Indian FMCG sector is the fourth largest sector in the economy with a total market size in excess of Rs. 2,000 billion. The sector has grown at a CAGR of 11 % over the last decade. Food product (43%) is the leading segment followed by personal care (22%).

The Indian FMCG sector is expected to grow at a CAGR of ~12-17% over the next 5 years and reach market size of anywhere between Rs. 4,000 to Rs. 6,200 billion by FY 2020.

[Source: FMCG Roadmap to 2020 | Confederation of Indian Industry (CII)]

Confederation of Indian Industry (CII) FMCG Summit 2015, “Rising GDP growth over the next decade, will quadruple consumption in the country. This and the demographic dividend where 70 % Indians will be of working age in 2025, the flexible younger generation becoming major consumers, increasing media penetration and rising aspiration means for a great period ahead for retail and FMCG sector”.

Drivers of Indian FMCG sector

- India’s favourable demographic trends;

- Rising income levels;

- Low per capita consumption;

- Growing rural economy.

[1] Demographic Advantage

According to recent census survey, India occupies 17% of the world’s population and half of these people are below the age of 25. Such a ‘young’ economy with growing disposable incomes and greater exposure to western lifestyles will prove to be favorable in coming years.

Read More: Future Prospects of Indian Economy

[2] Rising Income Level

Rising disposable income across India will ensure that the consumer goods markets will continue to grow as buying power of people will increase and consumers are becoming more aware of brands. In addition, India’s growing middle class with annual household incomes of $3,000-$5,000, is increasingly become aware of the importance of personal care & grooming.

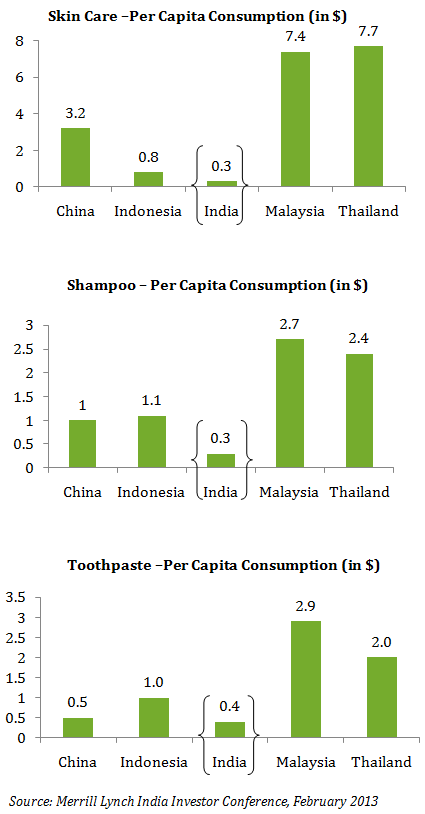

[3] Low Per capita consumption

In India, per capita consumption in most product categories like skin care, toothpastes, hair wash, shower gels, deodorants etc, is amongst the lowest in the world, which provide ample scope for all the FMCG companies to tap the unsaturated market.

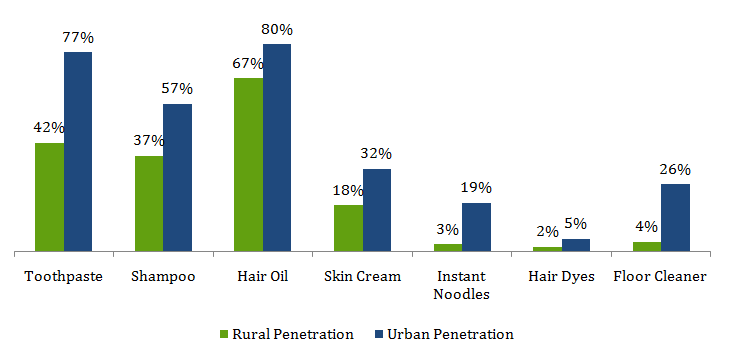

Penetration levels across categories

[4] Growing Rural Economy

FMCG stocks have benefited over the last few years from rise in disposable income in rural areas, where 70% of the country resides and accounts for 33% of the total FMCG market. This represents huge untapped market potential for FMCG stocks. Growing Indian population, particularly the middle class and the rural segments, represents an enormous growth opportunity in FMCG space.

Companies Effort in Gaining Market Share

- Availability of products in small sachets pack has further increased affordability in rural areas.

- Britannia has consistently focused on the rural segment by bringing out products in small pack sizes and in low prices. Example: Good day (5 Rs. packet)

- Cadbury has launched ChocoBix, a chocolate flavored biscuit which targets rural consumers, given their preference for biscuits over chocolates for their children.

