UPDATE: 1 JUNE 2016: NOTE: THE BELOW STOCK WAS SPLIT 10:2 ON 10 MAY 2016. EFFECTIVELY IF YOU BOUGHT 1 STOCK AS OF THE DATE OF THIS REPORT, YOU WILL TODAY HAVE 5 STOCKS IN THE COMPANY.

Transcorp International Limited (“Transcorp” or the “Company”) specializes in providing foreign exchange and inward remittance services in India. The Company offers money changing services, inward remittance, car renting services and organizing tours & travels.

| Current Price (BSE) (23 Feb, 2015) | Rs 46.00 |

| Market capitalization (23 Feb, 2015) | Rs 23.39 Cr |

| Face Value | Rs 10 |

| EPS (TTM) | Rs 4.36 |

| P/E | 10.55 times |

| No of Shares | 50,85,239 |

| BSE 52 week High | Rs 56.85 |

| BSE 52 week Low | Rs 27.15 |

- Foreign Exchange Business: The Company is an RBI licensed money changer including buying and selling of foreign exchange in retail as well as wholesale to individuals and corporate clients.

- Inward Money Remittance Business: The Company is a principal agent of western union financial services for inward money remittance and is one of the leading players in this particular industry.

Diversified Product Portfolio

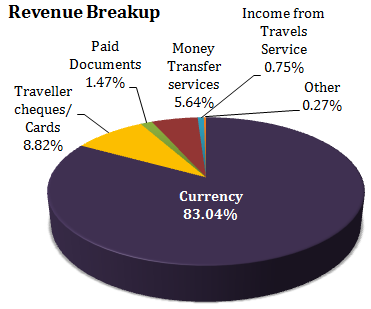

The Company offers a diversified number of products like currency exchange, traveller’s cheques, travel cards and caters to both segments of customers – leisure and business travellers. Transcorp International operates from 25 locations in India.

Also see – this post covering stocks in travel industry.

The volumes in the wholesale as well as retail currency market have been increasing year on year. During FY 2014, the Foreign Exchange division did very well and contributed positively to the bottom line of the company.

Financial Performance

| Particulars (in Rs. Cr.) |

2014 | 2013 | 2012 |

| Income from operations | 668.47 | 673.72 | 679.58 |

| OPBDIT | 7.53 | 5.87 | 6.15 |

| PAT | 1.14 | 1.70 | 1.91 |

| EPS | 2.80 | 4.18 | 4.69 |

| Equity Share Capital | 4.07 | 4.07 | 4.07 |

| Total Shareholders’ funds | 41.19 | 40.44 | 39.30 |

| Total Debt | 9.76 | 6.45 | 3.53 |

| OPBDIT / Operating Income (In %) | 1.13 | 0.87 | 0.90 |

| PAT/Operating Income (In %) | 0.17 | 0.25 | 0.28 |

| Return on capital employed (In %) | 14.78 | 12.52 | 14.36 |

| Return on Shareholders’ funds (In %) | 2.77 | 4.20 | 4.86 |

| OPBDIT/Interest & Finance Charges | 1.53 | 1.91 | 2.17 |

| Current Ratio | 0.98 | 0.87 | 0.89 |

Growing presence in Inward Money Remittance Market | Western Union tie up

India remained one of the biggest recipients of remittances from abroad during the year 2014 and this market is still growing at a healthy pace. Transcorp acts as the principal agent of Western Union Money transfer. During FY 2014, Western Union remained market leader in the inward money remittance market. The major strength of Transcorp’s inward money remittance business comes from the fact that its major segment is direct cash transfers. Hence the company is not affected by the growing number of operators of mobile money transfer / card to card transfer and internet transfers.

As major foreign currencies keep appreciating against the Indian Rupee (INR), there is likely to be more inward remittance from NRIs and Indians based overseas.

Risk: Highly Regulated Business Environment

The Inward Money Remittance business is highly regulated and from time to time, RBI sets rules regarding high standards of audit and due diligence for the network. To ensure strong compliance and maintain proper audit function would be very expensive and will impact on the bottom line. In future, frequently changing policies may negatively affect the operating margins of the company.

Risk: Rising competition from banks and online services

The remittance industry is facing intense competition with a number of large retail banks, Money Transfer Services (MTS) and online payment services. Banks are increasingly focusing on the remittance business to tap NRI clients by offering low-cost service and use these customers for cross-selling opportunities. Further, a number of online money transfer services such as Paypal, etc. are posing serious challenges to players like Western Union.

** The stock analysis of Transcorp International including the financial analysis report above, is for information purpose only. This analysis should not be taken as a buy/sell recommendation. The circumstances of the company and the economic environment may have changed since the date of this stock analysis. For an updated list of the best small cap stocks, visit here – Multibagger Ideas