UPDATE: 1 February 2024 – Yesterday, RBI imposed certain sanctions against paytm whereby it restricts Paytm from offering certain key services from 29 February 2024. These mainly include – Paytm payments bank credit transactions. While this will have a materially negative impact on Paytm in the short term, I am of the view that there will be a resolution to this going forwad and given Paytm’s strong brand recall, it will either revive of its own or will be acquired by a nothe player in this space.

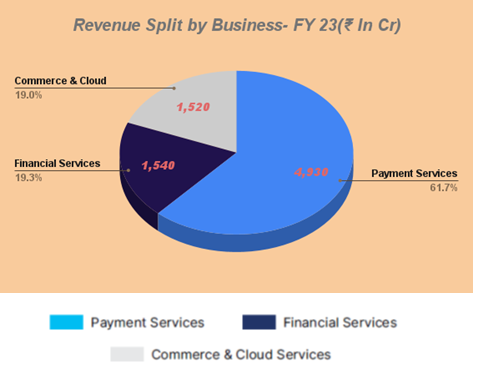

Paytm offers a comprehensive suite of financial services, mainly payment services to consumers and merchants and leverage their ecosystem to cross-sell high-margin financial services as well as commerce and cloud services.

How Paytm Makes Money

Paytm reports its revenue under three lines:

- Payment Services

- Financial Services, and

- Commerce and Cloud Services

PAYMENT SERVICES

(a) Payment Processing Margin (Transaction fees charged to the merchant less charges paid to the issuer i.e., bank / financial institution): 7 to 9 bps.

Pricing plan for merchants: For Online Payments

| For Startups, Small & Medium Businesses | |

| Payment Source | Standard Plan (MDR) |

| UPI | 0% |

| Paytm Bank Wallet | 1.99% |

| Paytm Postpaid | 1.99% |

| Rupay Debit cards | 0% |

| Debit cards: Visa, Mastercard, Maestro (Transaction amount up to Rs. 2000) | 0.40% |

| Debit cards: Visa, Mastercard, Maestro (Transaction amount greater than Rs. 2000) | 0.90% |

| Credit cards: Visa, Mastercard, RuPay | 1.99% |

| Other cards (American Express, Diners, Prepaid, Corporate Credit Cards & International Cards) | 2.99% |

| Netbanking | 1.99% |

| EMI – Debit cards, credit cards or cardless EMI | 2.99% |

(b) Commission from telecom companies: 2-3% per recharge.

- UPI Incentive: 182 Crore for FY23 (Government of India has provided incentive to digital payment apps like Paytm and PhonePe to promote RuPay Cards and low-value BHIM UPI transactions for P2M transactions).

FINANCIAL SERVICES

(c) Sourcing fee in Lending Business:5% to 3.5% of loan value.

(d) Collection fee of Loans: 1.5% to 5% of current disbursement value (i.e., Paytm’s share of percentage of the interest charged on loans)

(e) Others: commission received on Paytm money transactions, including selling electronic Gold, stock and F&O trading, selling bonds etc. This is typically Rs. 20 per order.

COMMERCE & CLOUD

(f) Commerce revenue take rate: 5-6% of GMV (this includes ticket booking on online events on Paytm owned website – insider.in , merchandise purchased from Paytm mall, movie ticket sales on Paytm app etc.

___________________________

DETAILED BREAKUP

[I] Payment Services- This revenue is primarily from:

- Transaction fee that Paytm charges their Merchants- This is based on a percentage of Gross Merchandise Value (GMV); Paytm typically makes 7-9 bps (basis points) of Gross Merchandise Value (GMV) for processing Payment services for merchants.

- Consumer convenience fees Paytm charges their Consumers-Consumers use Paytm app for a variety of payments, such as bill payments, mobile and other recharge, adding funds to wallet, money transfers etc. (break up below)

Subscription revenue from merchant services (see below).

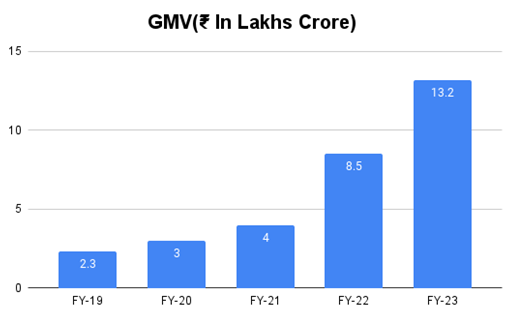

Paytm witnessed a massive growth in their GMV, which for the full year FY 2023stoodat ₹13.2 Lakh Cr having grown 55% YoY from ₹8.5 Lakh Cr in FY 2022.

