INVESTMENT RATIONALE

- Titan Company is on track to achieve the jewelry revenue guidance of 2.5x FY22 revenue by FY27,

implying an impressive CAGR of 20%. Despite Titan’s current high trading multiple of 102, there is optimism based on the potential increase in market share from the current 7% to an anticipated 10% in the jewelry segment. This growth is anticipated as the unorganized sector transitions to organized, presenting substantial expansion opportunities. - Titan Company has performed reasonably well despite the high volatility in gold prices. Strong marketing campaigns and programs like the Golden Harvest and the Gold Exchange program continue to contribute to sales growth.

-

- Golden Harvest– Tanishq runs the GHS scheme where the Investors can pay a monthly installment of as low as INR 2,000 or multiples of INR 1,000 for 10 months through cash at their showrooms, online

through the website or Tanishq Golden Harvest mobile App and can avail of a special discount of up to 75% of the 1 installment at the time of redemption. - Gold Exchange program- If a customer brought jewelry that was lower than 22 carats but higher than 19 carats pure, he/she could exchange it with Tanishq’s 22-carat jewelry by just paying for the making charges.

- Golden Harvest– Tanishq runs the GHS scheme where the Investors can pay a monthly installment of as low as INR 2,000 or multiples of INR 1,000 for 10 months through cash at their showrooms, online

-

- Titan remains one of the few consumer-discretionary companies growing at this rate despite the headwinds post-pandemic and the discretionary nature of the business. This reflects the strong brand positioning on the back of multi-decal trust from the company.

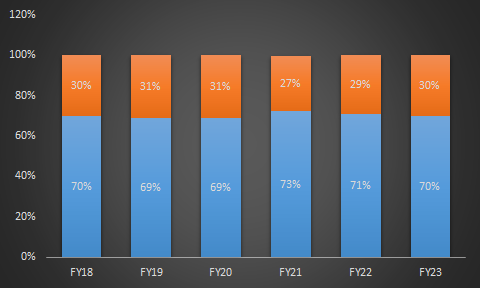

- The gradual recovery in the studded ratio and the higher emphasis on studded jewelry are expected to improve the margins in the future. (See chart below)

- With a current market share of ~7% in a sizable ~INR5t market, there is significant headroom for growth. Factors such as increasing disposable income, the emergence of lightweight jewelry, the growing wearables segment, and the premiumization trend in other business verticals make it a strong player in the consumer

discretionary space. - Titan has an impressive track record of outperforming its peers as well as exceptional long-term growth potential, all of which justify its premium valuations

The Guidance provided by the management indicates a strong visibility in the future.

- Titan Company has given revenue guidance of INR 1,000+ cr each for Indian Ethnic Wear and women’s bags by 2027.

- In the watches & wearables segment, the management has given guidance of INR 10,000 cr revenue by FY26, with wearables contributing 30% of the total revenue.

- In jewellery the management has given revenue guidance of 2.5x FY22 revenue by FY27.

Distribution of key categories as % of Jewellery sales- Studded Jewellery is a High Margin Business.

ABOUT THE COMPANY

- Titan Company Ltd is a leader in the Indian Gold and Diamond Jewellery market with ~7% market share.

- Initially started as a watch manufacturer, the company established leading positions in the Jewellery, Watches & Wearables, and eye care categories. It has diversified into other emerging businesses like Indian Dress Wear and Fragrance & Fashion Accessories.

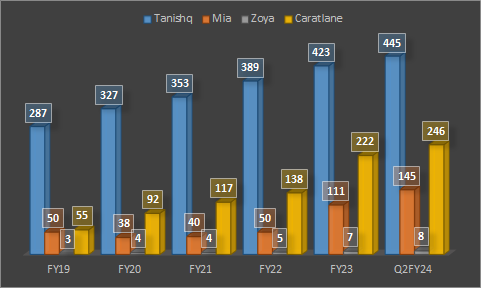

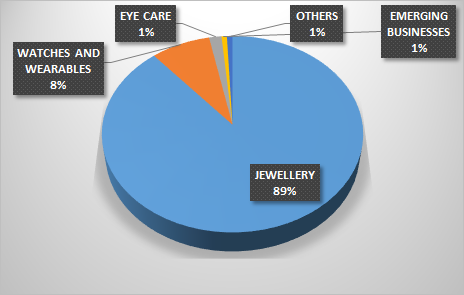

- The jewelry segment which houses some of India’s well-known brands like Tanishq, Zoya, Mia, and CaratLane contributes ~89% of the company’s revenue. The segment has manufacturing facilities in Hosur and Pantnagar. And, have four Karigar Centres.

