Much against the overall market trend of are super expensive valuations, large cap IT Stocks are optimally poised and are likely to provide green shoots going forward.

| Nifty PE Ratio (28 July 2015) | 23.21 |

| Average PE Ratio for top 5 IT companies (5 year average) | 20.43 |

| Average PE Ratio for top 5 IT companies (Current – based on EPS TTM) | 18.60 |

Last week I spoke about avoiding stocks until we see substantial correction in stock prices (you can see the video here). As a result, I got a lot of queries from you guys asking if you should be selling your stocks now?

Please stop!

I did not mean that investors should develop bad habits. On the contrary, forget about selling; this is as good a time to buy into stocks as there ever has been. What I spoke about was a general direction of the Sensex. Short of that, it is in fact universal to all markets that the best portfolios are created by those who are able to differentiate investment from short term speculation and do not try to time the market.

Should you go short on the market or on a stock? Hell no, never.

If I believed in that kind of thing, I would be recommending F&O calls too. But unfortunately they don’t make money for very long.

The only way to make consistent money is with consistent investments. At all times, look for companies that are perfectly priced. Within this correction which we are likely to witness there will be stocks which will come out unscathed. In fact, this correction is what shows the strength of such stocks. Think about it, would you wait to buy these stocks when the market starts appreciating again, or are you trying to predict a bottom? Let me assure you that for over 100 years, experts have failed at doing both with any success whatsoever.

The next 12 months may well be described as the cherry picking period in equity markets. Instead of focusing on sectors, focus on stocks with a bottoms up approach. Below, I will address a related question:

Top down or bottoms up, what works better for you and how do you start looking for stocks?

Also Read: Stock selection criteria for Large Caps

An easy way of selecting stocks is by combining the 2 approaches. You first look for sectors which are fairly valued (i.e. top down) and then within that sector you look for stocks which are positioned to benefit most, based on future events. I will try to explain this below taking the example of large cap IT Stocks where I believe valuations to be most favorable at this point of time.

Large Cap IT Stocks – Selection Criteria

Once you have zeroed in on the sector your job is that much easier. Not only do you have fewer companies to look at; you also can compare them against industry specific averages.

TCS

| Price Earnings (PE) Ratio Average for 5 years – 21.11 | ||||

| FY2011 | FY2012 | FY2013 | FY2014 | FY2015 |

| 25.56 | 22.01 | 22.14 | 31.2 | 23.98 |

| Current PE Ratio – 24.54 @ Rs. 2,501/- share | ||||

INFOSYS

| Price Earnings (PE) Ratio Average for 5 years – 19.97 | ||||

| FY2011 | FY2012 | FY2013 | FY2014 | FY2015 |

| 28.84 | 19.42 | 18.2 | 20.35 | 18.75 |

| Current PE Ratio – 19.97 @ Rs. 1.072/- share | ||||

WIPRO

| Price Earnings (PE) Ratio Average for 5 years – 20.93 | ||||

| FY2011 | FY2012 | FY2013 | FY2014 | FY2015 |

| 24.18 | 23 | 19.01 | 22.07 | 16.38 |

| Current PE Ratio – 16.89 @ Rs. 555/- share | ||||

TECH MAHINDRA

| Price Earnings (PE) Ratio Average for 5 years – 14.10 | ||||

| FY2011 | FY2012 | FY2013 | FY2014 | FY2015 |

| 13.70 | 8.17 | 10.96 | 14.15 | 23.54 |

| Current PE Ratio – 19.09 @ Rs. 521.15/- share | ||||

HCL

| Price Earnings (PE) Ratio Average for 5 years – 16.91 | ||||

| FY2010 | FY2011 | FY2012 | FY2013 | FY2014 |

| 24.18 | 23 | 19.01 | 22.07 | 16.38 |

| Current PE Ratio – 21.65 @ Rs. 935.90/- share | ||||

Based on the above Price Earning (PE) multiple averages for the past 5 years, Wipro appears to be the cheapest and is currently trading at ~ 20% discount. The other way to look at this would be to calculate the fair price of the stock based on its historic PE multiple. In other words if Wipro’s fair PE multiple is seen at 20.93, what should be its price right now? This is an easy calculation to do:

Price / EPS = 20.93

Price = (20.93 * EPS) = (20.93 * 35.43) [this is Wipro’s EPS for the trailing 4 quarters]

Price = Rs. 742

Based on 5 year average PE ratio, Wipro’s fair price is Rs. 742 while it is trading at Rs. 555 or at a 20% discount. You can do a similar math for all other companies. You will find that the top 5 large cap IT stocks (barring Wipro) are all fairly valued.

| (In Rs.) | TCS | Infosys | Wipro | Tech Mahindra | HCL |

| Fair Price | 2,152 | 1,090 | 742 | 380 | 825 |

| Current Price | 2,501 | 1,072 | 555 | 521 | 936 |

So should you buy Wipro?

Probably not.

