Established in 1986, Vascon Engineers Ltd is a Construction Engineering Company in India, with presence in real estate business having an asset-light model and Clean Room Partition manufacturing business.

CMP = Rs. 74

Disclaimer: Invested

The company operates in 3 segments:

1) Engineering, Procurement, and Construction(EPC)– Construction of Residential, Commercial, Industrial, and other projects.

-

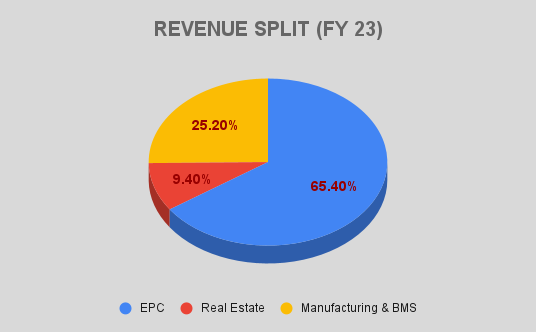

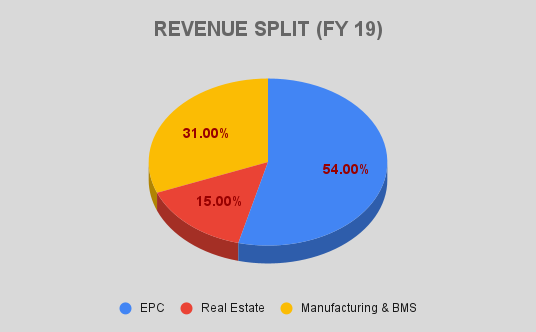

65.4% of total sales in FY23 vs 54% in FY19 –> Vascon Engineers Ltd targets 15-16% Gross margins in the EPC segment (Cash cow segment)

- The EPC segment continue to grow booking 20%-25% year-on-year in terms of their top lines

- For EPC business, Vascon is targeting revenue of Rs1000 crore for FY 25

EPC COMPLETED PROJECTS

2) Real Estate Development–Development of Residential, Hotel premises, Industrial park etc

-

9.4% of total sales in FY23 vs 15% in FY19

- Volatile in terms of sales and margins

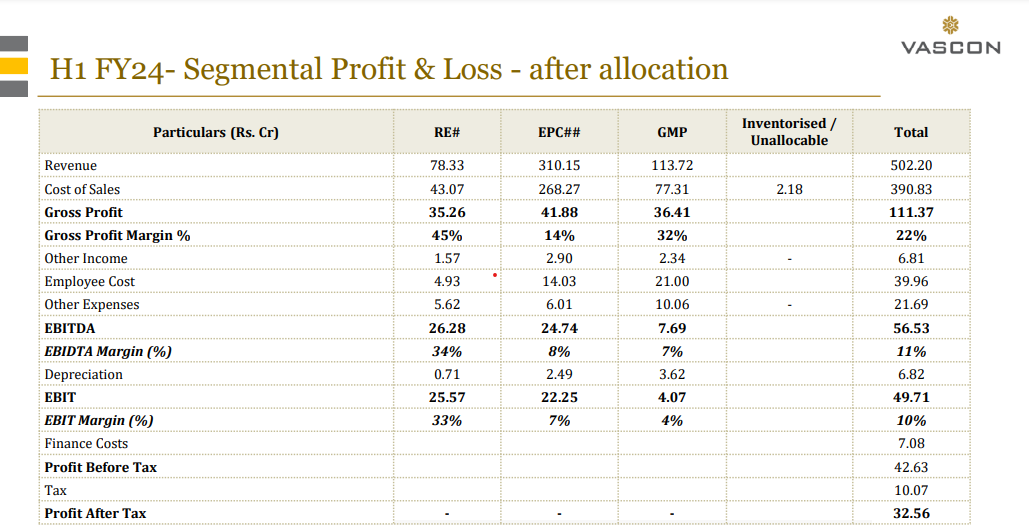

- High Margin Business –> Vascon Engineers Ltd targets a 30% Gross Profit margin in Real Estate Development. Currently, EBITDA margin is in the range of 34%.