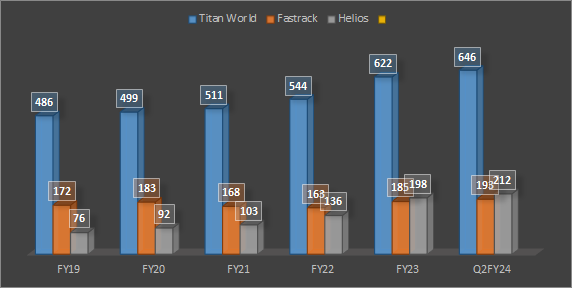

- The Watches & Wearables segment, which houses brands like Titan, Fastrack, and Sonata, has manufacturing facilities in Hosur and Coimbatore—3 assembly facilities in Pantnagar, Sikkim, and Roorke.

- EyeCare segment has a manufacturing facility in Chikaballapur and 2 lens facilities in Noida and Kolkata.

- The company has forayed into the international jewelry market with its flagship brand, Tanishq. Tanishq stores are in the UAE, the US, Qatar, and Singapore, comprising 13 stores. The company has recently opened its first Mia store in Dubai.

- CARATLANE- Titan acquired the additional stake of 27.2% in CaratLane, taking its ownership to 98.28% from 71.09%. — Caratlane reported 47% revenue CAGR over 8 years

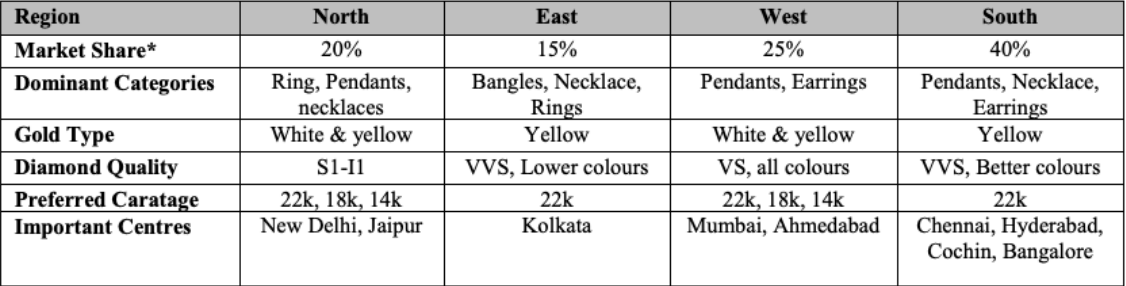

Regional Demand Preferences

Titan has implemented several strategies in Tamil Nadu (the largest jewelry market in India), i.e., introducing region-specific products and expanding retail networks.

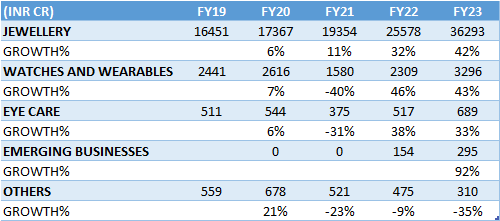

Segment Wise Revenue Diversification

- Jewelry Segment- The jewelry segment houses some of India’s well-known brands like Tanishq, Zoya, Mia, and CaratLane contribute ~89% of the company’s revenue. The segment has manufacturing facilities in Hosur and Pantnagar. And, have four Karigar Centres. The jewelry segment posted a growth of 42% YOY in FY23. Domestic jewellery sales were robust driven by a healthy double-digit growth in new buyers and average ticket size. The segment also gained due to the high diamond and studded mix. The company has forayed into the international jewelry market with its flagship brand, Tanishq. Tanishq stores are in the UAE, the US, Qatar, and Singapore, comprising 13 stores. The company has recently opened its first Mia store in Dubai.

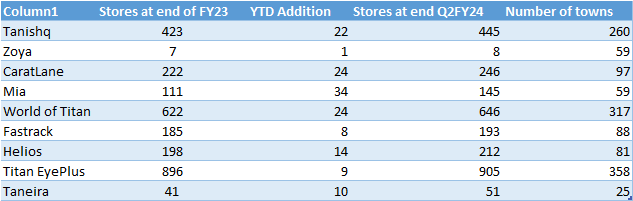

Store expansion Jewellery Segment

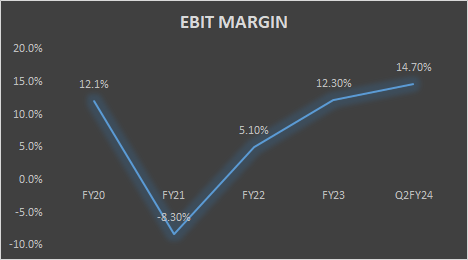

- Watches & Wearables- The segment contributes ~8% of the company’s revenue. The segment posted a healthy revenue growth of 43% YoY in FY23, led by growth in both analog and smartwatch segments. It recorded the highest-ever sales from smartwatches. and it crossed 1000+cr of quarterly revenue for the first time in Q2FY24. The Watches & Wearables segment, which houses brands like Titan, Fastrack, and Sonata, has manufacturing facilities in Hosur and Coimbatore—3 assembly facilities in Pantnagar, Sikkim, and Roorke.