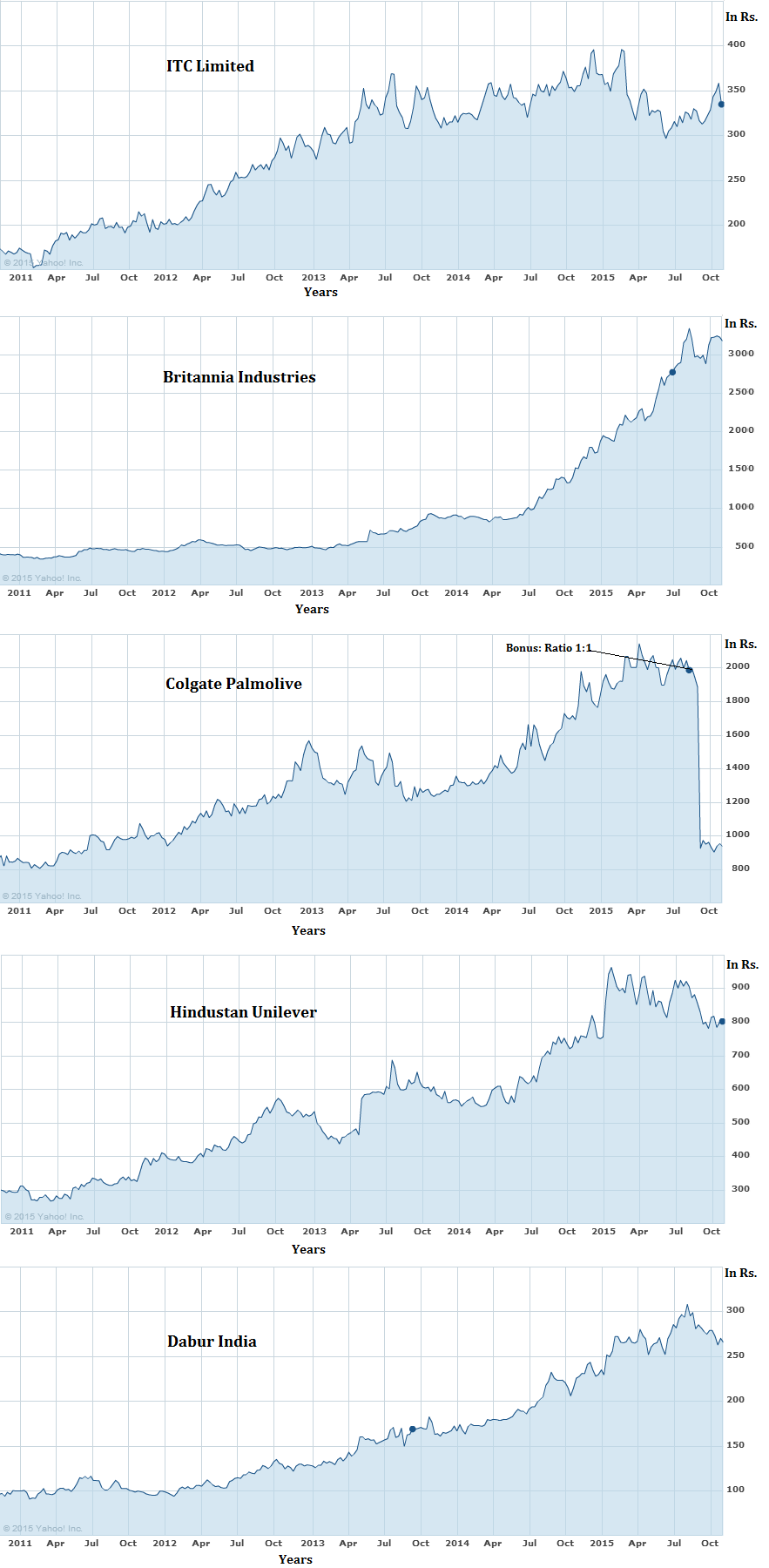

Listed FMCG Stocks in India

Below is a SWOT Analysis of Top 5 FMCG Stocks in India

Note: We have exercised discretion in selecting the stocks below and the words ‘top 5’ may not be indicative of size or market capitalization. If at all, it indicates my personal positive bias for the 5 stocks discussed below.

[1] ITC

STRENGTHS

Dominant Position in Cigarettes Business

ITC is the market leader in cigarettes with 80% domestic market share. This dominant position gives ITC a strong pricing power. ITC cigarette brands include Insignia, India Kings, Lucky Strike, Classic, Gold Flake, Navy Cut, Players, Scissors, Capstan, Berkeley, Bristol, Flake, Silk Cut and Duke & Royal.

Huge Market Opportunity | India’s Demographic Advantage

The long term prospects of the cigarette industry in India is very encouraging with a significant portion of the country’s large population being below the age of 18 which is the minimum legal age to purchase or smoke cigarettes in India. Such a ‘young’ economy with growing disposable incomes and greater exposure to western lifestyles is favorable for an aspirational product such as cigarettes. As per Census India 2011 data, there will be roughly 100 million people attaining the age of 18 in the next 5 years. This should create a potentially huge market and considerable demand for cigarettes.

