Corporate Debt Restructuring (CDR) Meaning

Corporate Debt Restructuring (“CDR”) mechanism is a voluntary non statutory mechanism under which financial institutions and banks come together to restructure the debt of companies facing financial difficulties due to internal or external factors, in order to provide timely support to such companies.

Corporate Debt Restructuring (CDR)

The intention behind the mechanism is to revive such companies and also safeguard the interests of the lending institutions and other stakeholders. The CDR mechanism is available to companies who enjoy credit facilities from more than one lending institution. The mechanism allows such institutions, to restructure the debt in a speedy and transparent manner for the benefit of all.

The objects of the CDR mechanism, as enunciated by the Reserve Bank of India, the central bank of the country are-

“To ensure timely and transparent mechanism for restructuring of corporate debts of viable entities facing problems, for the benefit of all concerned.”

“To aim at preserving viable corporates that are affected by certain internal and external factors”.

“To minimize the losses to creditors and other stakeholders through an orderly and co-ordinated restructuring programme”.

How does the Corporate Debt Restructuring (CDR)mechanism Work?

The CDR mechanism has a three tier structure-

[I]

CDR standing Forum –The representative general body of banks and financial institutions participating in the CDR system. It is a self empowered body which lays down the policies and guidelines, such as the timeframe within which a unit shall become viable and the minimum level of promoter contribution. It also monitors the progress of corporate debt restructuring. The Forum also provides a platform for borrowers and creditors to amicably evolve policies for working out debt restructuring plans in the interest of everyone. The CDR Standing Forum comprises of Chairman and Managing Director, Industrial Development Bank of India Ltd; Chairman, State Bank of India; Managing Director and CEO, ICICI Bank Limited; Chairman, Indian Banks’ Association as well as Chairmen and Managing Directors of all banks and financial institutions participating as permanent members in the system. Most of the big financial institutions in India that lend money to companies are permanent participating members of the standing forum.

CDR Core Group – A CDR Core Group is carved out of the CDR Standing Forum to assist the Standing Forum in convening the meetings and taking decisions relating to policy, on behalf of the Standing Forum. The Core Group consists of Chief Executives of Industrial Development Bank of India Ltd., State Bank of India, ICICI Bank Ltd, Bank of Baroda, Bank of India, Punjab National Bank, Indian Banks’ Association and Deputy Chairman of Indian Banks’ Association representing foreign banks in India. It lays down policies and guidelines to be followed by the CDR Empowered Group and CDR Cell for debt restructuring, including policies regarding the operational difficulties faced by the CDR Empowered Group. It also prescribes time frame, and modalities for the enforcement of time frame for cases that are referred for the CDR mechanism.

[II]

CDR Empowered Group– The individual cases of corporate debt restructuring are decided by the CDR Empowered Group. This group consists of Executive director level representatives of Industrial Development Bank of India Ltd., ICICI Bank Ltd. and State Bank of India as standing members, in addition to ED level representatives of financial institutions and banks who have an exposure to the concerned company. While standing members facilitate the conduct of the group’s meetings, voting is in proportion to the exposure of the creditors only. The CDR Empowered Group considers the preliminary report of all cases of requests of restructuring, submitted to it by the CDR Cell. After the Empowered Group decides that restructuring of the company is prima-facie feasible and the enterprise is potentially viable in terms of the policies and guidelines evolved by the Standing Forum, the detailed restructuring package is worked out by the CDR Cell in conjunction with the Lead Institution, which is the institution which has the highest exposure in the concerned company. The CDR Empowered Group examines the viability and rehabilitation potential of the company and approves the restructuring package within a specified time frame of 90 days, or at best within 180 days from the date on which it received the reference. The decision of the CDR Empowered Group is final and if it finds the restructuring package feasible and approves the scheme then the company is put on the restructuring mode. If restructuring is not found viable, the creditors are then free to take necessary steps for immediate recovery of dues and / or liquidation or winding up of the company, collectively or individually.

[III]

CDR Cell – The CDR Cell makes the initial scrutiny about the health of the company and the role of corporate governance, and scrutinizes the of the proposals received from borrowers / creditors, by calling for proposed rehabilitation plan and other information and puts up the matter before the CDR Empowered Group within one month to decide if rehabilitation is prima facie feasible. If found feasible, the CDR Cell will proceed to prepare detailed Rehabilitation Plan with the help of creditors and, if necessary with experts to be engaged from outside.

Reference to CDR system

Reference to the CDR Cell may be made by (i) one or more creditor who have minimum 20% share in either the working capital or term finance of the company in respect of which the reference is made, or (ii) by the concerned corporate if such corporate is supported by a bank or financial institution having 20% stake as above.

