TTK Healthcare Limited (“TTK Healthcare” or the “Company”) commenced its operations as a pharmaceutical company and has over the years diversified its presence across many industries. The company’s product categories include contraceptives, gripe water, cosmetics, medical devices and home care products and food products.

This Stock Analysis report presents a long term outlook and the future prospects of TTK Healthcare.

WHAT’S DRIVING THE STOCK

Strong Product Portfolio

The Company’s brands consist of products that are sought by a wide range of customers. The Company operates in personal care products offering the Eva range of women’s personal care products in a variety of fragrances. TTK also markets and distributes Woodward’s Gripe Water – the undisputed market leader in the baby care category – and the recently introduced Woodward’s Baby Soap. The Company also entered into contraceptives category with brand name Skore. In order to garner more market share in contraceptives category, the Company is taking new innovative steps like launch of mobile apps to increase its sale.

Foods division manufactures potato and cereal based pellets under the brand name ‘Fryums’ and Panipuri Papad for markets in India and abroad and Medical devices division is involved in the manufacture and distribution of India`s first heart valve prosthesis – the tilting-disc TTK Chitra Heart Valve.

We believe the future drivers for growth would be the contraceptive (condom) business of TTK Protective Devices Ltd. and food and medical devices business of TTK Healthcare, This amalgamation will help the company to increase its bottom line & help it to grow at a rate of 20 % to 25 % for the next 5 years.

Strong Financial Position

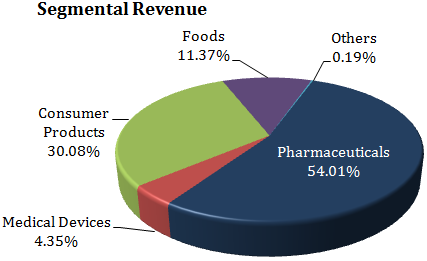

The Company has shown consistent growth over the last 5 years (i.e. 2009-10 to 2013-14). TTK’s net revenue from operations over this period grew at an impressive CAGR of 10.51 %. For FY 2014, income from operations increased by 8.86 % to Rs. 416.18 Cr. from Rs. 382.30 Cr. TTK Healthcare has reserves in excess of Rs. 99.16 Cr and operates with negligible debt on its books. This strong financial position not only enables the Company to have bigger marketing and advertising budgets to attract customers; it also enables TTK in expanding its operation in a subdued economic environment.

With rising sales and steady margins, earnings could grow significantly in the coming years. The Company also has a strong dividend history. For FY 2014, the Company has declared 40 % i.e. Rs 4.00 per share as dividend.

Orthopaedic Implants – A huge growth potential area

To further consolidate its position in the medical devices segment, the Company has entered into Ortho implants business by acquiring Ortho implants business and assets from Invicta Mediteck. TTK’s Ortho division has a technical collaboration with BP Trust USA. Under the collaboration, the company manufactures and markets Orthopaedic implants under the brand name ‘TTK Altius- Hi-flex knee’ in India. During FY 2014, the Company reported a sales turnover in excess of Rs.5 Cr from this segment. The Company’s knee implants are competitively priced in an import dominated market, thus providing it an edge over its competitors. This niche segment being in the emerging growth stage provides immense future growth prospects.

The Company is making efforts to develop an export market. Also the Company is taking steps to further develop this segment by entering into cemented titanium implants, porous coated knee implants, etc.

WHAT’S DRAGGING THE STOCK

Intense Competition

The Company’s revenue comes mainly from the Pharma and Consumer Products Division which are highly competitive in nature. For FY 2014, the Company has achieved lower growth partly on account of the discontinuation of the distribution arrangement for Kohinoor / Durex brand of Condoms in the previous year. However, the Company has itself launched “Skore” brand of condoms, which currently has 8.4 % share in the first year of launch. The Company faces huge competition in this segment. The market leaders are Mankind Pharma’s Manforce (28% share) and Raymond Ltd.’s Kama Sutra (18%), followed by Kohinoor and Moods, with 13% and 12% market share, respectively.

High Advertising Expenses

The Company has been consistently spending on advertising to build brands like Eva and Score. The Company’s advertising expenses (as percentage to sales) stood at 15.77 % for FY 2014 as compared to 14.39%. The increase in expenses is on account of enhanced advertisements / higher sales promotional expenses incurred on various product categories. Further increase in the advertisement expenses should match with an increase in the sales revenue otherwise it will hit the company’s bottom line.

________________________________

** The stock analysis of TTK Healthcare including the financial analysis report linked above, is for information purpose only. This analysis should not be taken as a buy/sell recommendation. The circumstances of the company and the economic environment may have changed since the date of this stock analysis. Click the link for an updated list of the mid cap companies in India.