Strong Distribution Network

In terms of distribution network, the cigarette business of ITC is a logistical marvel with 2 million retail outlets. ITC made cigarettes have the deepest penetration and are available in the remotest areas of the country.

Growth of Non-Cigarette FMCG Business

Over the last few years, the company has been expanding rapidly in the Indian (i) FMCG (non-cigarette), (ii) retailing and (iii) hotel sector. The company has launched a diverse range of products including confectionaries, biscuits, noodles, wafers and ready to eat meals. Some of its brands such as ‘Vivel’ in the soaps and shampoo category and ‘Sunfeast’ in biscuits have quickly cornered a significant portion of the market in which they operate.

CHALLENGES

Systemic Risk and High Regulation and Tax in Cigarette Business

Tobacco and in particular cigarettes are taxed heavily in India. There are about 30 different effective tax rates on cigarette sale across the country. ITC’s average VAT is at 20%. It is unlikely that the government will not increase further the rate of tax on cigarettes, let alone reducing such rate. Any such upward revision in taxes imposed on cigarette sales will make them more expensive reducing the volume of sales which will have a negative impact on ITC’s results of operations and financial performance.

Note: Over the last 3 financial years (FY 2013 to FY 2015), the incidence of excise duty and VAT on cigarettes, at per unit level, has gone up cumulatively by 98% and 104% respectively.

Intensifying Competition

The company faces intense competition in the non-cigarette space with well-established players such as Hindustan Unilever, Britannia, Nestle, Cadbury and many more. Over the years, the strong brand recognition of these companies has led to customer loyalty for their products. ITC is likely to face difficulty in winning and maintaining customer loyalty in the long term and may need to have huge advertising and marketing budgets on a continued basis to promote its line of products.

[2] Britannia

STRENGTHS

Strong Brand Presence in the Indian Biscuit Market

Britannia is the second largest player in the Indian biscuit market with approximately 30% market share. The biscuit segment contributes over 80% of the overall revenues of the company. The company’s brands include Good Day, Marie, Tiger, Cream Treat, 50-50, Milk Bikis and Nutri Choice are well known and enjoy strong recognition in the domestic market.

Diversification of Product Portfolio

Britannia has increased its focus on non-biscuits portfolio like dairy (butter, Milk and Dahi), bakery and healthy breakfast (Poha, upma and Oats) in an effort to diversify its product line which will support the top line growth.

Premiumisation & New Products Launch

In the urban landscape, Britannia is focusing on premiumisation of their product line. Britannia is also making efforts to add new sub brands and introduce new variants/innovations under existing brands. Britannia launched ‘Heavens’ under the Nutri Choice and ‘Chunkies’ under Good Day brand as premium category of biscuits. The company’s focus on premium brands is expected to generate significant returns in coming years.

Distribution Network to Penetrate Rural Markets

Britannia’s current rural market share is 70% and the company is planning to increase the same to 1.5 times over FY 2017the next 2-3 years. The company plans to scale up its rural presence by increasing its distribution network by ~7% and product penetration by ~10% each year.

CHALLENGES

Intense Competition

The Indian biscuit market is led by a few players like Parle and ITC. However, foreign players like Kraft are planning to expand their presence in the branded biscuit segment in India. On the other hand, regional/local brands have a strong presence in the rural markets of India. Any increase in competition from the new and regional players would deteriorate the market share of the company.

Stringent Food Regulations

The U.S. Food and Drug Regulators (USFDA) has recently rejected many products due to reasons varying from products manufactured in unhygienic conditions to pesticides being above permissible limits. More stringent food safety regulations with stricter policies in terms of quality standards, supervision and sanctions perpetually present an ongoing threat for FMCG companies.

[3] Colgate

STRENGTHS

Indian Oral Care Industry: Enormous Untapped Potential

The Indian toothpaste market is estimated to be Rs. 5,200 Cr and is expected to grow at an annual CAGR of 9 % over the next 10 years. Given its low market penetration and even lower per capita consumption, toothpaste market offers enormous growth potential in India.

Market Penetration

Currently, 55 % of Indian population uses toothpastes and only 15% of them brush twice in a day as recommended by most dentists. In comparison, in developed markets like the U.S.A., up to 97 % people use toothpaste and up to 87 % of them brush twice in a day. The opportunity is highlighted further when we take into account rural consumption of toothpaste in India which currently stands at ~ 45 % in comparison to ~ 89 % in urban market.

Per Capita Consumption

India consumes less than 1/4th the amount of toothpaste in comparison to USA. Compared to the other emerging economies of Asia, India’s per capita consumption of toothpaste is less than half.