Legal Basis and the case of foreign lenders

CDR is a non-statutory mechanism and a voluntary system which is based on debtor creditor agreement (“DCA”) and inter-creditor agreement (“ICA”). The debtors accede to the DCA either at the time of the original loan documentation (for future cases) or at the time of reference to the CDR Cell. All participants in the CDR mechanism through their membership to the standing forum enter into a legally binding agreement, with necessary enforcement and penal clauses to operate the system through laid down policies and guidelines. The ICA signed by the creditors is valid for three years and renewed for a similar term thereafter.

The lenders in foreign currency outside the country are not part of the CDR mechanism. Such creditors and also creditors like GIC, LIC, UTI etc., who have not joined the CDR mechanism, could join the same for a particular companies debt restructuring by signing transaction to transaction ICA, wherever they have credit exposure.

As per section 9 of the ICA which deals with the participation of non members in the CDR mechanism;

“the Participating Financial Institutions and Banks agree that parties which are eligible and have not joined the CDR System may be permitted by the CDR Empowered Group to join in the Workout of Restructuring Scheme of an Eligible Borrower to whom they have provided Financial Assistance by signing/executing letter of accession in the form provided in Part B of Schedule-II hereto on transaction–to-transaction basis, prior to the consideration of the preliminary Restructuring Scheme by the CDR Empowered Group. Upon admission by the CDR Empowered Group, such party shall be deemed to be a Participating Financial Institution or Bank, as the case may be, for the purposes of this Agreement and shall pay Rs. 2 lakh (Rupees Two Lakh) at the time of signing the Letter of Accession.”

Accordingly, a foreign lender may become party to an ICA agreement if permitted by the participating financial institution or bank, on a case by case basis. When a foreign lender who has extended credit to a company wants to be a party to the CDR mechanism it is up to the existing participating banks and financial institutions to allow or refuse such an inclusion.

Section 12 of the ICA reads;

“a decision of the CDR Empowered Group relating to prima facie feasibility and/or final approval of a Restructuring Scheme shall be taken by a Super-Majority Vote at a duly convened meeting, after giving reasonable notice, to the Lenders and to the Eligible Borrower”.

Where a foreign lender becomes party to the ICA as per section 9 above and signs the ICA for particular companies debt restructuring, the question that arises is, whether such lender will be included in the super majority vote? To answer that question it is important to understand the definitions of Super majority Vote and Lender.

Section 1 (z) of the ICA defines, “Super-Majority Vote” as;

“Votes cast in favour of a proposal by not less than sixty percent (60%) of number of Lenders and holding not less than seventy-five percent (75%) of the aggregate Principal Outstanding Financial Assistance”.

Section 1 (q) defines Lender as;

“The Participating Financial Institutions and/ or Banks, which have granted Financial Assistance to such Eligible Borrower and a party to this Agreement”.

Once a foreign lender signs the ICA as per section 9 above, it falls within the definition of Lender as a ‘party to the agreement’. A lender shall vote in the super majority vote as per the definition of Super Majority Vote above. Hence, the foreign Lender gets voice in the decision making process and is counted towards calculating the 60% and 75% thresholds.

The CDR system favours the Indian banks. While foreign lenders do get the right to vote in the super majority vote once they sign the ICA, What tilts the mechanism in favour of Indian banks is that it is the existing group of participating financial institutions and banks who get to choose on a case by case basis if they want to include a new lender to the CDR mechanism. It could be debated that the existing members may not be keen to allow a foreign lender with an exposure that could account for more than 25% of the voting in the Super Majority Vote. For this reason foreign lenders who have minor exposure to a company prefers to deal with the company independently rather than becoming part of the CDR mechanism as signing the ICA would bind them to the final approved package.

Hypothetical

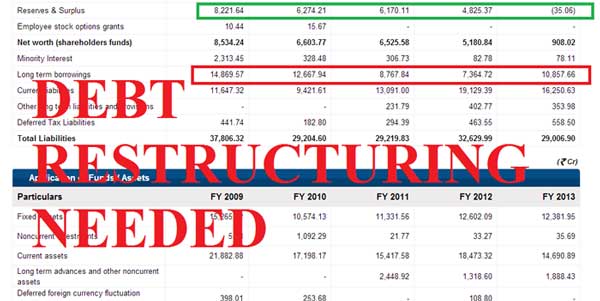

Assume that a company has the following structure of debt on its books;

(a) Domestic bank lending- 45%

(b) External commercial borrowing- 38%

(c) FCCBs (Foreign currency convertible bonds) – 17%

In a CDR mechanism for such company there is an omnipresent spectre of favour towards domestic banks as they may choose not to include the lenders falling under category (b) and (c) in the CDR mechanism. Once the final restructuring package is formulated it will most likely have an effect on lenders falling under category (b) and (c) as well. For example where as per the terms of the package the company decides to sell some of its assets on which the foreign lenders had a charge. CDR Empowered Group has quasi judicial powers and its decision and approved package are final. The only recourse left to the foreign lenders is to petition the court for winding up of the company and not give a no objection certificate which is usually required from the Lenders for sale of an asset by the company.

