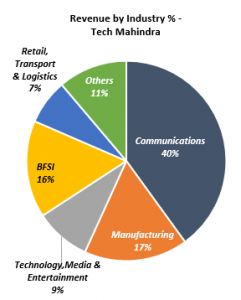

Leading Player in The Telecom Vertical

With a leadership position in the communications space (accounts for ~40% of total revenue) and preferred partner for leading players in the communications service space, Tech M is well-placed to capture 5G-related spends from telecom service providers and OEMs. The Company believes that its investments/partnerships with AltioStar/LCC differentiate it from other IT services vendors. Tech Mahindra’s early investments in network capabilities through LCC, investments in IPs and platforms and investments/partnerships (Intel, Rakuten, AltioStar and among others) to develop an ecosystem would help the company to capture opportunities with the roll-out of 5G. On 25th August 2020, the Company mentioned that it expects $150-200 million as the potential revenue from the fifth generation (5G) services as it goes mainstream.

Higher Exposure To The Telecom Business

Though a higher exposure to the telecom business shields Tech Mahindra’s revenues to some extent given limited impact on telecom players from COVID-19, the rollouts of 5G has got delayed as enterprises have been conserving cash due to COVID-19-led business disruption, spectrum action delays and logistics issues continue on account of labour unavailability.

Effort to Diversify the Business into Non-Telecom Area

The Company has been focusing on diversifying its offerings from just a telecom vertical to other verticals (financial, manufacturing, healthcare, etc) over the last decade through mergers & acquisitions, securing large deals and building capabilities in other verticals.