From starting a business to purchasing a luxury car, buying a home to going on a vacation – these days you will find customized bank loans for all your needs. This creates a huge opportunity not only for banks but also for businesses selling consumers products. Banks label loans on the basis of end use of proceeds. Terms and conditions and other features of loans differ mainly based on this end use, i.e. the purpose of the loan.

Bank loans on the basis of end use

- Personal loan, as the name suggests, loans received as personal could be utilized by the recipient for any requirement. For example – marriage, home improvement, travel or any miscellaneous expenses. These days’ credit card companies give you an option to apply for a loan for up to the extent of your credit limit. This is processed online where you can choose your EMI and duration of repayments and a cheque will be delivered to you within 3-4 days, no questions asked. All you need is a credit card. The interest rate is highest for this category of loan.

- Home Loans, typically has the lowest rate of interest and is usually taken for a very long duration.

- Car Loans, these days’ automobile companies have ventured into finance by setting up separate subsidiary companies solely for this purpose. They are able to offer the best interest rates often with zero interest rate schemes. They usually undercut any bank’s finance terms since they are able to eat into their profit margin on the underlying vehicle.

- Education loan, just like personal loans, the rate of interest is really high for this category. However the big advantage here is that most banks will give you a grace period before your EMI’s or repayment terms start. The grace period takes into account the duration for which your education lasts i.e. repayment starts once you complete your education and get into job market.

- Business loan, again, the interest rate is really high for this category mostly because of the risk involved.

Major Terms in Bank Loans

Interest Rates: Interest rate naturally is the most important factor to look at when applying for a loan. This determines the amount of extra money over your principal which the lender will take from your pocket over the duration of the loan. Read the terms of repayment and prepayment carefully. Read the fine print of legal terms and conditions.

IF YOU WISH FOR US TO DRAFT, REVIEW, COMMENT OR EXPLAIN THE TERMS OF YOUR LOAN AGREEMENT, CONTACT US AT INFO@SANASECURITIES.COM

Base Rate – How Banks Set Interest Rates on Loans

In 2010, RBI introduced the ‘Base Rate’ which is the minimum interest rate at which a bank is allowed to lend. Banks determine their actual lending rates on the basis of this Base Rate. Current Base Rate (March 13, 2015) is 10.00/10.25% (i.e. base rate for lending is between 10.00% and 10.25%). Simply put what this means is that commercial banks must select a base rate between 10%-10.25% and add whatever percentage point they wish on top of this base rate. So for example Axis Bank which has decided to keep its base rate at 10.15% could lend at 10.15% + whatever percentage it wants to add to that.

All categories of bank loans are required to be priced only with reference to the Base Rate. In keeping with the objective of making lending rates more transparent banks are directed to announce their base rates on their websites.

Repo rate also has a bearing on the lending rate of banks. Visit this post – for a detailed discussion on Repo rate. Higher the repo rate, higher will be the base rate set by the banks. Everytime RBI cuts interest rates (i.e. reduces the repo rate) there is a probability that the banks will also cut their base rate in same proportion which will result in lower monthly installments on your loans so long as you had opted for a floating rate loan.

| Bank’s Base Rate (in %) | ||||||

| SBI | IDBI | Indian Bank | Andhra Bank | ICICI Bank | HDFC Bank | Axis Bank |

| 10.00 | 10.25 | 10.25 | 10.25 | 10.00 | 10.00 | 10.15 |

Fixed Rate vs. Floating Rate Loans

Fixed Rate: The rate of interest is fixed either for the entire tenure of the loan or for a certain part of the tenure of the loan. In case of a pure fixed rate loan, the EMI remains fixed for the entire duration irrespective of whether the bank increases or reduces its interest rates and irrespective of RBI mandated changes in interest rates. If interest rates move up over the years, a fixed rate EMI becomes very attractive as you pay far lower than the market rate. Consequently a reduction in interest rates will have the opposite effect.

Floating Rate: As the name suggests, the floating rate of interest varies with market conditions. EMI of a floating rate loan changes with RBI mandated changes in interest rates (and with changes in bank’s internal interest rate) from time to time. If market rates increase, your repayment increases. When rates fall, your dues also fall.

What falls on fixed vs. floating? – While fixed rate loans create certainty for a borrower by giving him the ability to plan things properly for the future, the fact that they are not influenced by market conditions is not always the best thing as it may appear. Consider this for an example, a lot of those who took fixed rate loans to purchase properties in the United States just before the sub-prime mortgage crisis of 2008 faced the most unique situation – After paying EMIs for a few years, it came to a point where their outstanding amounts (principal + interest) were far greater than what it would be if they took a fresh loan to re-purchase their house at the very same price at which they had initially purchased it. This was because interest rates came down significantly. The other reality was that interest rates prior to the crash were so high that post the crash their outstanding (principal + interest) exceeded (in some cases more than 2 times) the price of the property which crashed significantly during that time.