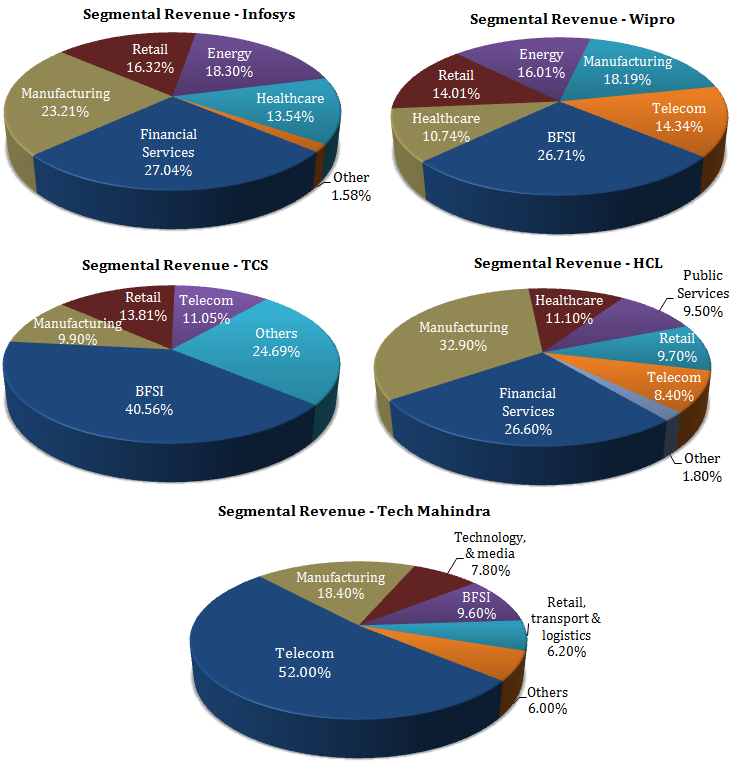

This is where you should look deeper into businesses. In fact there is a reason why Wipro is trading at a 20% discount, at least in my view. If you look at the sectoral revenue break-ups below; Wipro and Tech Mahindra have major exposure to telecom and energy. I am negative on both these spaces.

Negative on Telecom Sector:

The sector as a whole is going through a big shift. So far ~ 85% of revenue for top IT companies comes from voice calling and the balance 15% from data and from other services. Couple this with the fact that in the last 2 months or so, people have increasingly started using watsapp calling not only because it is free but also because of how clear the audio quality is. Prohibiting the use of such services will at best only delay the inevitable for a few months.

In short, the writing is on the wall – unless telecom companies can quickly find a way to shift from voice revenue to data revenue, the story looks like it’s over. I would not be surprised if most telecom stocks correct 50-70% from here over the next 2 years. Of course if there is a technological shift in their favour (which I don’t see happening right now) then things may be very different.

Given the urgent need to shift and to develop data technology, telecom sector has been a great client to IT companies. Will this continue going forward? No doubts it will not. Irrespective of whether telecom survives or dies, the sector is unlikely to help IT stocks any longer.

Negative on Energy Sector

I heard somebody talking about crude prices at U.S. $ 20 / barrel (I don’t think that will happen, on the contrary my views on crude oil are diametrically opposite). Crude moves for reasons varying from weather conditions in china to political situation in Middle East to production in the U.S. I try not to predict or even track this. In any event at U.S. $ 50 / barrel, where is the question of even proposing an up-gradation of technology to energy companies.

Analysis

In the ultimate analysis, yes IT Stocks are fairly valued and yes Wipro is at a discount but would you invest in this stock given its sector specific client exposure? Would you rather not look at a TCS which has majority of its revenue coming from BFSI? Which sectors do you think are likely to outperform over the next 12-24 months?

What about INFOSYS? Isn’t that a good Stock to hold?

What is your view on healthcare? Farma stocks perform good in past and some are doing good still. So what about them. INFOSYS earned from them also. Whatever you mentioned about telecom industry, if that is right then, tech mahindra is a big Scrap. What about them?

Sure. But I will have no quams suggesting TCS as a better buy at the current price (+/-10%).

Nice read, very informative and logical. Thank you.

I have a question – How is 5 years avg PE calculated, is it the avg of all the last 5 years individual PEs? It does not match up this way, hence the question.

Thank you.

I can not say. My numbers are 100% spot on correct.

Thank you for your reply.

How is 5 yrs avg PE calculated? Is it just the arithmetic avg of the PE of last 5 years?

Yes it is the average.

Wrt above comment, I used valueresearchonline.com, the 5 years avg PE they give for each stock and the current PE, for most of the stocks it is either a tad above or a tad below, not something matching to what you explained here. What am I missing?

Thank you.

We took price on the 31st of March each year and trailing 4 quarter earnings (EPS).

valueresearchonline, in their fair value assessment, gives a different number(which is almost equivalent to the TTM P/E) as 5 years PE avg, hence the question.

Thank you anyways, great help. 🙂

Is consolidated or standalone PE used?

Thank you.

Consolidated.

Hi Rajat,

One more question on this. When a business is growing healthy, its EPS and the share price naturally goes up right? So does the PE. It keeps touching new highs. In such cases, will this work too, comparing to the historic PE?

Thanks

Johns