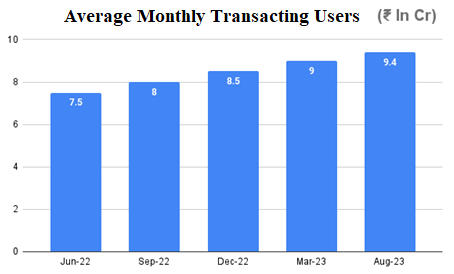

Average monthly transacting users for Quarter 2 of FY 2024, (which encompasses the average for July and August 2023), the Average Monthly Transacting users (MTU) reached 9.4 crore.

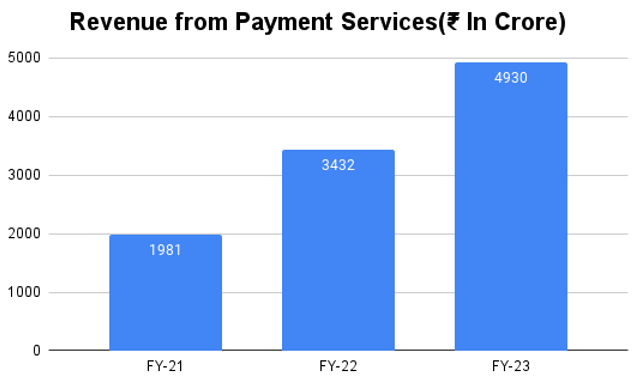

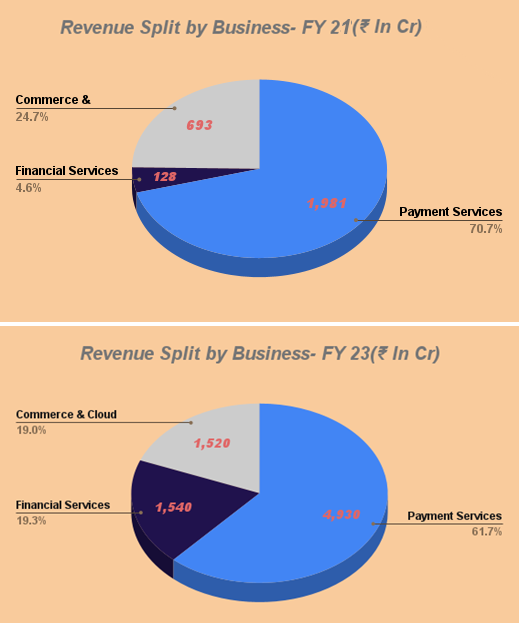

Payment’s revenue has grown from ₹1,981 Cr in FY 2021 to ₹4,930 Cr in FY 2023, growing at a CAGR of 58%. Payment’s business accounted for 62% of total revenue in FY 2023.

“Multiple payment instrument including UPI, Paytm Wallet, Postpaid, EMI, Debit Card and Credit Cards give unique advantage to Paytm over other UPI only apps”

“The unique online transacting users, transacting for services such as online banking, mobile top-ups, in-store payments etc. are expected to grow from 250-300 million in FY 2021 to 700-750 million by FY 2026”.

Subscription Revenue from Merchant Services (Part of Payment services)

Paytm claims to earn ₹100 to ₹500 ($1.2 to $6) per month subscription per active device. We enquired with some vendors who claim to have paid only Rs. 300 as one-time cost and Rs. 1 per month as rental. However, in addition to subscription revenue, the Paytm Soundbox and Card Machine helps Paytm generate merchant revenue on an ongoing basis based on transaction value; and disburse third party loans to merchants(this income is part of income generated from financial services – see below).

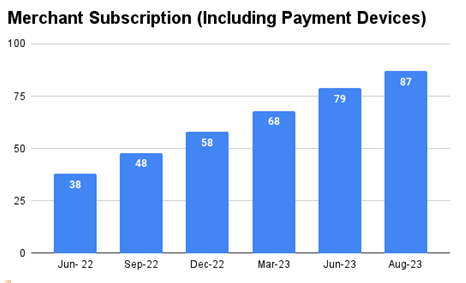

Paytm has sold 87 lakhs Merchant subscriptions to date. In comparison, their biggest rival PhonePe Smart Speaker has so far deployed 41 lakhs devices in India.