Store expansion Watches & Wearable Segment

- Eye Care Segment- The segment contributes ~1% of the company’s revenue. With store expansion and the introduction of premium products, the EyeCare division reported 33% revenue growth. The EyeCare segment has a manufacturing facility in Chikaballapur and 2 lens facilities in Noida and Kolkata. In FY23, it added 180 new stores, including 5 Fastrack stores, totaling 900 stores in India. It opened its first international Titan Eye+ store in Dubai.

- Emerging Businesses- The lifestyle industry has been a thriving avenue for Titan, Emerging Businesses comprising Fragrances & Fashion Accessories (F&FA), and Indian Dress Wear (Taneira) reported 92% YoY revenue growth in FY23. ; In sub-segments, Fragrances grew 12% YoY and Women’s Bags, led by ‘IRTH’ brand, clocked a healthy 31% growth YoY. However, the other fashion accessories comprising belts and wallets werer lower by 40% YoY. Taneira’s Q2FY24 sales grew by ~64% YoY.

Store Expansion Titan YTD

REVENUE DIVERSIFICATION

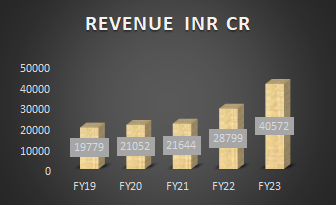

The company reported a strong consolidated revenue growth of ~37% YoY to INR 12,653 cr in Q2FY24 compared to 22% revenue growth in the base year. Titan is one of the few consumer companies that has posted such revenue growth in the past 5-6 quarters, despite the volatility in the gold prices and the discretionary nature of its business. During the fiscal year 2022-23,

revenue from the jewelry segment was ~89% of the total revenue. The watches & wearables segment and the Eyecare

segment contributed ~8% and ~2 respectively.

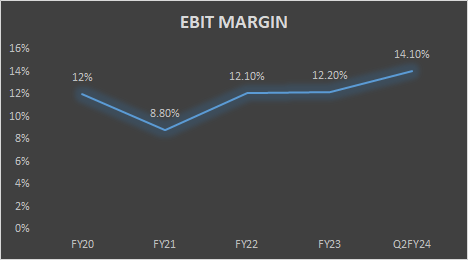

MARGINS

EBIT Margin – In the recent quarter, the company posted a consolidated EBIT of INR 1,392 cr with an EBIT margin of 12.8% (YoY decline of 98bps and sequential quarter growth of ~280bps).

- EBIT margin for the jewelry segment stood at 14.1% in Q2FY24(compared to a margin of 15.3% in the base year). Going forward the management expects a margin between 12-13% for the jewelry segment as the competition from other organized players intensifies.

- The margins for CaratLane came at 4.1%(compared to the EBIT margin of 5.5%) in Q1FY24 in the recent quarter.

- For the watches and wearables segment, the EBIT margin stood at 14.7% in Q2FY24, driven by a rise in wearables and strong premiumization trends in analog watches for Titan and International brands. The management expects a margin between 12-13% for the full year from the segment.

- EyeCare posted an EBIT margin of 14.9%(compared to 16.5% in the base year) in Q2FY24.

- TEAL posted an EBIT margin of 15.9% in the quarter, improving as the aerospace industry recovers.

