Yesterday I had written an article on Hedge funds in India. I received a few comments about how hedge funds differ from venture capital firms in India.

The most basic difference:

The manager of the hedge fund has complete authority in terms of how and where he wants to deploy the money collected from investors. In comparison venture capital firms will invest in young/ start up companies at different stages of their maturity (i.e.venture capital money goes into financing unlisted companies).

Note that unlike mutual funds, hedge funds manager can deploy the money pretty much anywhere including in unlisted companies. To that extent, hedge fund managers could act as venture capital firms but not the other way around.

Further, venture capital funds will have the partners participating actively in the management of the funds. They will sit on committees and the board of the fund to talk to young businesses about their business plans. They actively participate in where to invest and when to exit. The exit comes when the start-up company reaches the stage of an Initial Public Offering (IPO), or when a bigger company wants to buy out the investment / share of business.

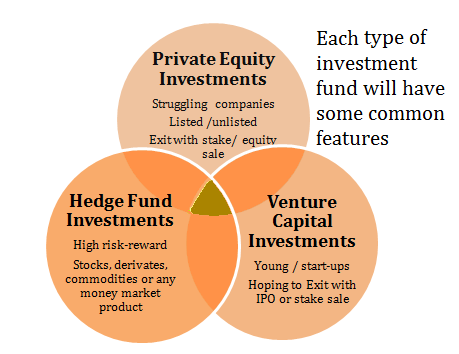

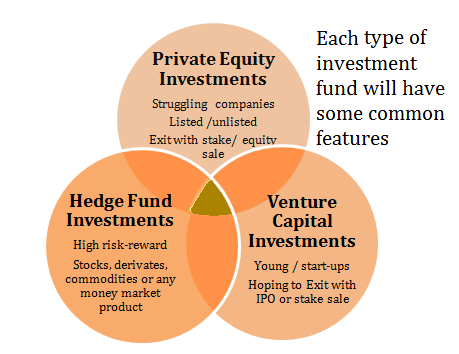

Private Equity vs Hedge Fund vs Venture Capital Firms

Taxation & Structure – There are many different structures based on the type of firm/ partnership/ company which you plan to incorporate. A good tax attorney should be consulted before finalizing the structure. Many considerations have to be paid close attention to here – domicile of investors (or most of the investors), where is the fund likely to pre-dominantly invest, tax treaties with the country of incorporation etc.

In general – all such funds are subject to favorable tax treatment in most jurisdictions from which they are managed. You can see this Wikipedia post on this topic which will give you a fair idea about this aspect.

List of registered venture capital funds in India – http://www.sebi.gov.in/investor/venturecap.html

Nice illustration of the differences between private equity, hedge fund, and venture capital !

Thanks