Date and time – 3 August 2016 | 12:20 PM

I don’t remember the last time when there was so much consensus on ….. anything really, and I have witnessed many events that were as certain as change of seasons.

By now your ‘newspaper-wala’ surely knows that the markets are overvalued and that they will CRASH!! Really?

Sometime back, when the market-crash-wave was still gaining momentum, it eluded me as to why suddenly everyone had started turning negative. It turned out to be a perfect case of ‘fool me once, shame on you; fool me twice, shame on me’.

It’s interesting, in March 2015, Nifty was trading at 9100 mark and back then, nobody was waiting for a crash. Mind you, corporate earnings continued to decline for the next 3 quarters (i.e. Nifty Results Q1, Q2, & Q3 of FY 2016) from then and yet it was only towards the second half of 2015-early 2016 when we saw a correction.

Here’s a discussion of corporate earnings from August of 2015 – https://youtu.be/PQwBBm2MJxI?t=30s This was the time to be negative, not now as much.

This time, it’s even more interesting. Nifty is trading at 8600, everybody is waiting for a crash. So much so, that I am actually beginning to wonder, who really is buying for the last so many weeks for the momentum to sustain?

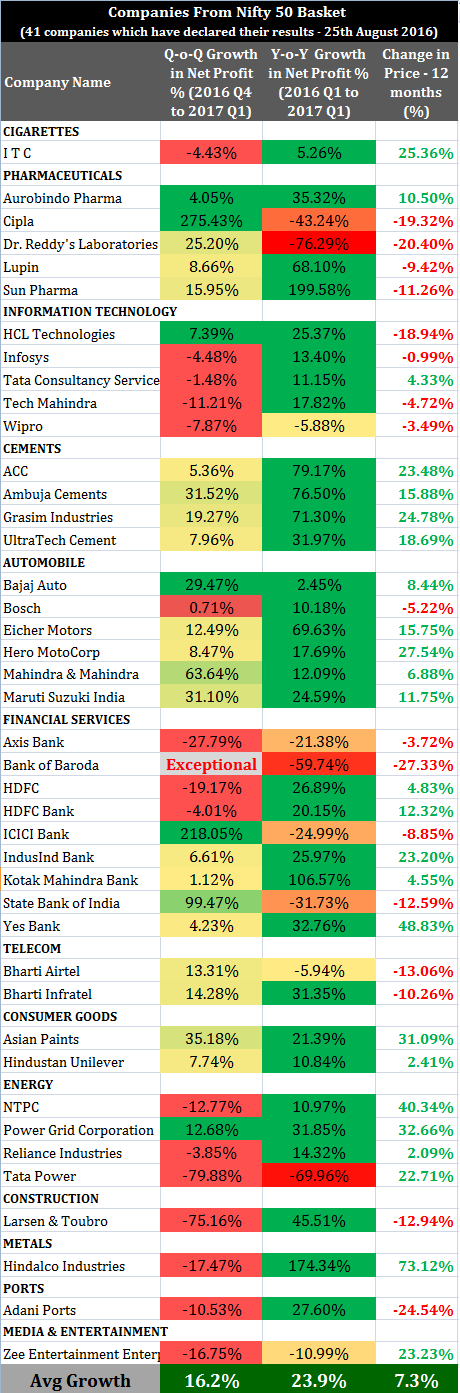

The other big difference between the two times was that in 2015, corporate earnings were falling all year, in 2016, its the opposite.

Nifty Results Q1 – 2017 Nifty 50 companies (so far – 41 companies which have declared results – until August 25, 2016).

Is the market Overvalued?

Of course it is. The other big worry is that some of the underperforming sectors are yet to report numbers including stocks from the infrastructure and power, metals and oil & gas pack.

But this is not the first time that market is overvalued and it certainly isn’t as alarmingly overvalued as the commentary seems to suggest.

Could the market correct substantially from here?

What is substantial? A 10% MARKET-WIDE correction cannot be ruled out between August-October.

To be honest, in percentage terms, – a 10% correction can never be ruled out in any month of the year; often without a reason.

And I may well add:

On that logic, a 10% appreciation in stock prices cannot be ruled out by Diwali 2016!

What do you do in Markets like these?

The only thing I have cautioned against doing is chasing small and mid cap stocks. Large cap stocks are trading at reasonable valuations and I do expect the market to trade over 9000 over the next 2-3 months. In my view, this will be led primarily by stocks in the large cap space.