Since the beginning of 2016, Indian stock markets have fallen close to 7%. Overall they have fallen ~ 20% from their highs of 2015. What’s intriguing about this stock market correction is not the pace at which it has happened but the fact that no other asset class has done well during this period.

What’s causing this correction?

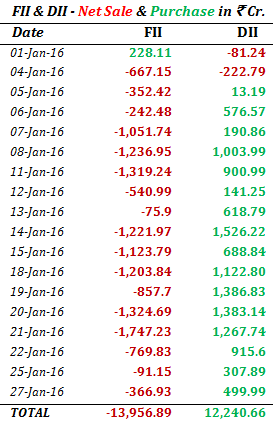

Let me try and answer this with some facts and figures. In the past 9 months Foreign Institutional Investors (FIIs) have sold over Rs. 64,000 Cr of Indian equities. In the first 17 trading sessions of 2016, FIIs have sold over Rs. 13,500 Cr of Indian equities.

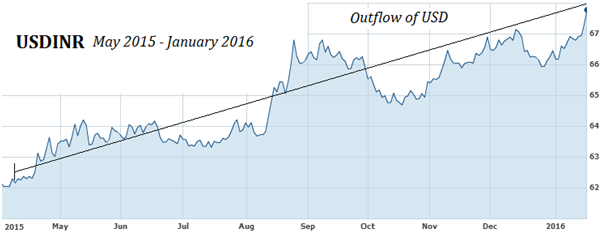

This outflow of money also got reflected in the way US$ appreciated against the INR over the past 6 months.

Here are the top 3 reasons for the recent stock market correction:

- China is slowing down – The world’s second largest economy is not producing as much as it was until a year back. This has caused major oversupply of base metals leading to a massive price correction for metal and commodity stocks around the world. Further, FIIs often trade on margins and take simultaneous positions in many markets around the world. If they suffer losses in any one market (in this case China), it leads to a domino effect as they are forced to reduce exposure to other markets to cover their losses.

- Oil prices are down – Given that India spends most of its Forex reserves on crude imports, low oil prices are good news for India but super oil prices are bad for global economy and hurt India in equal measure. Here is how this plays out – Oil producing nations (OPEC) are forced to sell oil far below the price they need in order to balance their internal budgets. This results in OPEC nations withdrawing large amount of capital deployed overseas. Additionally, it also puts strain on energy companies around the world.

- FED is raising interest rates – In December of last year, the Federal Bank of the United States raised interest rates by 0.25% after seven years. In the United States where borrowing costs are as low as 2%, when FED hikes or reduces the rate by 0.25%, it equates to 12% difference in the overall borrowing costs. In other words, the cost of capital for FIIs becomes 12% more expensive (i.e. from 2% to 2.25% is a 12% increase). In its last commentary FED indicated that more interest rate hikes are likely this year.

While all these factors are playing out at the same time, neither of these are fundamentally or structurally negative for the economy.

China slowdown: Over the last decade, China took massive debt to build more capacities anticipating continuous rise in demand which did not happen. One may ask why did demand not rise? Well, it did.

May be not as much as China anticipated- It was just bad anticipation.

Oil Prices: Of the many theories around oil prices, the most plausible one is that Saudi Arabia wants to (i) maintain its market share (ii) drive out competition from U.S. Shale oil boom and that (iii) Iran will soon start flooding the world with more oil. Again, neither of these factors point to any fundamental weakness in the global system.

FED Rate Hike: Finally, the fact that FED is confident of raising interest rates further suggests that in view of those in charge of printing money – there is enough liquidity in the system. This should actually be encouraging.

So have we just pressed the panic button for reasons which should at best be neutral if not encouraging?

Very well written and easliy understandable article.

Thanks Pawan.

sir,

could you throw more on light on how 0.25% of increment increases borrowing cost by 12%.

Appreciate your efforts.

Regards,

Akash

thanks for the above info can you [please suggest where to invesst and when

Thanks Mustafa. I will write back to you.