- The Real Estate Development segment continue to grow booking 15%-20% year-on-year in terms of their top lines

- For Real Estate Development business, Vascon is targeting revenue of Rs150-200 crore for FY 25

3) Manufacturing & BMS – Manufacturing of clean room partition & Building Management System (BMS)

-

25.2% of total sales in FY23 vs 31% in FY19.

- Stable though low margin 6-8% business

Clean Room Partition Business:

As part of backward integration, Vascon Engineers acquired GMP Technical Solutions, an integrated provider of engineering services, in August 2010. GMP is one of the largest manufacturers of Clean Room Partitioning Systems and Turnkey Solution Providers. However the company wishes to exit from GMP at the right valuations.

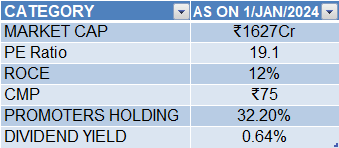

VIEW ON CURRENT VALUATION OF VASCON ENGINEERS

-

Company currently trading at fair static intrinsic value.

-

Upside of 35-40% on CMP, based on assumptions of 15% revenue growth @ CAGR at 11% EBITDA margins.

-

Discount rate – 14% (to accommodate for risks in the execution of real estate and high current finance costs)

-

Any external trigger like a promoter increasing stake or sale of non-core assets can lead to more upside

-

With improving EPC prospects and financial position, the company is poised for growth and subsequent re-rating

-

We recommend a BUY on every correction or Dip

INVESTMENT THESIS:

WITH ROBUST ORDER BOOK AND INCREASED CAPACITY UTILIZATION, PROFITABILITY TO IMPROVE..

RESULTING IN BALANCE SHEET STRENGTHENING

The total order book stands at Rs. 2854 crore as of 30th September 2023. Almost 87% of the orders are derived from government projects, which lends visibility to the uninterrupted cash flow, thereby providing assurance of stable operating performance over the medium term and supporting the business risk profile.

VASTLY IMPROVED FINANCIAL HEALTH:

Debt reduction :

- Debt reduced from Rs. 278 cr in FY18 to Rs. 176 cr as on 30th September 2023.

- Current net debt is Rs.72 Crore which makes it a relatively debt-free company

- Reduction in cost of capital from15% to 11%

Vast improvement in working capital position :

- FY23 working capital days stood at 209 days in FY23 as against 400+days in previous 6-7 years

- Receivables reduced to 78 days vs 140 days in FY19. (Receivables have been on an improving trend since the government bodies became the main counterparty for the EPC business. The company will continue to focus on government-related projects, which will help keep the receivables low.)

Improvement in credit ratings:

CRISIL BBB+/Stable (Upgraded from ‘CRISIL BBB/Stable)–> Long Term, CRISIL A2 (Upgraded from A3+)–> Short Term

- There has been continued improvement in VASCON ENGINEERS LIMITED’s operational and financial profile supported by steady execution, healthy profitability, and healthy accretion of reserves. The healthy profit margins and accruals are driven by prudent project bidding, a stable manufacturing segment, and higher deliveries in the real estate segment in fiscal 2023.

- Reduction of high-cost debt has allowed the company to get decent credit ratings from credible rating agencies like CRISIL it opens up avenues for the company to carry forward the growth cycle that has started in the years gone by.

REASON FOR IMPROVEMENT: GROWTH IN EPC BUSINESS AND INFRASTRUCTURE SECTOR REVIVAL:

- The company’s EPC segment is its cash cow. It has excellent average margins and great returns on capital. (17% 8-year avg EBITDA margins) (High Roce )

- The presence of price escalation clauses in most of the outstanding contracts in the order book reduces the exposure to raw material price volatility to an extent.