MARKET WISE SEGMENTATION

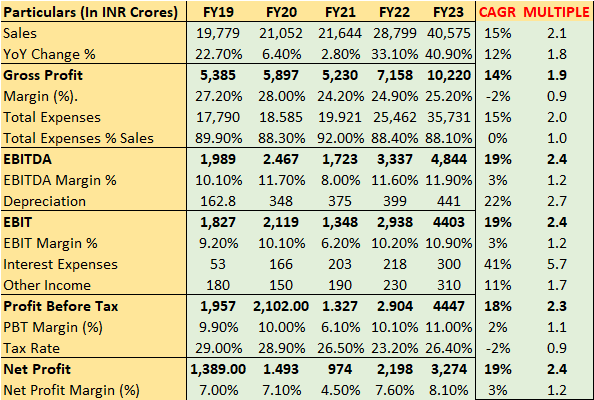

FINANCIAL SUMMARY

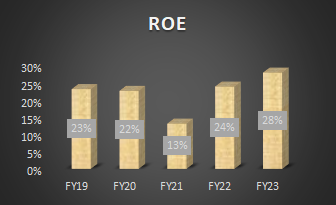

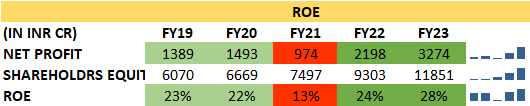

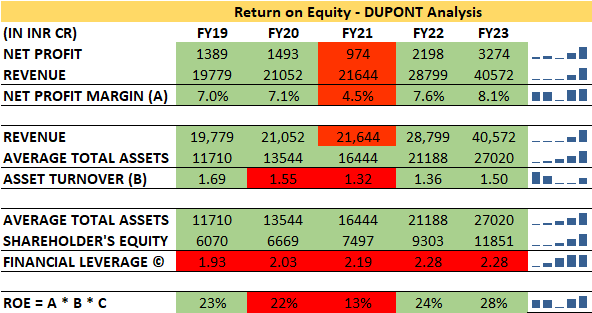

DuPont Analysis: Return on Equity

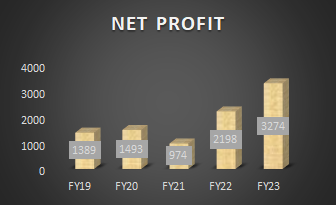

- Titan company’s ROE has decreased to 13.0% in FY21 due to a fall in net profit margin of 260bps. ROE has now exceeded the pre-covid level and currently stands at 27.6% as of 31st March 2023.

- The ROE has improved significantly over the period from 23% in FY19 to 27.6% in FY23. The reason for the said improvement in the ROE of the company pertains to (i) a slight improvement in the net profit margin of the company from 7.1% in FY2019 to 8.0% in FY2023, (ii) an increase in the financial leverage which currently stands at 2.28 in FY23.

- The Post-COVID level, the rise in ROE of the company was due to recovery in its net profit margin as the company improved its product mix in favor of higher studded jewelry, increase in market share for the organized jewelry players, inventory gains due to the rapid rise of gold prices post-pandemic, and improved in the overall cost structure of the company due to its lean cost structure.

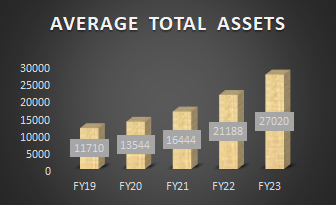

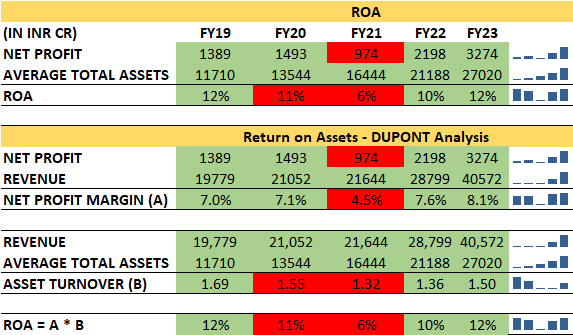

DuPont Analysis: Return on Assets

- The ROA of the company has also improved from a low of 5.9% in FY21 to 12.1% in FY23. The reason for said improvement in the ROA of the company pertains to (i) improving the net profit margin of the company to 8.0% in FY23, and (ii) improvement of the efficiency of its assets in the last three fiscal years post the pandemic slump.

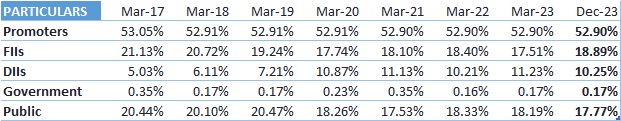

SHAREHOLDING PATTERN

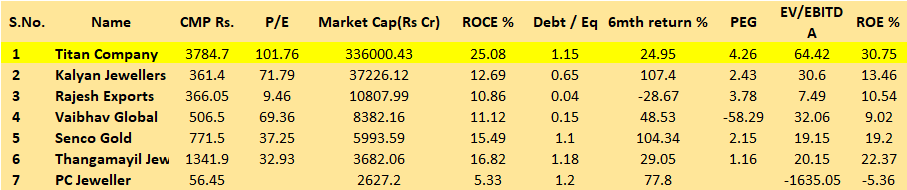

PEER COMPARISON

good

Thanks