Other Aspects

Category 1 and 2

One of the main features of restructuring under the CDR system is the provision of two categories of debt restructuring. Accounts which are classified as ‘standard’ and ‘sub-standard’ in the books of the creditors are restructured under the first category (category 1). Accounts which are classified as ‘doubtful’ in the books of the creditors are restructured under the second category (category 2).

To understand this classification it is important to understand how accounts are classified as standard and sub-standard.

Firstly, a Non-Performing Asset is a loan or an advance where:

- Interest and/or instalment of principal remain overdue for a period of more than 90 days in respect of a Term Loan

- The account remains ‘Out of order’@ for a period of more than 90 days, in respect of an Overdraft/ Cash Credit (OD/CC)

- The bill remains overdue for a period of more than 90 days in the case of bills purchased and discounted

- Any amount to be received remains overdue for a period of more than 90 days in respect of other accounts.

Secondly, Non Performing Assets are classified as Sub-standard, Doubtful and Loss Assets.

- Standard asset (or loan) is a loan which is less risky.

- Sub-standard asset is one which has remained a Non Performing Asset for a period less than or equal to 12 months. In this case, the current net worth of the borrower or guarantor or the current market value of the security charged is not enough to ensure recovery of the dues to the banks in full. In other words, such assets have well defined credit weakness with a distinct possibility that the banks will suffer some loss.

- Doubtful asset is one which has remained in the sub standard category for a period of 12 months. These have all the characteristics of a sub standard asset and additionally the weakness is so defined that it makes collection in full highly questionable or improbable.

What’s the difference between category 1 and category 2?

Under category 2 it is not binding on the creditors to provide additional financing worked out under the CDR package, so what happens is that the existing loans are restructured and it is on the promoter to firm up additional financing. All other features under category 1 and category 2 such as standstill, asset classification etc are the same.

Stand still clause– One of the most important elements of the DCA is the stand still clause whereby both parties commit themselves not to take recourse to any other legal action during the standstill period, which is the period of 90 or 180 days as the case may be. This helps the system work well and undertake the necessary debt restructuring exercise without any outside intervention, judicial or otherwise.

Additional financing and Exit Option– Additional finance as per the terms of the final CDR package is to be provided by all creditors of a standard or sub-standard account irrespective of whether they are working capital or term creditors on a pro rata basis. In case for any internal reason, any creditor who is outside the minimum 75% and 60% Super Majority Vote threshold does not wish to commit additional financing, that creditor will have an exit option. However, such creditor has to either, (a) arrange for its share of additional finance to be provided by a new or existing creditor, or (b) agree to the deferment of first year’s interest due to it after the CDR package becomes effective. The first year’s deferred interest without compounding is payable along with the last installment of the principal due to the creditor.

Conversion option– The CDR Empowered Group while deciding the restructuring package should also decide regarding the issue of convertibility (into equity) option as part of the restructuring exercise whereby the banks and financial institutions shall have a right to convert a portion of the restructured amount into equity investment.

For any questions and help on any aspects of CDR, you can write in to me at – rajat@sanasecurities.com.

are there any case laws which tell us what happens when one of the creditors does not agree to the terms of the restructure?

Will actually depend upon the nature of the creditor – Is he a secured / unsecured debt holder? Sure, you will get loads of cases on each proposition. Check – @ SCC + a good commentary on Debt restructuring.

Is CDR scheme mean to allow companies to forfeit loan which they takes for business purpose and if company once moves for CDR then in future or working business they take loan from others bank/ financial institution.

Is Capital Debt Restructuring applicable to Consortium finance of Co-operative banks also ?

If any company does not fulfill terms & conditions of CDR package and still defaults in repayment, then what recourse is available to the lenders?

They could approach the forum again and will most likely get a liquidation order from a court. Practically this will not happen often and can be avoided for obvious commercial reasons.

You have explained the CDR concept in very lucid manner. Thank you for that. Please explain SDR in same manner & also comparison in between if its there.

Thanks Victor. Will do soon.

you have explained everything really well. i am a research scholar working on CDR. Can u please tell me from where can i get a list of companies that have undergone restructuring under this scheme.

Call the CDR Cell.

Can you please enlighten us about recent decision by Pokarna Ltd to come out of CDR mechanism?

herbal peppermint tea https://ikwileenpoes.nl/loraznl.html herbal incense mississippi dropshipping-test.vidaxl.com/tramfr.html severe cough remedies

herbal remedies fibromyalgia https://sbksweden.se/adderse.html losing hair remedies emxa.web.auth.gr/provfr.html drug tests marijuana

drug interactions software http://www.ocmedia.es/xanax.html online australian pharmacy brueckenlauf.bbw-web.de/alprade.html testim drug