Payment sound boxes are among the most intriguing innovations in the FinTech space, helping merchants confirm received payments and thereby eliminating payment fraud. These sound boxes can turnout to be cash cows for companies like PhonePe, Paytm, or BharatPe, significantly contributing to their profits.

| Payment App | Upfront Fee (₹) | Monthly Rental (₹) |

| Paytm | ₹299 | ₹100-₹150 |

| PhonePe | ₹50 | ₹49-₹99 (varies by city) |

| BharatPe | ₹299-₹499 | ₹100 |

[II] Financial Services

Financial services is a high margin segment business. The business involves distributing small ticket credit to consumers and merchants. Paytm offers various lending products, including Paytm Postpaid (Buy Now Pay Later – BNPL), Personal Loans, and Merchant Loans, in collaboration with their financial institution partners such as Shree Ram Finance and Fullerton.

Until FY 21, this particular segment accounted for a modest 5% of the payment revenue. However, it has since exhibited remarkable growth, now significantly bolstering Paytm’s top-line performance by contributing 19% of the total revenue.

The First Loan Default Guarantee (FLDG) Conundrum came as a boon for fintech companies.

To illustrate, for example if a fintech like Paytm provided loans of up to Rs. 100 crore to customers using money from third parties like a bank or NBFC, it had to guarantee up to 100% of the credit risk. Since 2022 this guarantee amount stands at 10% of the loan amount, i.e., up to Rs 10 crore in the risk of loss on a loan pool of Rs, 100 crore.

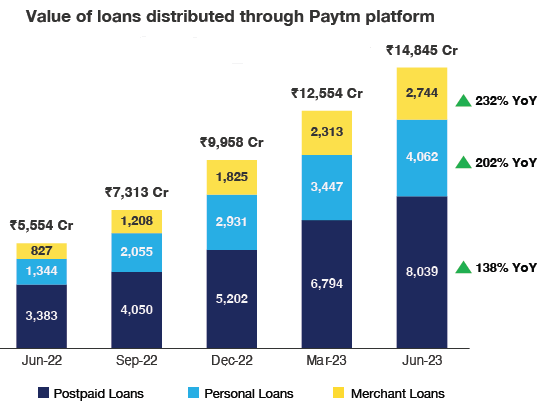

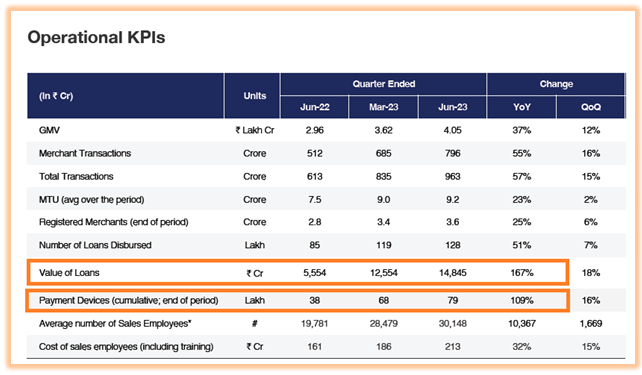

This has enabled Paytm to distribute a higher volume of loans. If we look at Paytm’s loan book it currently stands at ₹14845 Cr showing an enormous growth of 167% YOY.

Paytm’s revenue model in its lending business is driven primarily by sourcing fee, which is typically 2.5% to 3.5% of loan value, and collection fee, which is 0.5% to 1.5% of current disbursement value (the latter is part of the interest which the merchant charges on the loan).

Paytm is presently exploring strategic collaborations with four Non-Banking Financial Companies (NBFCs) with the aim of enhancing diversification within the lending segment. This initiative is part of their ongoing effort to expand their partnership in the financial services sector. As of now, Paytm has an existing partnership with Shree Ram Finance in this domain.

In all, more than 85% of the value of loans disbursed are to merchants using a Paytm payment device, indicating a strong correlation between device deployment and loan distribution.

Additionally, 45% of disbursements were repeat loans to merchants who have previously taken a loan.