- The EPC segment has witnessed tremendous growth since FY17. Sales have grown from Rs. 196cr to Rs. 654 cr in 6 years growing at a 22% CAGR (even considering COVID years). The company’s focusing on Government projects has led to an improved working capital position and steady cash generation which has allowed it to reduce debt and improve its financial position.

- The growth in the EPC segment was due to a revival in the infrastructure sector due to the Government’s thrust on infrastructure spending.

- Infrastructure revival has also led to improving performance of its Manufacturing business which has consistently growth over the last 5 years. FY23 EBITDA at 19cr vs 5cr in FY19.

- The company has successfully executed projects including, residential buildings, IT Parks, hospitals, corporate offices, airports, and Shopping Malls. They have done third-party projects for some pretty big-ticket clients like Adani (Shantiggram Residential in Ahmedabad).

EPC BUSINESS TO CONTINUE ITS GROWTH JOURNEY:

- The EPC segment will continue to grow given the infrastructure upcycle and Government thrust on infrastructure spending.

- Improved funding position to lead to higher order book: The Company’s EPC order book was stagnant for the last 3 years due to constraints on its Bank guarantee levels because of its weak financial position. But now with the company’s credit ratings improving, the company has applied for enhancement of bank guarantees and this will allow them to significantly increase their order book position and continue the EPC execution run rate. The company has just got a CRISIL rating upgrade for a proposed enhanced bank guarantee of 40crs (Existing facilities of 300cr). Thus, the EPC segment will keep on growing quite well.

“The EPC will continue to look for order booking year-on-year, augmentation of their banking facilities as we grow. And so it’s a cyclical thing. We grow our banking limits, and then we take more orders. We grow further. We keep going back to the banks. So that process will continue. And hopefully, from here, the EPC story is to keep delivering similar or slightly better PBTs while they continue to grow at booking 20%-25% year-on-year in terms of their top lines.” – Management

Increased Bank Guarantees -> Higher EPC order book -> higher growth and improving financials -> better credit ratings -> Increase bank guarantees (It’s a virtuous cycle)

Management commentary-What is your current rate of interest for that? Santosh Sundararajan: Current rate is 10% -11%. The cost to the company as of now is 11%.

“Going forward, for this year, we would want to focus on improving our rating also by a notch or two and then renegotiating our terms with the banking consortium so that our terms are much more efficient. As of now, we still feel we are not getting the best of terms. We haven’t backed performance for a while. Now that we have performance on our side, we would want to negotiate our terms with the bank this year.”

REAL ESTATE – Multiple ongoing projects and learning from past mistakes:

Multiple Real Estate projects of the company will be completely completed in FY25.

Management commentary- So in FY ’23, we had completions from about 3 or 4 real estate projects. And that is why those revenues have been reflected on the balance sheet. And the bottom lines are also reflecting. Going forward, in FY ’24, we do not foresee completing any bigger projects because most of them have just started, including Coimbatore and Kharadi. And so these projects will not be completed in the coming year. They will get completed in the year after that, so again, a good chunk of revenue recognition, we foresee to be happening in FY ’25 and not in FY ’24 for real estate. So FY ’24 will be slightly softer or maybe some decline in terms of sales

Change of business model to asset-light in Real estate to avoid past troubles.

ASSET LIGHT MODEL: Joint Venture and Joint Development Agreement with landowners with low upfront deposit

Management commentary-“Again, we are not now looking for huge parcels as we used to 10, 12 years ago, 50-acre township projects. We are now looking for not more than 4-5 acres of land; not more than 1 million square feet in a project that we can deliver over a 3–4-year period and move on. So that is our strategy as of now to do with — and as I said, we are not looking at land banking. We will be looking at joint ventures. So yes, that is the strategy for real estate.”

