A few days back I got a call to subscribe for a service which promised to offer powerful trading calls which will help my financial planning goals.

Given that I do a fair bit in the financial planning area, I probed further. They proposed a free trial for a couple of days after which I had to pay Rs. 10,000 for a 3 month membership. Over the next 2 days they sent me all sorts of nonsense via SMS. In all approximately 14 stock trading calls. It was a mix of buying / selling / stocks / futures / options (and a combination of all the above). I thought the nightmare was over at the end of the 2nd day, but I was wrong. While the SMS’s stopped, the phone calls started. I almost felt obligated to subscribe to their services with the representative telling me – “for subscribed members, we give even more profitable calls”. Really! In other words, for those who have not yet subscribed they give less profitable trading calls [1].

I thought these guys were geniuses; they could not only predict the future but could even control the extent of profit which they wanted their clients to make. Then I thought – wait a minute, I went to some of the finest colleges in the world and I have no clue how this is done? What a waste?

I started trying to learn this – Making profits, helping others make profits, controlling how much profit each person makes. Basically – playing god.

The Rule of Randomness

When you flip a coin – it’s either a head or tail. When you buy (or sell) a share it either goes up or down. The likelihood of either thing happening being an exact 50%. Instead of trading yourself, if you can find 1000’s of other traders who will trade as you suggest – 50% of them will make a profit and an exact number will make a loss. Note that, I am assuming a complete random basis of recommending stocks.

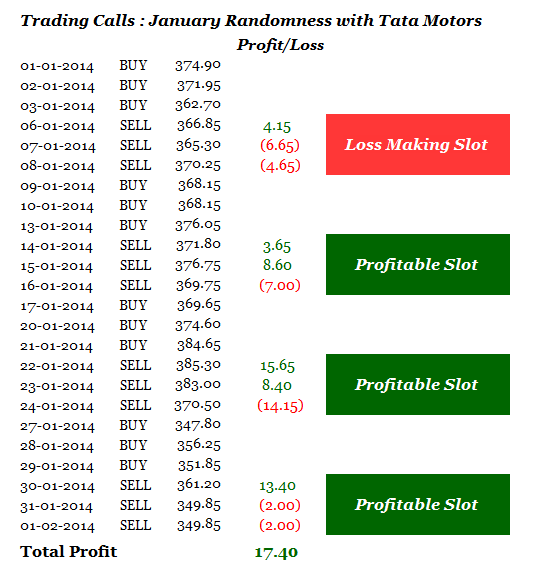

Example: Trading Calls – January Randomness with Tata Motors

Look at the chart below – Trading calls – January Randomness with Tata Motors. It follows a simple rule. Each month, buy or sell an equal number of shares in each trading session. To make it even more random – buy for 3 days | sell for next 3 days – then repeat.

It reminds me of the story I once heard of an extremely enterprising lawyer who told his clients that he had very good relations with the judge and if you paid him Rs. 5, 00,000/- he will arrange a favorable verdict. On the day of the trial, he argued with all his skill and merit. Of course he did not know the judge. But again, the judge would decide one way or the other. If the lawyer won, he kept Rs. 5, 00,000/. In case he lost, he used to return the money with deepest apologies claiming that the judge did not want to risk getting caught in such a sensitive matter.

What can I say; people like to rely more on tips and insiders rather than merit and hard work. What is even more surprising is the number of people who fall for such business models. These days, there are tones of websites giving trading calls and stock tips, by whatever name called. It has almost become an industry.

Bigger the marketing efforts, higher the number of potential subscribers.

My point is not that the entire world is clueless about the markets but rather that with such incentive to generate high volumes; it is difficult to find those who stay focused on research. The idea then becomes getting maximum people to join. Often, clients are equally to blame. For it is often hard to convince them that at times the best market tip is to do nothing.

To conclude, don’t be fooled by Randomness – If you must, trade or invest based on your own assessment. You should listen to market analysts for their views (I won’t say otherwise given that I myself run a firm of market analysis) but do realize that they will all have their own views often conflicting with each other. Ultimately, who you rely on besides yourself is also your call.

__________________________

[1] On a close examination of these 14 calls, I made a net profit of 0.3%. It could have gone any way really.