Unlike any other year, this time around investors are no longer waiting for the union budget to see big bang reforms. The new government has taken many steps to stimulate growth since it assumed office in May 2014. The hope is that this trend will continue and that many more steps will be initiated to strengthen the economy before the union budget of 2016.

Some of the initiatives taken by the government include labor reforms, insurance legislation, opening up of Foreign Direct Investment (FDI) in defense and railways, clearing defense deals and infrastructure projects and deregulation of diesel prices.

Major Government reform initiatives in FY 2015

Oil & Gas Sector

- Deregulation of diesel prices – This will allow companies like Indian Oil, BPCL, HPCL to increase or decrease diesel prices according to global crude rates. Also see – Deregulation of petrol prices.

- Hike in domestic gas prices – This will increase the price of gas to $5.6 per unit, or roughly 33%, from $4.2 at present. This hike will increase fertilizer, power, CNG and PNG rates.

Power Sector

- 10 years tax holiday, under the Income Tax Act, for all power projects to be set up by March 2017. The incentive allows companies to claim deduction up to 100 % on profits for 10 years.

- Open up coal mines to private players – the government has allowed e-auction of mines to private companies for their own use, as well as permitting some firms to sell the fuel in the future.

- Private sale of power allowed to corporate (with certain conditions).

Defense Sector

- Increase foreign direct investment from 26 % to 49 % – with this reform, French aircraft giant Airbus is likely to tie up with the Tata’s to manufacture transport planes for the defence sector.

- Approval of defense projects worth Rs 80,000 Cr.

Infrastructure

- Investment of Rs 55,000 Cr. in Mumbai-Ahmedabad bullet train project.

- Rs. 500 Cr. is provided to facilitate the sluggish public-private partnership (PPP) projects. A new body 3P India will be set up to look at PPP projects.

- Opened up the railway infrastructure segment for foreign direct investment.

- Infra bonds.

Lots of reforms have already been initiated and lot of them are announced but the point to note here is that it will take long time to get reflected in companies stock prices. It is not correct to assume that power sector stock currently trading at Rs. 12 will get double i.e. Rs. 24 after the announcement of reform.

Key reforms will help the companies to increase their earnings which is the ultimately driver of stock prices. Reforms also not often help all the companies operating in the sector equally. Indeed, reforms beneficial to one sector might actually be harmful to some companies operating in another sector.

Here are my 5 big expectations from the Union Budget 2016:

- Implementation of the Goods and Services Tax (GST) – If businesses have to be efficient they must be able to “source from anywhere and sell anywhere” and have clarity on the amount of tax they owe. So many tax forms layered over an equal number of state and central tax laws create an environment which is appropriate for unnecessary business planning and gives rise to tax evasion. It’s about time the government helps businesses become efficient.

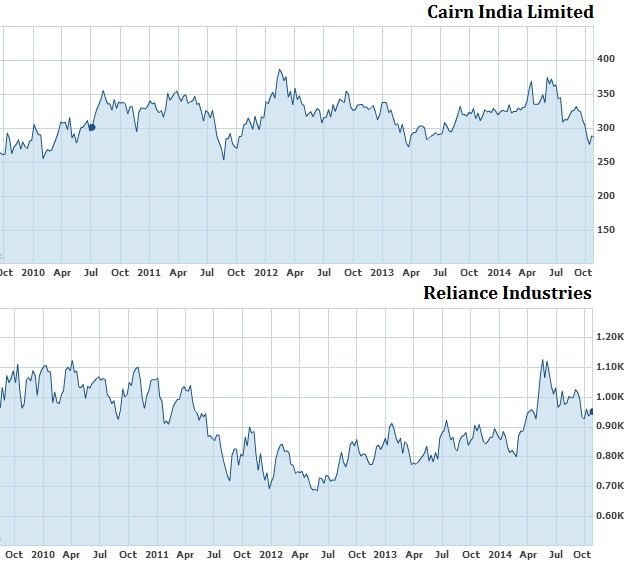

- Oil & Gas Reforms – Rise or decline in crude oil prices adversely affects the results of operations of companies engaged in the exploration of crude oil. Higher crude oil prices would result in higher realizations from crude sales for oil exploration firms such as Cairn India, ONGC and Oil India Limited. On the other side, lower prices will reduce the amount of crude oil that the companies can produce economically, thereby reducing the economic viability of exploration projects. For this reason stock prices of exploration companies move in line with international crude prices. The government must incentivize oil exploration companies in their hunt for oil to reduce India’s dependency on imported crude. Similarly natural gas prices @ $5.6 per unit from 1st November (an increase from the current price of $4.2 per unit) are considered unattractive by oil exploration companies.