ROBUST GROWTH GUIDANCE:

Management commentary- “See, we do expect 15%-20% growth is what I would give as a guideline over the next 3, 4 years. That is visible. We do not see any impediments to stopping that kind of a trajectory, if not more; also, the bottom line is on average since we have the evolution of the bottom line from real estate, which will be a bit volatile year-on-year due to Ind AS. So again — but on an average over the next 4 years, we should be doing more than Rs 100 Crores as a bottom line; and growing Rs 1,000 Crores into 15%-20% Y-o-Y. That’s a target we can take. They might not exactly double, but yes, hopefully, if we can, that will be even better.”

Consolidated revenue is expected to increase ~7%, aided by EPC revenue which is expected to reach ~Rs. 700-730 crore in fiscal 2024 and stable manufacturing segment. Further, real estate collections are expected to increase gradually and will improve in the ongoing fiscal with a healthy launch pipeline and committed receivables of Rs 111 crore as of March 31, 2023. (Credit Rating)

SALE OF NON-CORE ASSETS:

The sale of non-core assets of Land and GMP technicals business could unlock further value.

Management Commentary- “9-acre land parcel in Aurangabad: NOC received from State Bank Of India and the transaction is under process. (“About Rs 26 crores Rs 28 crores we expect from the sale of Aurangabad land, but see, that is Aurangabad land is pledged with SBI for our consortium banking limits. So we’ve got NOC from them to sell the land. And then the proceeds will be kept as an FD with the bank, at least in the short term till we find alternate collateral”

Management Commentary- “For GMP Technical, have you got any bid or anything else, sir? Santosh Sundararajan: No. GMP, we have not yet started actively looking. I mean there are mandates. We’re not desperate or looking very actively with a target in mind to sell it. We will look at valuations as and when we get offers, and if we feel something is good, then we will take it forward.”

GMP TECHNICALS IMPROVEMENT AND ITS GROWTH GUIDANCE:

Management Commentary- “If you see, in GMP, over the last 2-3 years, they have also — just like our EPC division, the growth has stabilized. They have come out of whatever issues we had. And the bottom line this time has also — the percentage EBITDA has stabilized. We look — going forward now, it is a matter of growing. And I think that we — they are also predicting — that division is also predicting to grow at — same like our EPC division, to grow at about 15%-20% year-on-year for the next 2-3 years. And the bottom line percentage would only slightly improve with scale.

GMP currently has an order book is more than Rs 200 Crores lying with them. So this is current condition, so — as it’s been said that the order keeps on coming every month every quarter. So GMP’s growth is — significant growth is expected next year also, is continued.

GMP is now clear of all its legacy troubles and issues. It is now looking robust, and ready to grow at the same pace, so we are expecting another 15%-20% growth in the top line in the coming year. And the bottom line has now stabilized. The impact: With scale, we expect the bottom line would also, in fact, increase by a percentage point or 2 at the EBITDA level.”

RISKS:

EXPOSURE TO RISKS RELATED TO REAL ESTATE PROJECTS:

- Saleability and implementation risks in the real estate sector persist, as reflected by sharp fluctuations in real estate income, sales, and collections over the past few fiscals. In light of the weak demand scenario in the past, certain projects have demonstrated limited progress. Ability to liquidate real estate inventory of ~Rs 257 crore (excluding Rs 148 cr as land and development potential) as of March 31, 2023, delay in completion or launch of real estate projects, and any additional debt taken on to support real estate cash flow mismatch will remain a key monitorable.

- Inventory remained stretched over the last two years because of the strong backlog as a result of unsold real estate units, which stood at Rs 257 crore (excluding Rs 148 cr as land and development potential) as of March 31, 2023.

Vascon’s EPC operations are working capital intensive:

- Vascon’s EPC operations are working capital intensive, primarily on account of high receivables which include retention money it has to keep with clients (10-15 percent). Vascon has significant receivables in the EPC segment, with recoverable due for more than 3 years amounting to Rs.55.03Cr as of December 31, 2022, and receivables due for more than two years but less than three years of about Rs.13.65Cr out of a total receivable of Rs.107.70Cr as on December 31, 2022.