VIDEO UPDATED AS ON 22 JULY, 2015

Ever since news of Vedanta Cairn merger started doing rounds in brokerage houses and among the helpless retail investor community, analysts and experts have given all sorts of views on things ranging from valuation to regulation. This is typical of big mergers. On the one hand, PR firms of companies work with top notch market experts who give their educated views on such corporate events. On the other, some voices from among shareholders question the rationale of such a merger.

I became Cairn Shareholder in the year 2013 at a time when Cairn India share traded at Rs. 348. At that time, it looked like a wise decision, and to be fair, based purely on fundamentals prevailing at that time I would still say it was a very wise investment. To the point that if the same company was being managed by a different set of people, I would still buy it at Rs. 348 a share, even today. Of course it currently trades at Rs. 183, which is ridiculous to say the least.

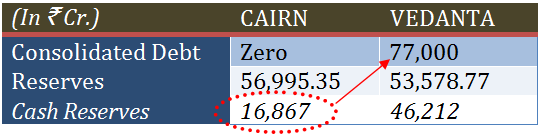

So why exactly should a zero debt company with Rs. 57,000 Crore in reserves trade at valuations of 5.7*? (*PE based on consolidated TTM).

Further, this 5.7 itself is a fairly high number given that for the last 4 quarters the company’s performance has been suffered on account of:

- Significantly lower gross income due to weak crude prices;

- Significantly higher expenses; and

- Significantly higher depreciation charges;

If one were to assume that crude oil prices will bounce back to reach close to where they were and the company will start making how much it made until last year (Note: I am not hoping for any improvement, I am assuming that the company will make exactly how much it made until last year).

In such a case the PE Ratio of Cairn would be 2.8 (based on last year’s EPS and today’s price of Rs. 181).

What’s Wrong With Vedanta Cairn Merger Terms?

The most honest and simple answer to this is that – I invested in an oil company at Rs. 348. While I have no problem that it trades at Rs. 181 today, I am not happy with selling my stake at this price, let alone swapping it with some metal company buried in debt which feels it can create synergy and may be a big resources company in the world.

Be that as it may be, I will be happy to exit at a price of Rs. 418. I do not wish to get into valuation and how I arrived at this Rs. 418 but I will feel slightly cheated at that price (~ 20% higher than my initial purchase price of Rs. 348 after 17 months. Below I will also get into the factors responsible for this fall – mainly fall in crude oil prices).

5 IMPORTANT THINGS ABOUT THE VEDANTA CAIRN MERGER

[1] Merger Ratio

I first heard something like 1.1 shares of Vedanta for 1 share of Cairn. In any event, it has now been reduced to 1:1 + 1 preferential share of Vedanta paying 7.5% annual dividend, for 1 share of Cairn.

Having worked closely with some of those who spent hours doing company valuation, I can say with some level of confidence that my figure of Rs. 418 is as likely to be correct as Rs. 184 or Rs. 841.

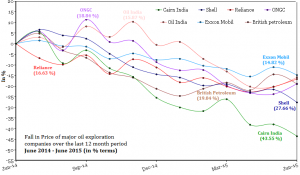

The question which often remains unanswered by those who specialize in valuation sciences is – what caused the below chart to look like the way it does?

(click to enlarge)

Also Read: Why crude prices below US$ 90/barrel are not sustainable.

Over the past few weeks I have heard global crude oil prices being blamed for everything that has gone wrong for Cairn India. How is it that Cairn India got affected on average 2.5 times more than its domestic and international peers, despite being in a much better financial and operational condition compared to them?

[2] What Should Cairn be Valued at?

Ideally at a price no less than the highest at which the share ever traded in past and surely not at a price which is close to its life time lows. Clearly there is nothing wrong with this company other than the management. It has zero debt, has one of the best refining margins and operates in a strategically important sector.

Further, In this case the common promoters had no choice but to consummate this rather strange marriage. With the amount of debt on Vedanta’s books, there was no way that the company could have paid back the U.S. $ 2 billion loan which it extracted from Cairn India in the last financial year, of course without any consent from the shareholders. The loan was termed – regular treasury operations. In case this transaction does not go through, it would be interesting to see how Vedanta repays the U.S. $2 billion loan.

For more on this read here: Cairn India Stock Analysis

[3] Should you hold on to Cairn India Shares?

One of my friends often used the word- ‘Boo-hockey’. It always sounded as funny.

Here is the deal – if you have been a long time investor in Cairn India, you will have to either sell at a loss or become a shareholder in a metals company. As an investor, now you must decide whether a metals company can earn you what you thought an oil company could. If you don’t understand metals, take the advice of someone who does. Alternatively, sell at a loss. It’s OK, sometimes things don’t go your way. Accept it and learn to meditate, it helps.

Chances are that post the merger the price of Vedanta will move up. This has nothing to do with fundamentals or the kind of synergy this nonsense will create. It has more to do with the fact that those who were responsible for bringing down the price to these levels will start buying post the merger to get back their holding to pre-merger levels. Of course, I have no idea who these people are but I can tell you with some surety – post merger the company should do far better.