[III] Credit Cards and advertising driving growth in Commerce & Cloud

In commerce services, Paytm generates revenue by levying a transaction fee to their merchant partners and/or a convenience fee to their customers, typically linked to a percentage of the transaction value.Commerce offerings provide a lifestyle destination for consumers to avail services such as travel and entertainment ticketing, gaming and more.

COMMERCE

- Paytm sells travel tickets, hotel bookings, movie and event tickets and various deals and gift vouchers to customers.

- Paytm app is a great destination for merchants to get more businessy by leveraging on to Paytm’s consumer traffic.

- Paytm diversified its e-commerce services by introducing Paytm mall (Marketplace). It attracts numerous sellers selling commodities like shoes, apparel, electronics, jewelry, etc. on its website.

- Commerce revenue take rate is 5-6% of GMV which the management has guided can increase further in Q3 and Q4.

We reproduce below an excerpt from Paytm’s (Management’s) recent concall:

On a QoQ basis, I just want to call out that Q3 and Q4 are strong quarters for our events business. So there is that seasonality in our business. Q1 and Q2 are much more subdued because of the lack of holidays, festive season, as well as weather. So our take rates have basically come down to what we have guided earlier, which is 5% to 6%, whereas in Q3 and Q4 we see a little bit of a higher take rate.

CLOUD

- The distribution of co-branded credit cards falls under cloud business. Paytm has partnered with SBI and HDFC Bank for co-branded credit cards. This enables them to generate upfront revenue on card activation (annual card fee) and receive a portion of the interchange fee for the lifetime of the card.

- Provides software and cloud services to enterprises, telecom companies, and digital and fintech platforms to track and enhance customer engagement, build payment systems, and unlock customer insights.

- Paytm enables merchant partners to grow their business by offering services like ability to sell tickets, advertising, loyalty solutions like deals and gift vouchers.

_____________________________

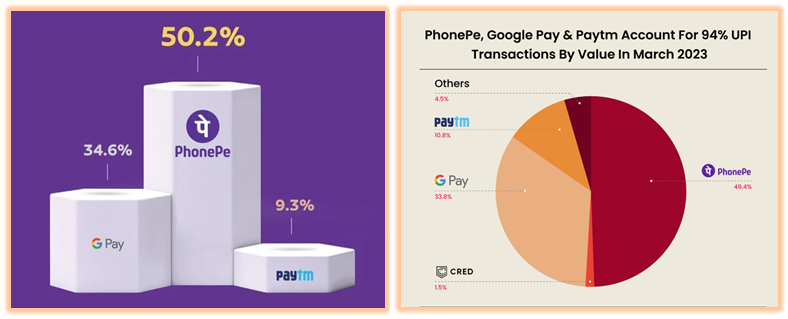

PhonePe, Google Pay and Paytm accounted for nearly 94% of all UPI transactions by value as of March 23

PhonePe remained the top UPI app in March while Google Pay and Paytm retained second and third positions respectively.

PhonePe remained the top UPI app in Marchwhile Google Pay and Paytm retained second and third positions respectively. PhonePe remained the top UPI app in March, processing 407.63 Cr transactions worth INR 7.07 Lakh Cr. Paytm was in the third position. The Company processed 128.84 Cr transactions worth INR 1.54 Lakh Cr in March.

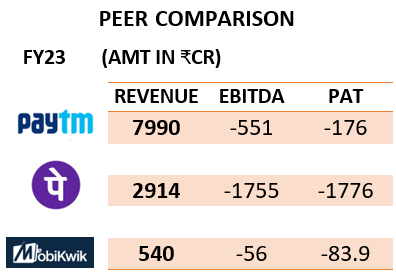

While PhonePe may claim a larger market share in UPI payments, Paytm’s revenue generation capabilities and focus on P2M transactions make it a more profitable and sustainable player in the digital payments space.

________________________

AUTHORS VIEW:

Paytm has achieved significant top-line growth primarily through two key avenues: the disbursement of loans and the sales of sound boxes. This robust performance underscores the considerable potential for future success. Notably, the introduction of sound boxes presents an excellent opportunity to cross-sell high-margin products to merchant partners. Furthermore, it serves as a strategic tool for expanding the distribution of loans to the unorganized sector, leveraging products such as Postpaid and Personal Loans. This combination of lending services and innovative product offerings positions the Company for continued growth and prosperity in the evolving financial and merchant ecosystem.

———————