As penetration level in India increases and as more and more people switch from the traditional dental care products towards toothpastes; the toothpaste market will see considerable growth.

Premiumisation & New Products

In the urban landscape, companies are focusing on premiumisation of their product line. The sensitive / advanced oral care toothpaste segment is gaining rapid popularity on the back of increased awareness and aggressive advertisement campaigns educating tooth sensitivity. As consumers learn more about dental conditions and the advancement in dental care, the premium segment toothpaste market will develop rapidly.

The mouthwash segment has been growing rapidly on the back of a low base share in the total oral care industry in previous years. Colgate has been aggressively marketing its ‘plax’ brand of mouthwash and has quickly cornered 26.5 % of the mouthwash market which makes it the second biggest player in the mouthwash segment. Johnson & Johnson’s Listerine continues to be the market leader.

Enhancing Existing Dominance

A logistical marvel, Colgate is one of the most widely distributed brands, with a presence in 4.85 million retail outlets out of a total of 5.72 million in India. The brand equity which Colgate enjoys is such that the word Colgate has almost become synonymous for toothpastes and oral care in India. For years, Colgate has dominated the toothpaste market in India with ~55% market share.

CHALLENGES

Threat of New Entrants

Over the last decade, the Indian oral care industry has been dominated by few established players such as Colgate, Hindustan Unilever, Procter & Gamble (“P&G) and Dabur. Colgate has been successful in consolidating its market position by gaining market share from smaller players.

In the FMCG space there is always a threat of new entrant especially that of an existing FMCG company who may want to expand their portfolio of offerings. If a new player with big advertising budgets enters the oral care industry, it will surely eat into the market share of existing players.

[4] Hindustan Unilever

STRENGTHS

Dominant Position in Soaps & Detergents

Soaps & detergents segment contributes ~48% to the overall revenue. The company’s strong brands in soaps (Lifebuoy, Lux, Liril, Rexona) and detergents (Wheel, Surf Excel, Surf, Vim) have helped the company to maintain its dominant position in both segments (~40% in detergents and ~45% in soaps) over the years, despite intense competition.

Strong Brand Portfolio in Personal Care Products

The company has strong brand portfolio and presence across all categories of personal care segments (hair care, oral care, skin care, men’s grooming, and cosmetics). HUL brands caters to all segment of consumers – Premium – Pond’s, Axe, Dove, Close Up; Popular – Vaseline, Sunsilk, Pepsodent; Mass – Fair & Lovely, Clinic Plus. Personal care segment contributes ~47% to EBIT.

Premiumisation – Revenue Driver for Beverages

HUL is the second largest branded tea company in India with brands like Lipton, Taj Mahal, and Red Label. The company is also growing in the branded coffee business with its brand ‘Bru’. Growing green tea and coffee culture in the country and shift of consumers to premium flavoured teas and tea bags is expected to generate steady revenue for company’s beverages portfolio.

CHALLENGES

Intense Competition

Threat of New Entrants

Over the last decade, the Indian FMCG industry has been dominated by few established players such as Colgate, Britannia, Procter & Gamble (“P&G), Marico and Dabur. In the FMCG space there is always a threat of a new entrant who may want to expand their portfolio of offerings.

[5] Dabur India

STRENGTHS

Presence in Niche Categories

Dabur India has a strong presence in niche product categories. Dabur has differentiated its position as a natural and herbal product provider in all segments (hair care, oral care, skin care, home care, health supplements, and digestives). The company’s strong portfolio of brands includes Dabur Chyawanprash, Real (juices), Fem (bleach), Honey, Meswak, and Dabur Red.

Expansion in Distribution Network

The company has made large effort in establishing a distribution network in the less developed regions of India (reaching 44,128 villages in March 2015 from about 15,000 in March 2011). On the urban distribution front, the company expanded its network to over 87,000 outlets from around 49,000 in March 2015.

Well Diversified Business Mix

A well-diversified product mix makes Dabur’s revenue and profits stable across business cycles and seasons. The company’s product categories include

Consumer Care Business – Health Care, Home & Personal Care (HPC) and Food verticals which accounts for 66% of consolidated sales

International Business includes Dabur’s organic overseas business as well as the acquired entities of Hobi Group and Namaste Laboratories LLC. This vertical now accounts for 31% of Dabur’s consolidated sales.

CHALLENGES

Threat of New Entrants

Over the last decade, the Indian FMCG industry has been dominated by few established players such as Colgate, Britannia, Procter & Gamble (“P&G), and Marico. As Dabur expands its product portfolio in hair care and oral care, it will face an increased competitive threat from global players such as Procter & Gamble, Unilever, and Colgate.

Very accurate and detailed analysis of the stocks of various Indian FMCG companies.

Thanks Aditya