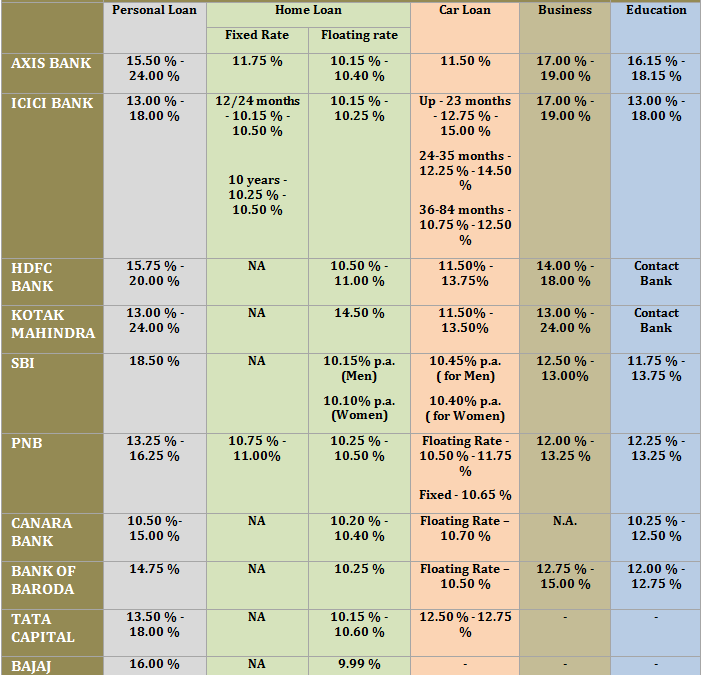

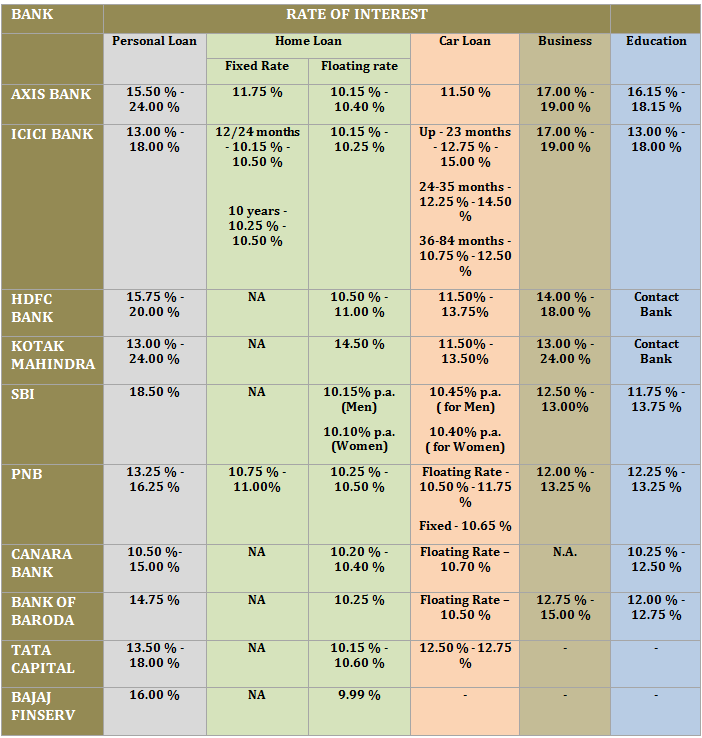

Interest Rate on Bank Loans (Updated – March 2015)

Other Factors to Consider

Penalty Charges: If you are not able to pay your dues on time generally a heavy penalty is charged on your loan account. You should find out about the exact details regarding the penalty which may be levied in case you are unable to service your debt in full or part, or in case you are late in making an EMI payment.

Processing Fees and Penalty Charges (based on personal loans)

| Banks | Processing fees | Prepayment Charges | Late Payment Charges |

| Axis Bank | 1.50% – 2.00% + Service Tax | Nil | 2 % per month |

| ICICI Bank | Up to 2.50% + Service Tax | 5% of principal outstanding | 2 % per month |

| HDFC Bank | Up to 2.50% of the loan amount with minimum of Rs. 1,000/- & maximum of Rs. 25000/- | No pre-payment permitted until repayment of 12 EMIs | 24 % per annum |

| Kotak Mahindra | Up to 3% of loan amount | After 12 months, 5% of principal outstanding + service tax | Rs. 750.00 per dishonor instance |

| State Bank of India | – | No pre-payment charges. | |

| Punjab National Bank | – | 2% of principal outstanding | 2 % per month |

| Canara Bank | 0.50% of the loan amount with a minimum of Rs.100 and a maximum of Rs.500 | 2% on the outstanding liability | NIL – only penal interest collected |

| Bank of Baroda | 2% (Minimum Rs.500/, No Maximum limit) | No pre-payment charges. | 2% per month |

A word about credit history

All banks look at your credit score before approving your loan. It is advisable that before you apply for a loan, you should check your credit score (i.e. CIBIL score) to know the likely prospects of getting your loan sanctioned.You can find out your credit score on CIBIL’s website.

If you have a bad score, you should first work towards improving that before you apply for a loan. A rejected loan application will reduce your chances of getting a loan in future. One of the best ways to have a good credit score is to – (i) Get a credit card (ii) Use up to 30% of your credit limit and (iii) be sure to make your credit card payments before the due date. Much as it sounds odd, having debt on your books and having available lines of credit is actually a great thing for your credit score. What banks are looking for is your previous history when it comes to credit lines and how your serviced your debt in past.

There are a number of steps you can take to improve your credit score but these steps will take time. Its like playing a test match, not a T20 game.

I would like to add the point that no one should fall into credit card debt!

Do not be like the millions of Americans and now what I hear are Indians too who fall into the trap of easy credit card availability and repent when the bills become too overwhelming.

You really do not need to buy the Rs. 50,000 smartphone if you dont have the money in hand!

Very nice article and easy to understand.

Pls allow loan

Post your requirement at – info@sanasecurities.com

what is the meaning of base rate?

i need cashloan for my new business…i have also my own business now…i need loan because i open a new business so what is the processer and the charges for this….plz mention

It’s really helpful

wow

Thanks for sharing valuable information. Very useful, keep posting more articles on loans.

Hey this is such an amazing article on loan, hope to see some more interesting material on which and How to get Loan from bank.

Thanks for such informative info. Do post more such contents on how to get loan from bank.

Loans are a best way to meet the financial circumstances, so when and how to get loan from bank is relevant.

Helpful message! Helpful post! Maintain more sharing!