Decide how long you wish to stick around.

[4] How do Companies get away with this?

They don’t!

I cannot even begin to imagine what would have happened to these companies and their promoters and above all- to their directors, for approving such a merger in the United States. I pick the United States not least because it is immune to any corporate crimes but more because securities markets are regulated in a reasonably transparent manner.

It is possible to get away with such mergers in India because of 2 reasons:

- Lack of Shareholder Activism: Most big Indian companies have their majority shareholding concentrated in the hands of a single unit or a close group of people who owe allegiance to each other. Retail shareholders are mostly not in a position to stall a merger. Even if they come together to raise voice, unless they find a common law remedy, it would at best get them some newspaper coverage, may be some monetary benefit on the sidelines.

Note: As per the company’s act, a merger must be approved by a majority of the minority shareholders (discussed below).

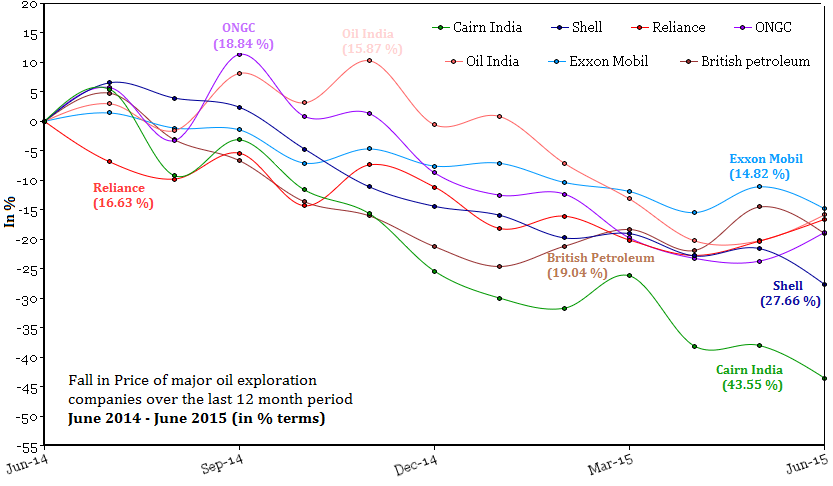

- Weak Regulation / lack of will to act: One does not need a degree in space propulsion to look at the price movement of a stock to tell if it is being manipulated or not. I get mightily amused every time I think about what the investigation team at SEBI keeps themselves busy with all day. Below are some of the charts (I have deleted the names of the companies – what do you think?).

[5] Majority of the Minority Rule – Is it a Done Deal?

Not yet but of course !

As per SEBI regulations (circular: CIR/CFD/DIL/5/2013) for such merger proposal to be approved, votes cast by public shareholders (i.e. shareholders other than the promoters) in favor of the proposal must be at least two times the number of votes cast against it. Simply put, for such a merger to go through – public shareholders of both companies should approve the merger.

As per the latest shareholding pattern of Cairn India, on paper the promoters and promoter group own 59.89% shareholding of the company. Of the balance 40.11% public shareholding, Cairn UK (the erstwhile promoters) own 9.82% and the Life Insurance Corporation (LIC) owns another 9.33%. Besides these two large minority stakeholders, there are mutual funds, smaller institutions and the retail investors who hold the balance ~ 20%.

Naturally, the consent of one if not both of these large minority stakeholders will be needed to push the merger through. Why would either of them give their consent? While I have a list of reasons, both for and against why such consent should or should not be given, the thing to think about is this – would the company have announced such a merger without having comfort of these large minority stakeholders?

If Vedanta management was not convinced (by at least a 100%) of getting this deal done, they would never propose something which gets them so much negative publicity.

This is one of the most comprehensive articles I have read. Better than any other in the newspapers. Well done and thanks.

And that is one of the best thank you comments. Thanks Manish.

How do you say that the merger needs to be approved by the majority of public shareholders. Where is that written?

Hi Anil, this is based on regulation. Refer to this article – http://194.195.112.90/majority-of-minority-rule-public-shareholder-approval-requirement-for-listed-company-mergers/

I need to know that the share alloted to investor 1:1 it will be disappoint for the carin sahreholders. I thnk carin shareholder will be selling their share or may be hold for the right time. So i need to know whether merger had affected to the investors.

Hi Karim, If you mean whether you should hold on or sell at the current price; my suggestion would be to hold on until the merger goes thru, if at all.

Very well written article,Really goes on to show how small shareholders are at the mercy of big corporates.

Thanks Rajat.

I wonder what the Independent directors are doing in the board.

Thanks for this analysis,it gives very clear situation about deal and minority shareholder can decide what they want(stay or exit).

HI I am Abdul Karim Holding 1200 Vedanta share @ 180, what shall i do if the merger going to happen.

thanks for the insightful analysis. the deal is up now with more favorable terms. Basically Vendanta wants to fund Cairn india buy out using its cash. Minority voters should press LIC and vote against this.