There will be exceptions to each of the three investing mistakes below; where committing such a mistake would have actually made you money. That is the very reason why investors continue to make these mistakes – that sometimes committing this mistake will save you or make you money.

In general however, or let’s say in an overwhelming majority of cases, these investing mistakes will actually depreciate your return.

- Averaging – Single Biggest wealth destroyer. I am sure that at some point you have averaged a stock which you bought at a higher price. I am also sure that sometimes this decision paid off in getting you out of that investment at a lesser loss, or even at a profit. Statistically however, if you were to calculate the number of stocks in which you have averaged your holding, I bet that none of you would report an overall profit. Looking at client portfolios for years, I have observed that this is a bad habit in the long run and you should change it. If an investment did not work in the first instance, it won’t work in the second; and just in case it does, then your first decision will prove right. What I mean is that when you average, you are more likely to get out of the stock once it trades above your average holding price. Chances are that if the stock price reaches back your average price, there will be much more steam to the stock.

Moral: Instead of thinking of it as an average, think of the second purchase decision, independent of your original purchase decision, i.e. ask yourself: WOULD YOU BUY THE STOCK FOR THE VERY FIRT TIME AT TODAY’s PRICE? If in your analysis, the stock is still worth buying, then do not call it averaging – you are buying a great stock at a great price (which is how it should be in every instance of buying a stock).

- Buying High – Toughest time to pick a stock is now, easiest time to pick a stock was 2014 (or if you remember – 2009). A few days back someone over twitter said – “I wonder what Indian asset managers are busy with; there are only 7 stocks you can buy in this market”. This to me was one of the best observations for this year. Not that good businesses have ceased to exist, just that I wouldn’t pay Rs 700 for a coffee; chances are, it can almost never justify its price. Consider this, someone who started a monthly SIP of Rs. 10,000 in 2010, would have invested Rs. 4,80,000 by the year 2014. His portfolio value however would have been below his investment. Such were the markets. 4 years of SIPs gave negative returns. Yet it all changed over the next 4 years (markets almost doubled between 2014-2018). Now, markets are expensive and it’s unlikely that you will make very good returns going forward if you buy at today’s prices. I don’t care how good the stock, you will get it cheaper in sometime and I can bet my last buck on this. Investing at all times is a good idea. Investing where is what differentiates good portfolios from the bad ones.

- Over Concentration – Wealth is not made by buying a top stock. Wealth is made by buying 7-10 top stocks. You could have been lucky if you invested in Infosys at the IPO time, and held on to it till today. The word I use is ‘lucky’. In reality however, most investors who buy large quantity of a single stock will at some point regret their decision.

Similar to the problem of averaging, statistically, over concentration would have done more harm to portfolios than help.

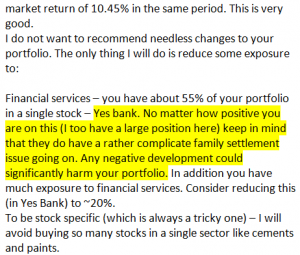

Particularly in current market environment, you will hear many stories of investors who got protected because 70-80% of their portfolio was in 2 stocks which did not fall (something like RIL and Infosys). These portfolios are always in danger of cracking big on the turn of the tide. Nobody is perfect at juggling a 2 stock portfolio before every turn of the tide. Diversification is really the key. Consider this advice I gave to a client 6 February 2017:

We all know what happened to the Yes Bank stock since then. Let alone analysts and advisors, even the promoters and management is never 100% sure of their businesses. Business is a risk. Period.

Diversification cuts that risk in your portfolio.

There are many other wealth destroying habits which we develop as investors. Some of the more classic ones can be found in the timeline to this tweet below. What habit do you think has harmed your portfolio that you would like to change. Leave a comment.