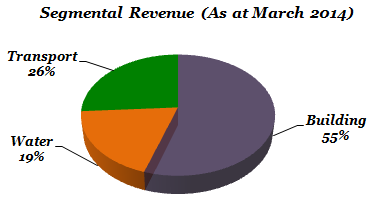

Unity Infra projects Limited or UIL is engaged in construction and engineering activities primarily in India, Nepal and Bangladesh. The Company operates in three segments:

- Civil construction: construction of commercial and residential buildings, mass housing projects and townships, airports, InfoTech parks, hotels, hospitals, educational complex, stadiums, telecom towers and railway stations.

- Irrigation and water supply: dams, tunnels, lift irrigation, water supply, sewerage and micro-tunneling projects.

- Transportation engineering: roads, bridges, flyovers, subways and tunnels.

The Indian infrastructure industry is the second largest contributor to the country’s GDP growth. Infrastructure companies such as Unity Infra projects have a huge opportunity of capitalizing on the openings presented by the trillion dollar 12th five year plan devised by the Planning Commission, Government of India to meet the unmet infrastructure demand in the country.

As per the 12th 5 year plan, key infrastructure sectors have the following allocations:

- Rs. 2, 20,000 Cr. for modernizing and upgrading highways,

- Rs. 40,000 Cr. for civil aviation,

- Rs. 50,000 Cr. for ports, and

- Rs. 3, 00,000 Cr. for railways.

This Stock Analysis report presents a long term outlook and the future prospects of Unity Infraprojects.

WHAT’S DRIVING THE STOCK

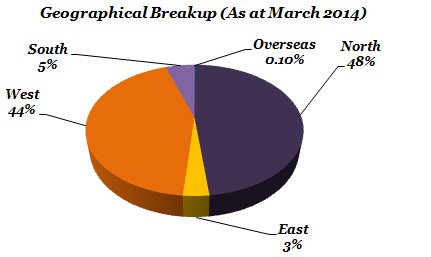

Diversified Revenue stream with pan India presence

In addition, the company has a well diversified order-book across 20 states in India as well as 2 projects overseas, in Nepal & Bangladesh. This diversification across verticals and geographies minimizes the risk from any sectoral or geographic concentration.

Healthy order book and revenue visibility

The Company’s strong order inflow and robust operating level performance can serve as key trigger for the stock in the near term.

Advancing to a bigger league

With proven execution record and growing net worth, the average order size for United Infra has increased from Rs. 65 cr. in 2005 to Rs. 573 Cr in 2013. The big ticket size orders enable the Company to deploy its resources effectively resulting in better profit margins. As the Company gains expertise in micro-tunneling and projects involving higher engineering skills, it now competes with more established players in the construction business. Over the last few quarters, the Company has entered into strategic JV agreements with various other companies whose resources, skills and strategies are complementary to UIL’s business through which UIL has developed the expertise to bag and handle large ticket projects.

De-risking the business

Unity Infra’s business interests are protected with 90% of its contracts having cost escalation clauses, an adequate hedge amidst fluctuating raw material costs. Besides, a majority of the company’s projects have been awarded by government agencies. More than 85% of its orders are state sponsored and only the remaining 15% come from the private sector. This ensures safe and timely realization of receivables. Additionally, there is lesser likelihood of cancellation or deferment of projects.

WHAT’s DRAGGING THE STOCK

Slowdown in infrastructure sector

The Government of India is running a high fiscal deficit which limits its spending capacity. Given that a considerable portion of Unity Infra’s order book comes from civil infrastructure and a majority of its revenues are derived from the government coffers, any slowdown in infrastructure spending by the government could adversely affect the business prospects of the company going forward.

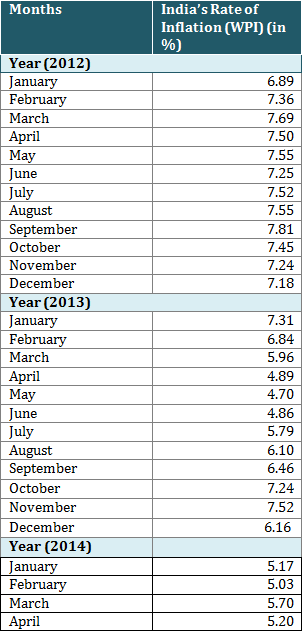

Rising inflation and political concerns

- The state of high inflation in India;

- The ability of the government to meet people’s expectations in initiating and pushing the reform process forward.

______________________________

** The stock analysis of Unity Infra projects including the financial analysis report linked above, is for information purpose only. This analysis should not be taken as a buy/sell recommendation. The circumstances of the company and the economic environment may have changed since the date of this stock analysis.