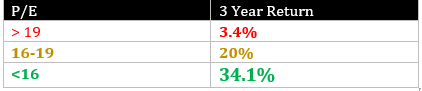

DO YOU KNOW, every time markets are trading below valuations of 16, they deliver 34% returns over the next 3 years. When trading between 16-19, they deliver 20% over the next 3 years. When trading above 19, the returns are only 3.4% for the next 3 years.

But what does it really mean when someone says, “VALUATIONS ARE CHEAP/ EXPENSIVE?”

What they are referring to is a number which typically moves between 12 and 30, and not really just stock prices. Simply put, valuation on a market wide basis is the number you get when you divide stock prices by earnings generated by these stocks. It is possible that markets are expensive when Sensex is at 30,000 and the same markets become cheap when Sensex is at 40,000. Its all a function of how much are those stocks earning.

For the last few years, I have been skeptical about buying stocks. Stocks have consistently traded at extremely high valuations. This however has not stopped the magnanimous investor community from betting big on this asset class. As a result, equity prices soared and soared more.

Here’s the truth . . . . .

In overvalued markets, the best of minds can research and analyze 16 hours a day to build a basket of top stocks. Based on all experiential evidence, I can safely say, this carefully selected basket of stocks will underperform any category of equity mutual fund if the latter is “purchased at the right time, i.e. in undervalued markets”.

In short, all you need to do as an investor is to be heavy on the right asset class based on market circumstances.

A few days back I gave an example on how staying invested in fixed income instruments can deliver higher than market returns if you follow a simple rule of asset allocation. What I paste below was written before the current crash:

. . take for example . . . In an overvalued market, you choose to stay invested in fixed income and make 8% every year. At the end of 3 years, you will make ~125 on an investment of 100 (i.e. 100 growing at 8% for 3 years).

In the same overvalued market, you choose to invest in stocks growing at 15%. At the end of year 3, you will still reach 125, no matter in which of the three years does market fall even a minor 10%. MARKET DOES FALL MORE THAN 10% ONCE IN EVERY 3 YEARS. . .. and this is being very conservative. It actually falls a lot more.

The above will be of particular help to the cynical investors out there who believe that spending time in the market is more important than timing the market. In reality, asset allocation will achieve the best results over time.

A major part of my time goes into convincing investors one thing and one thing alone – it is always the same; that the cyclical nature of market repeats.

Have the markets fallen so sharply because of a virus?

Sure.

Would they have fallen for any other reason?

Absolutely yes! Markets find a reason to fall every time there is overvaluation. For those of you who remember 2008 will probably blame it on the housing crisis in the United States. I will still blame high multiples at the end of 2007 as the main reason for the 2008 correction.

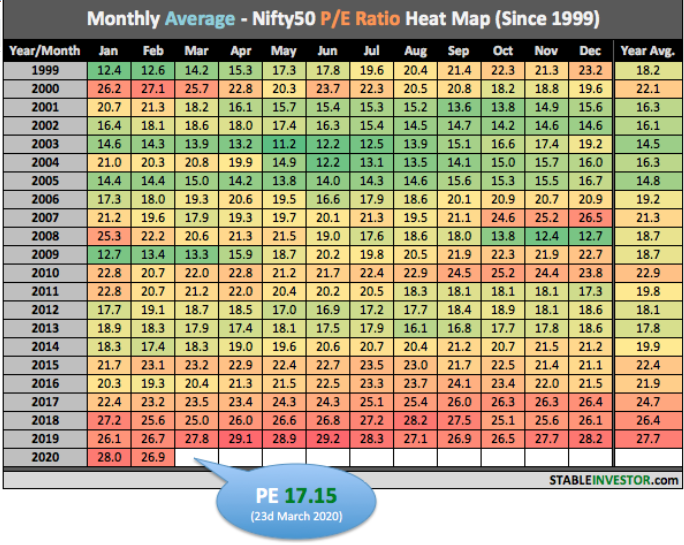

As for historic data on valuations, I take help from this heat-map drawn by my dear friend Dev Ashish from Lucknow (who is marked on this email and who I am yet to meet in person). He like me has spent a large part of his youthful days explaining the power of valuations to investors.

Somehow investors still find it easy to invest in stocks when money is flowing easily into the market.

The same clients who were extremely excited about investing in stocks until the beginning of this year are now mindful of even looking at equities. They judged my rationale for investing in fixed income schemes and are now equally judgmental about my excitement for stocks.

If you do not invest in stocks now, you never will!

let me answer some of the questions I have been asked in the past few days:

Should we buy mutual funds/ stocks at this time?

Answer: Yes please, to your hearts delight.

Can markets fall more?

Answer: Of course, they can.

In my experience however, they turn around from the kind of valuations they are trading at, at this point. Don’t forget, the outcome of this crisis depends upon a bio-medical resolution more than a financial one. Also make no mistake, we already are in a slowdown/ recession but I believe that stock prices are way below they should be for a recessionary scenario.

Think of it this way, if you invest at the current level of Nifty (@ 7500), markets can fall at best another 10-15% to 6600-7000 range; but in 3 years you will surely find them trading 30-50% higher than the current level (i.e. a return of ~ 10-17% p.a.)

Should we sell our stocks/ mutual funds/ stop our SIPs?

Answer: Anybody in right mind should be buying more. If you purchased fixed deposits / debt / fixed income schemes, now is the time to shift all of that into equity. If you did not, find money to invest but please do not think about selling anything. As for monthly equity investments (SIPs), you can safely double the amount of your monthly SIPs, if not more. Buy as much more of those units as you can while the prices remain depressed.

Should we invest more by breaking our FDs, home, jewelry, etc etc.

Answer: Please don’t overdo this!

If you were planning to get rid of an asset otherwise, please do and put that money to work in markets; but it’s a foolish idea to change your life only because markets have fallen.

__________________

Finally, hope you are doing well and are making most of this time at home. Do reach out to me if you want to discuss anything or just talk, we all have time to plan!

Loved it.. Would recommend all to read it. When everyone is trying to find bottom.. Rajat sir has been sharing his insights… As of writing this India is in complete lockdown for 21 days. It will be interesting to see how the stock market reacts. I would request Rajat sir to write more often. As someone like me who has just started investing with initial capital of 20000-25000 it will be really helpful to get guidence. Looking forward to more of these articles..

Thank you for your appreciation