Over the past 6 years, a majority of blue chip stocks have remained range bound. Naturally, the broader markets have gone nowhere. Not only is this unusual, it has resulted in sound investing principles being questioned by the most well educated investors. Micro caps, and small and mid caps are now almost treated as best investment grade stocks. Long term wealth creators have become somewhat boring. This cannot go on for long.

Below I am discussing top 5 blue chip stocks from 5 core sectors –Power, Oil & Gas, Banking, Information Technology and Defence.

Power Sector

SJVN – Power space has not performed for the last many years. Recently, the government has made a lot of efforts to improve things on the infrastructure side, especially on power transmission and on State Electricity Board (SEB)’S debt problem.

Read a more detailed article here – Power Stocks: Deep Value or Junk Buying?

When you look at the power space, 90% of your job gets cut down because most of these power stocks are trading at such high levels of debt that you don’t want to buy them. SJVN is one of the only stocks where the company operates with negligible level of debts (0.24:1).

Currently the Company is trading with a dividend yield of 3.72%. The Company produces ~2000 MW of electricity and by FY 2022, SJVN is planning to scale that up to 10,000 MW. The Company is entirely into hydro and wind energy which is where the government is providing most encouragement. In addition, the Company could be a major beneficiary from the new UMPP Policy of the government as companies with lower debt like SJVN can approach banks easily to raise loan.

Read – SJVN stock analysis

Oil & Gas (Exploration) Sector – Will emerge as the most strategically important sector over the next 5 years.

ONGC– Upstream companies (i.e. oil exploration & production companies) perform well when crude oil prices starts recovering. We are particularly bullish on ONGC in this space. ONGC is available at price earning of 11.94 and has a dividend yield of 4.39%. Reserves of Rs. 180,454.40 and debt of Rs. 47,582.75 Cr (FY 2015 figures for debt and reserves).

ONGC is going to invest $5.07 billion to develop Krishna Godavari basin (KG basin) which will boost the company’s oil and gas output 5 times in about four years. The Company is also expanding by acquiring 15 % stake in Rosneft in Russia. So fundamentally, everything is looking good for the company. In addition, there is also some development for the oil & gas sector including discretion in the pricing of new discoveries which will further help the Company in consolidating its financial position.

For Financials of ONGC visit here

Note – Although Cairn India operates with zero debt, still we recommend staying away from the Company due to the bad corporate governance standard that Cairn India has exhibited. Read here – Cairn India stock analysis (although Cairn stock is at artificially low levels and may rebound)

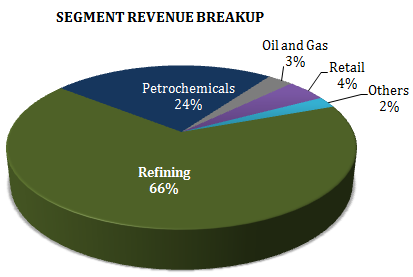

Reliance Industries – Only 3% of its revenue comes from exploration business.

Banking

Axis Bank – We are bullish on blue chip private sector banks. Unlike public sectors banks, private sector banks have structural growth stories and are less impacted by asset quality challenges. Within the private sector, we are positive on those banks which get a lot of their revenue from service sides (i.e. non-funded revenue), like Axis or Kotak.

Axis gets about 20% of its revenue from non-banking fee based services. Growth in other income or non-funded revenue is good for the bottom line (i.e. net profit) as income from this stream is derived without significant mobilization of deposits and hence the cost associated with this income is relatively low compared to interest income.

Axis bank operates with strong loan book accretion and consistent healthy fee-income performance. Given the well capitalized balance sheet, robust return ratios (Average 5 year growth in RoE stands at 17.01%) and consistent net profit growth, Axis Bank is a definite long term buy.

For Axis Bank Financial visit here

Information Technology

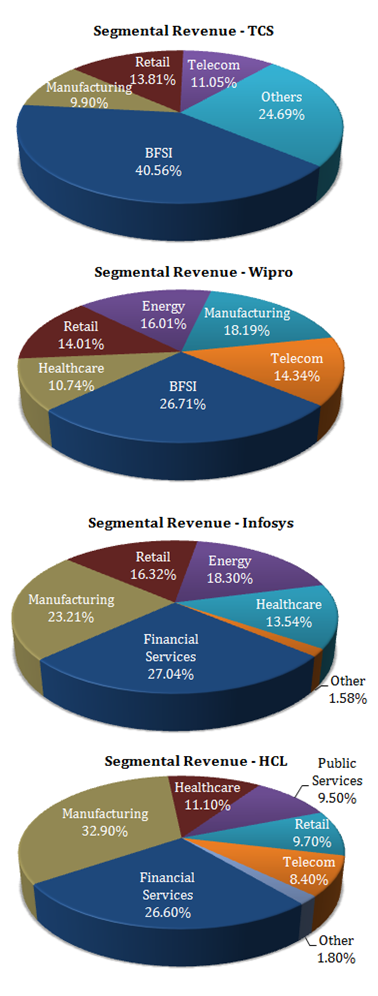

TCS –Within the blue chip IT pack, we would focus more on companies which get a majority of their revenue from BFSI (Banking & Financial Services Industry) sectors which is likely to do well in the coming years and avoid companies which have maximum exposure to telecom or other beaten down sectors like metals. TCS’s BFSI domain constitutes 40.56% of its total revenue.

TCS operates with strong financial position with its net profit growing at an average of 24% over the last five years as compared to Infosys (15%) and Wipro (14%). TCS growth strategy is based on 2 strategies – (1) improving client metrics with an equal focus on sector exposure and (2) Sustaining profitability with incremental revenue addition.

Geographical Breakup – 56.4% of the overall revenue of the Company comes from U.S., followed by 25.3% from Europe, 8.6% from India, 7.6% from the Asia Pacific region and 2.1% from the Middle East.

Read more – Indian IT Stocks – Industry wise Revenue and Exposure.

For Financial visit here

Defence

Bharat Electronics – The biggest boost for the defense stocks came from the long-pending Defence Procurement Policy (DPP-2016). The new policy will focus on India-made defence products and fast track the acquisition process for the companies.

Bharat Electronic is a market leader with 44% share in the defense electronics segment. The Company has a strong balance sheet with zero debt and reserves of Rs. 8,116.84 Cr. Accelerated order inflow and consistent performance over the past 10 years, give reasonable confidence on the robust prospects of the Company. The Company is currently trading at a P/E multiple of 22.51 and has dividend yield of 2.42%.

Besides being in the defence, the Company is also into security and surveillance space where not many companies are currently present. The Company security products include Radio Frequency Intrusion Detection System, Closed Circuit Television (CCTV) Surveillance System, Remotely Operated and Mobile Surveillance systems. Bharat Electronics has wide portfolio of products in homeland security which makes the Company a strong buy in the defence space.

Note: Homeland security equipment (i.e. human and X Ray bag inspection machines) is one of the most exciting space to watch out for.

Hi Rajat…. Thank you for your recommendations…..I personally believe wealth is created from mid & small cap stocks… when they move up the value chain….small getting into mid & mid into large….though takes time….but in bullish times…it is a possibility….hence suggest some mid / small cap…unknown names…with creditable management..excellent business oppurtunities and growth prospects… something like HFC…eg. GRUH / GIC / repco / lic etc…paint companies…decent banks eg..yes / indus ind / karnataka etc..

I personally believe wealth is created from large cap stocks 🙂

Thanks Rajat for sharing this informative details

Can we buy this stock and keep it for long term like 10 years plus as part of financial portfolio