We hope that the government of India will take steps to encourage oil exploration in the country either before or in the Union Budget of 2016.

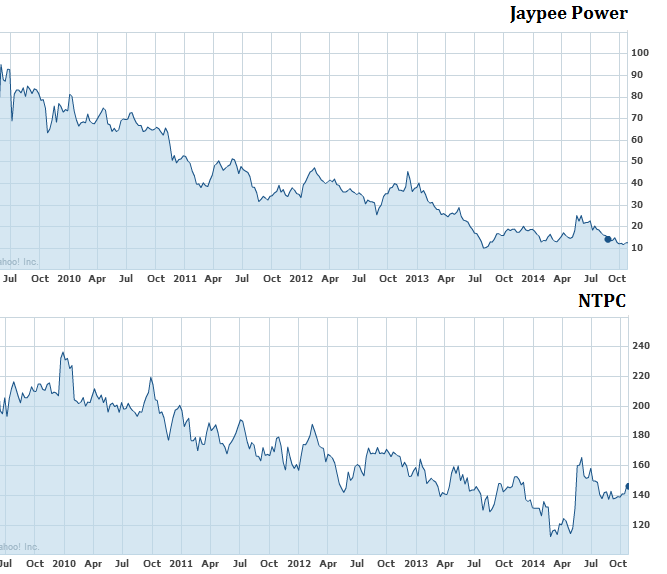

- Power Sector Boost – This is a sector where nothing right has happened in the last 6 years (may be more, but I can vouch for this time frame based on experience) Up until a few years back, the big problem with the power sector was one of inadequacy of fuel (coal) supply. The near bankruptcy of State Electricity Boards (SEBs) has now taken over as the bigger problem. SEBs who buy power from generation companies are not able to pay for the power. Under the current system, SEBs buy power and supply it to the end user. Once the end user makes the payment they go on to reimburse the power companies. In a way the SEBs act as collection agents for the generation companies. Most SEBs are not able to realize the amount for the power they supply. This is partly because of nonpayment from the end user but mostly because of power theft. The result is that the SEBs hardly ever realize the full amount for the power they purchase from the generation companies. Second, there is a serious need to hike power tariff. Naturally, this will be an unpopular step but one of which the time may have come. We are confident that the government will take steps to encourage energy and power in the union budget of 2016.

- Travel & tourism – Improvement in the economic scenario coupled with a new found interest in India makes it a perfect time to showcase what India has to offer. Giving boost to travel and hospitality helps in more ways than one. Most importantly, people love going back to countries where they are treated well. Where the quality of their stay is high and where there is enough to do beyond their work schedules. We are one of the oldest civilizations in the world and offer more history than anywhere else; we take pride in hosting visitors. This has to be encouraged by the government.

Note: The author has Indian Hotels (IHCL) stock in his portfolio and had recommended the same to clients. Click here for our detailed report on IHCL recommendation.

- There must be a real estate crash – For years I have been amazed that people earning 7 figure salaries are finding it hard to buy even basic homes? It is strange how the entire nation seems to be fascinated by the idea of bringing back black money stashed in Swiss bank accounts when in reality the biggest black money market is right here, in our own country. The government needs to discourage real estate investments and encourage home ownership. First time home buyers should be incentivized and buying second, third and fourth . . . home should be discourages.

That said, most of how this could get accomplished may be a state subject. For instance, increasing circle rates to the point where it would become unattractive to pay any black money for buying property. In fact, if this is done now then all those who had used their black money to buy properties are unlikely to profit from these investments, at least in their lifetime. [See footnote]

While the government has taken various steps to revive the ailing real estate sector like implementation of Real Estate Investment Trusts (REITS) and allowing FDI in affordable housing, I believe the story is broadly over for most big real estate firms in India. I have been predicting a complete collapse in the real estate space since 2011, read here for my views on future of real estate stocks at current valuations.

Also see – Successful Investor – Oversupply and herding.

[Footnote] By increasing the circle rate the Government fixes the minimum price at which property could be sold in a given area. The stamp duty has to be paid at least as per that minimum price. To give an example, presently if the circle rate for a locality is Rs. 20k per/sq ft, typically a 1000 sq ft house would cost in excess of Rs 4 Cr. The buyer pays 2Cr in white (i.e. the sale is shown at the minimum circle rate at which stamp duty is to be paid, i.e. 20k * 1000), and the balance in black. By increasing the circle rates to 30-35k in this case, the government will discourage the use of black money. Moreover, all those who had purchased at the peak will get trapped which will lead to panic sales and a crash in real estate prices. If that’s what it takes to discourage black money investments.