Below, I will analyze the investment potential for Thomas Cook India Limited (from the tourism industry) – a sector I have been extremely bullish on for the last 2-3 years. If I were to measure my success rate in this sector, I will hands down beat any analyst anywhere on this planet. In the last 3 years I recommended 2 stocks from the tourism sector.

First, I recommended Indian Hotels (click to see the report) on 29th August 2013 @ Rs. 45. I closed this call on 5 January 2014 @ Rs. 121.

Second, on the same date I closed my buy call on Tourism Finance Corporation @Rs. 87. I recommended this stock on 9 July 2014 when the stock was trading @ Rs. 36.65.

You can see the track record page here to see these calls.

I have never recommended any other stock from the tourism industry. Please do not take this as me saying that there are no good stocks in this sector other than the 2 above. Just that I haven’t found any. Though EIH Limited and the heavily burdened Hotel Leela have always generated interest given that they have always been 2 leaps ahead of the acquisition wolf, particularly Leela.

Thomas Cook (India) Limited is a leading integrated travel and travel related financial services company. It offers a broad spectrum of services including foreign exchange, corporate travel, mice, leisure travel, insurance, visa & passport services.

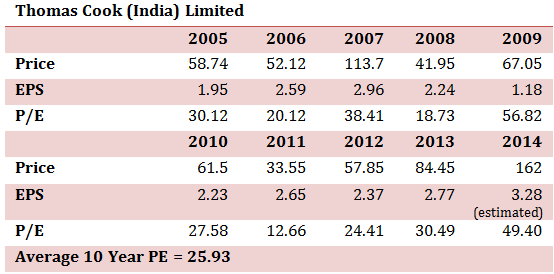

Fair Value Based on Price Earnings (P/E) – It is easy to calculate the Price Earnings Ratio of any stock by simply dividing its current price by its reported EPS of the last 4 quarters (take consolidated EPS). The best way to assess the PE is by comparing it to industry PE and with the historic PE of that specific stock.

At the current price of Rs. 205 (closing price for – 13 January 2015), Thomas Cook (India) Limited’s trailing 12 month PE comes to ~ 62.5 which is a 141% premium to its 10 year average PE Multiple of 25.93. It is another way of saying that the fair value of this stock should be Rs. 71, while you will have to pay Rs. 205 for each share. Of course this may be over simplistic and does not factor in the future growth plans of the company. That said you will have to factor in very significant change to justify buying the stock at current valuations.

At these prices and based purely on a PE analysis, Thomas Cook (India) Limited is drastically overbought. I would stay away from this stock for now.

* I see some strong momentum in this stock and will not be surprised if it moves up (or down) by 10-20% from here over the next few trading sessions. Views expressed above are based purely on fundamental investment value of Thomas Cook (India) Limited.

Other Qualitative Factors

Market Leader in Forex Business

Thomas Cook is one of India’s largest foreign exchange dealers in both the wholesale and retail segments of the market both by number of outlets as well as sales. The Company is the single largest exporter of foreign currency notes in India.

Thomas Cook also caters to a broad range of Authorized Money Changers (AMCs) including Banks, FFMCs and RMCs as well as corporate and retail customers. Forex business accounts for over 50% of the total revenues of Thomas Cook.

- Strong distribution network with retail outlets across India – 202 locations across 86 cities in India.

- Strategically located outlets such as international airport terminals – 19 outlets across 6 airport terminals in India, Mauritius and Sri Lanka.

The Company is working towards increasing its presence by adding ~35-40 outlets over the next two years.

Acquisition of IKYA – A Move Towards Diversification

In May 2013, the Company acquired a 74.85% stake in IKYA human Capital Solutions Limited, the third largest staffing company in India employing over 70,000 employees, for total consideration of Rs. 2,568.20 million. IKYA offers specialised human resource services including search, recruitment, project-based hiring, general and professional staffing, skill development, and facilities management to over 500 leading Indian corporate clients through 32 offices, with 1,400 team members and over 54,000 associates. By virtue of this investment, Thomas Cook has broadened its portfolio by entering into human resource business.

Another acquisition

Thomas Cook acquired Sterling Holiday Resorts (India) Limited. Sterling Holiday Resorts owns 19 resorts with over 1,500 rooms in India. The management plans to consolidate all the leisure & travel related businesses under Thomas Cook to effectively exploit the huge potential in the domestic tourism industry.

The Company’s consolidated revenues are expected to grow at a CAGR of 25 % over FY2014-17 with IKYA being a key revenue driver.

NEGATIVES

Extremely High Valuations

As discussed above – Hard to explain the recent run up.

Intense Competition

The Indian tourism industry is highly fragmented with organised players like Thomas Cook, Cox & Kings and Kuoni India and a few sizeable regional players including Kesari, Club 7, and a number of smaller players. Increasing competition from companies in Travel & Tourism (Kuoni Sita and Le Passage to India in inbound travel; Cox & Kings and Kuoni in outbound travel), forex, online travel agents (Makemytrip and Yatra in online travel) and the unorganised segment makes it very difficult to maintain market share and profitability of the company going forward.

Slowdown in Economy to Affect Tourism Business

A slowdown in the Indian economy would dampen the consumer sentiment, thereby affecting Thomas Cook’s travel and tourism business.

Dear Rajat Sir your research so knowledgeable for new investors, Thanks for it, i request please start long term investment portfolio in stock market for 10 to 15 years time period.

Thanks Gamanand.

The problem is that most people need to see money on a daily or at most – monthly basis. Forget long term, my only advice is – do not invest your salary in stocks on the 1st of every month.

Rajat – I really like your blogs and snippets. What would be very interesting is to see you take a contrarian call in a bull market based on fundamental reasons that has come out true. As the Oracle of Omaha says the first rule of investing is “Don’t lose Money”….Would make an interesting article for your readers to showcase such a call you took that “saved” money

Another basic question.. When do you capture the price of the share for the P/E calculation for the 10 year average P/E ?

For example, for Thomas Cook, on what day would you take the share price of 52.12 and an EPS of 2.59 for 2006?

Sorry for these trivial questions, but I feel these are essential for me to understand your blog correctly..

Take any day of the year – I took 31st March Prices. Just be consistent.

Yes if the price for a given day (- i.e. 31st March of a given year) is up or down by a lot for any one off reason, you may want to take a weighted average for 2 week period around that day. But over 10 years, it all balances out.

Thanks for clearing that up Rajat!