West Coast Paper Mills Limited (“West Coast Paper” or the “Company”) manufactures paper and paperboard. Company’s product offerrings include premium printing papers, business stationary, coated duplex boards and machine-glazed (MG) varieties. The Company operates in two business segments –

- Paper / Paperboard at Dandeli

- Telecommunication Cables

West Coast Paper derives 94% of its revenue from paper/ paperboard business and 6% from cable business.

| Current Price (BSE) (21 December, 2016) | Rs. 129.10 |

| Market capitalization (21 December, 2016) | Rs. 852.60 Cr. |

| Face Value | Rs. 2 |

| BSE 52 week High | Rs. 149.10 |

| BSE 52 week Low | Rs. 52.80 |

Indian Paper Industry Overview

The Indian Paper Industry currently has a turnover (net of taxes) of over Rs. 55,000 Cr. and contributes over Rs. 5,500 Cr. p.a. to the national exchequer. The domestic consumption of paper is close to 14 million tonnes per annum (TPA), with over 2 million TPA being imported.

Installed Capacity – Installed capacity of paper mills in India is 15 million tonnes with average utilization of 85%. Capacity-wise industrial paper accounts for ~ 40%; printing & writing paper accounts for ~ 35%; specialty paper 6% and newsprint 19% of total production.

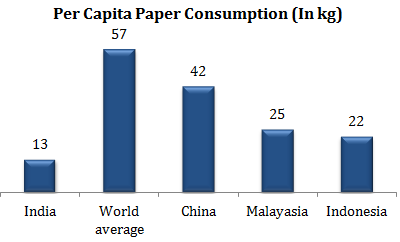

Low per Capita Paper Consumption – Per capita consumption in India continues to be low by global standards. The per capita consumption in India is projected to rise to at least 17 kgs by FY 2025.

Inadequate raw material availability domestically is a major constraint for the paper industry. Current demand for wood by paper industry is about 11 million tonne per annum (TPA) against domestic availability of 9 million TPA which is projected to rise to 15 million TPA by FY 2025. In India, 90% of wood demand is met through industry driven agro / social forestry; 10% through Government sources and imports. (see below: Rising import of cheap paper – a major constraint for domestic paper producers).

WHAT’S DRIVING THE STOCK

Fully Integrated Hi-Tech Paper Manufacturing Facility

From wood plantation to paper manufacturing, West Coast Paper is a fully integrated paper manufacturer. West Coast Paper procures ~50% of its wood chip requirement domestically mostly from Karnataka, which also includes social forestry, and has so far cultivated ~45,000 acres of land, to enhance the availability of wood.

Over the years, West Coast Paper has made investments in modernizing pulp mills and chemical recovery plants, resulting in overall operational efficiency and lower operational cost (reduction in consumption of utilities like water, steam & power etc). West Coast Paper converts in-house manufactured pulp into paper and paper boards ranging from 54 to 600 gsm, catering to diversified application segments. This has enabled the Company to sustain its market share at 8% in wood chip produced papers

Peer Comparison

West Coast Paper is amongst better bets in the paper space due to increasing margins and comfortable interest coverage ratio and slightly better debt to equity ratio as compared to its peers. The Company plans to become debt free in next two years and expects 5% hike in paper products which will improve revenue growth going forward (as per Company).

Financial Performance

| Particulars (in Rs. Cr.) | Tamil Newsprint | JK

Paper |

Intl Paper APPM | Ballarpur Industries | West Coast |

| Market Cap (as on 21 December 2016) | 2,318.56 | 1,291.47 | 1,205.43 | 1,055.39 | 898.93 |

| P/E | 8.26 | 11.39 | 40.67 | – | 13.64 |

| Income from operations | 2,373.16 | 2,427.74 | 1,130.77 | 4,321.49 | 1,694.99 |

| Operating Profit | 596.00 | 419.48 | 137.14 | 755.34 | 260.48 |

| PAT | 253.93 | 72.92 | 36.89 | (229.41) | 8.86 |

| EPS | 36.69 | 5.00 | 9.28 | (2.00) | 1.34 |

| Net Worth | 1,445.54 | 889.61 | 450.94 | 1,441.23 | 598.68 |

| Total Debt | 1,938.72 | 1,449.87 | 304.01 | 4,251.61 | 419.17 |

| D/E | 1.70 | 1.79 | 0.99 | 5.30 | 1.07 |

| Operating Profit Margin (In %) | 14.11 | 17.28 | 11.82 | 10.32 | 15.37 |

| Net Profit Margin (In %) | 10.50 | 3.00 | 3.18 | (3.74) | 0.52 |

| ROCE (In %) | 6.57 | 12.52 | 4.19 | 5.40 | 0.77 |

| ROE (In %) | 17.56 | 8.22 | 8.18 | (11.11) | 1.47 |

| Current Ratio | 0.70 | 0.89 | 0.88 | 0.92 | 1.02 |

| Interest Coverage | 1.28 | 1.55 | 1.59 | 1.06 | 2.10 |

West Coast – Diversified Presence in Paper Industry

The Company has its presence in all the 3 segments of paper industry:

[1] Printing & Writing: Printing and writing segment caters to office stationary, textbooks, copier papers, notebooks etc. This segment forms ~31% of domestic paper industry. The Government’s push on education through steps like Right to Education, Sarva Shiksha Abhiyan, rise in service sector will contribute to the growth of this segment in the coming years.

[2] Packaging & Paper Board: Packaging paper & board segment caters to tertiary and flexible packaging purposes in industries such as FMCG, pharma, textiles etc. This segment forms ~47% of the domestic paper industry. This is currently the fastest growing segment owing to factors such as rising urbanization, increasing penetration of organized retail and ban on plastic packaging.

[3] Newsprint: Newsprint serves the newspaper & magazines industry. This segment forms ~18% of Indian paper industry.

Upcoming Growth Opportunity in Cable Division

Owing to increased penetration of smart phones and growing demand for broadband service, the Company will benefit from optical fibre cable installations. With more and more consumers shifting towards internet driven applications like HDTV, video on demand and high-speed file sharing, there will be a huge demand for high speed data transmission infrastructure. All these factors will provide a considerable boost in revenue in coming years.

WHAT’S DRAGGING THE STOCK

Rising Imports of Paper, Paperboard & Newsprint

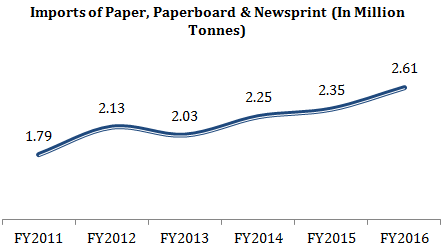

Import duty on Paper & Paperboard for Association of South East Asian Nations (ASEAN) countries has been reduced from 2.50% to 0% in 2013, which had implications in terms of cheaper imports. With weak global demand and anti-dumping duty imposed by the U.S. on supplies from Indonesia & China, imports from these countries have been flooding the Indian market posing a major threat to the economic viability of domestic manufacturers. For FY 2016, India imported 2.61 million tonnes of paper as against 2.35 million tonnes in 2014-15.

Excessive Exposure to One Segment

The Company derives 94% of its revenue from Paper/ Paperboard and Duplex Board business and 6% from Cable business. Not only is the availability of conventional raw-material a matter of concern but also increasing rates of wood due to competition among paper mills and other user industries is likely to affect the revenue of the Company.

Competition from Unorganized Players

Indian paper industry is highly fragmented with ~825 small to large mills. Any increase in the competitive intensity from unorganized segment may be detrimental for the company.