Back in 2014, at the peak of pessimism in stock markets there were hardly any takers for even the most marquee names in the stock market. Today’s Rs. 2300 share of Reliance was trading at 450. Infosys at 400 and HDFC Bank at 320 (both trading above Rs. 1000/ share today). These days things are different, a large number of investors are waiting for a crash to buy these stocks. Others are either buying or have already bought.

How does it all work? Why do people jump into the stock market after it runs up? I guess, the single biggest reason is short-sightedness, a condition that causes distant objects to appear blurred. This may not be a problem for traders but an an investor, this is a big big problem.

BEING SCIENTIFIC

Defined: Methodical

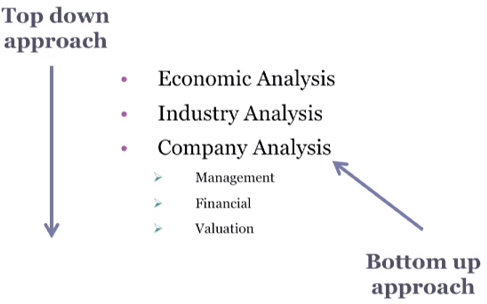

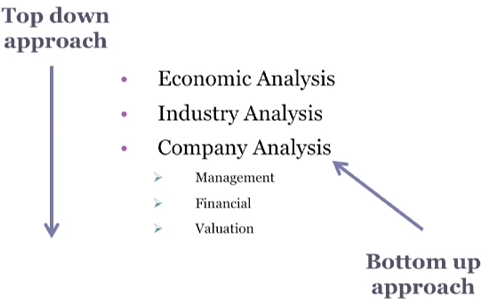

This is the part which you need to learn. Learn from books, from other investors and from the experience of others. Follow this three pronged approach.

First, look at the state of the economy – this is where you look to pointers like the GDP, inflation, employment, domestic and global geopolitical scenario etc. If you are broadly happy with the situation, you will move to step 2.

Second, look at all the industries like – banking, automobiles, IT, pharmaceuticals, FMCG. Where do you think most growth will happen in the next few years. Zero in on that industry.

- Third, Look for constituents i.e. stocks belonging to your chosen industry. This is really where analysis comes to the fore. Broadly, you should be studying:

Quality of Management - Fundamentals

- Valuations

- Return Ratios

- Competitive Advantage

- Intrinsic or Fair Value

In this article, I have covered these basics and how to look at them in much greater detail: All About Stock Selection Criteria

There is one more thing you need to keep in mind.

RISK & REWARD

Once you have chosen to be in stocks with all or a major part of your portfolio, your stock selection should still depend on how much risk are you wiling to take. It is easier to choose large well established companies with a track record of making 15-18% return than trying to hunt for companies that can grow exponentially. Well established large companies naturally tend to trade at much expensive valuation, so while there earnings may grow at 20%,stock price is usually elevated and does not grow at a similar rate. Small and medium sized companies (i.e. small and mid caps) can give you fantastic returns if you can discover them before they become big and start getting tracked widely.

The selection criteria should be broken down based on the size of each company,i.e. Market capitalization.

LARGE CAP STOCK SELECTION CRITERIA

Why are Blue Chips considered as best stocks for long term?

In financial terminology ‘blue chips’ refer to stocks of well recognized companies that have a strong financial position and a good earnings track record. What authenticates their status as the best stocks for long term is:

- Their ability to generate higher than average investment return at lower than average levels of risks.

- A track record of ‘Growth in Earnings’ in all economic environments. In other words, demonstrated ability to withstand economic slowdowns; and

- A long record of growing dividend payments.

MID CAP STOCK SELECTION CRITERIA

- Earnings growth – Stocks in accelerating growth phase of their lifecycle.

- Financial strength – Typically have greater liquidity and capital-raising ability than small caps.

- Information gap – Receive less attention from analysts than large caps.

- Research is based purely on fundamentals.

- Suitable for long term investors.

SMALL CAP STOCK SELECTION CRITERIA

Small cap companies in India which are not overly anticipated or widely tracked. Small or even start-up companies that have a unique idea and operate in an important market can offer extremely high returns over a period of time. There can be other traits which can make a very strong case for inclusion in our list such as – a strong product patent or where the company does not face much competition in a growing or niche market. Typical considerations for identifying Multibagger stocks in India:

- Out of the box idea or product

- The company is not very large (Market cap of less than Rs. 500 Cr)

- Product or idea is in a field that is likely to grow

- Product patents or monopoly (or near monopoly) rights

- The market is not conditioned or excited about the stock

We carefully follow what’s being recommended and bought by others. You may find our recommendations different from the market. Do study reasons for our conviction carefully before investing.

For me a good portfolio is one which

Firstly, splits money between asset classes based on overall economic scenario and market valuation. Secondly, further diversifies between companies of different size based on future growth potential. Of course there is a constant re-balance based on size of the company and potential reward for the risk you undertake.

BEING PATIENT

Defined as – the capacity to accept or tolerate delay, problems, or suffering without becoming annoyed or anxious.

Once you have allocated money between fixed income and stocks, you must constantly keep track of market valuations and economy. Set your eyes on at least the next 10 years. Remember, making fixed income return is a great idea until you are absolutely certain that stocks will deliver handsomely for at least the next 3-5 years. The last time I felt that way was 2014-15. Since then, while many stocks have delivered 100-200% return, the pickings have been few and patchy. I have 12-15 stocks on my radar, I have all of them in my portfolio but would like to add a lot more of the same stocks at the right price.

BEING LUCKY

People often underestimate the importance of luck in life. While you can at best be scientific and patient, there is something called luck after all. No body knows what happens in life and markets beyond a point. Even the managements and owners of the company’s the stocks of which you are buying are not sure how there business will shape up in future. Keep doing your best and you will be lucky one day. This I can assure you off.

Happy Investing!